May 27/June 3, 2019: Volume 34, Issue 25

By K.J. Quinn

It’s “Groundhog Day” for the commercial flooring business. Similar to the Hollywood comedy in which a cynical TV weatherman finds himself reliving the same day over and over again, industry members expect many of the trends and economic indicators that impacted the business the past two years to continue into 2019. Which means hard surfaces—led by LVT and WPC products—will sustain double-digit growth rates and further penetrate every major segment.

It’s “Groundhog Day” for the commercial flooring business. Similar to the Hollywood comedy in which a cynical TV weatherman finds himself reliving the same day over and over again, industry members expect many of the trends and economic indicators that impacted the business the past two years to continue into 2019. Which means hard surfaces—led by LVT and WPC products—will sustain double-digit growth rates and further penetrate every major segment.

Preliminary research shows commercial flooring is on track to post similar numbers as last year. Specified contract is projected to retain the lion’s share of both dollars and square footage (approximately 70%) vs. 30% for Main Street, according to industry estimates. Soft surface sales rose 1.5% to 2% in 2018 to roughly $3.3 to $3.6 billion and volume leveled off between 220 to 280 million square yards. Specified contract remains the dominant end-use market for carpet, representing approximately 75% to 80% of sales and 65% to 70% of volume.

Modular tile is supplanting broadloom as the leading soft surface, accounting for more than half of soft-surface sales and boosting its share of value to more than 60%, estimates show. Experts cited ease and speed of installation as key advantages for carpet tile. What’s more, recurring issues—i.e., proper seam matching, row cutting, roll sequencing and seam diagrams—related to broadloom can be difficult to address and reduce profits if not properly executed.

“Carpet tile is also more cost effective to store replacement tiles due to its modular size vs. broadloom,” noted Brenda Knowles, vice president of commercial marketing and product development, Shaw Industries. “Additionally, carpet tile offers sophisticated design options that broadloom can’t cost effectively replicate.”

While carpet sales moved at a snail-like pace, hard surfaces’ momentum can best be described as a runaway train. Category sales rose an estimated 11% to 13% last year to between $3 and $3.5 billion, with volume estimated at 2.5 billion to 3 billion square feet. Specified contract represents about two-thirds of commercial sales while Main Street accounts for the balance.

“The overall commercial market is in the middle of a very big transition,” said Mike Gallman, president of Mohawk Group, the commercial division of Mohawk Flooring. N.A. “There’s a mixing in terms of what’s going on the floor and a lot of growth in hard surfaces. LVT and other hard surfaces have put some head winds in front of carpet’s growth.”

Among hard surface categories, LVT continues to lead the pack. Research indicates the sub-category saw both sales and volume rise 10% to 20% last year, expanding across virtually all segments but particularly in healthcare and hospitality settings. Some believe it represents approximately 60% of commercial LVT sales.

“We are seeing increasing interest and installations of LVT in the commercial market,” said Deb Lechner, vice president, marketing, Armstrong Flooring. “This is consistent with the trend of commercial spaces being designed to appear more residential in nature.”

Resilient is not the only segment on fire in commercial at present. Right behind it is ceramic, which accounts for roughly 40% of total sales and 25% to 30% of volume, according to industry estimates. Approximately two-thirds to 70% of the business is from specified contract. Ceramic is also emerging as a major factor on Main Street, as roughly half of commercial volume is generated from this segment.

“There still remains tremendous growth opportunity for the tile category,” said Gianni Mattioli, executive vice president, Dal-Tile. “Our company is diligently working to take advantage of this opportunity and the tile industry as a whole also appears to understand this reality.”

While tile is among the most well-rounded floor coverings, it’s also the priciest (on a per square foot basis) and challenging to install. Nonetheless, suppliers say they are committed to boosting tile’s value proposition in the wake of designer preferences towards VCT as a low-priced alternative. “It’s important, as an industry, to continue to work to make ceramic tile the best overall value possible,” said Raj Shah, president, MSI.

While tile is among the most well-rounded floor coverings, it’s also the priciest (on a per square foot basis) and challenging to install. Nonetheless, suppliers say they are committed to boosting tile’s value proposition in the wake of designer preferences towards VCT as a low-priced alternative. “It’s important, as an industry, to continue to work to make ceramic tile the best overall value possible,” said Raj Shah, president, MSI.

With the trade wars and the recently announced anti- dumping petition by U.S. manufacturers of ceramic tile, however, the industry is seeing some instability in pricing. “Adding tariffs/duties to the ceramic tile category reduces the overall value of the tile vis-à-vis other flooring options,” Shah said. “This will affect overall demand and, most likely, tile installers and retailing jobs.”

End-use trendsFurther analysis of the commercial sector reveals unique issues affecting product specs in the five major segments: corporate/offices, healthcare, education, hospitality and retail. As such, flooring choices and volume are expected to vary this year in some segments while remaining constant in others, industry watchers say. “Resilient flooring, particularly LVT, is growing across virtually all of these commercial channels, as hard surface is seen more and more often in spaces that used to feature carpet,” Armstrong’s Lechner said. “This is true from offices to hotel rooms.”

The largest sector remains corporate/offices, representing roughly 40% of commercial flooring sales. While the segment grew modestly in 2018, the ongoing growth in employment coupled with trends in workplace design for aligning people, culture, processes and technology with organizational goals are expected to positively impact flooring sales. Carpet tile emerged as the top flooring choice, representing an estimated 55% to 60% market share, thanks in part to evolving aesthetics and formats.

Broadloom is expected to remain a favorite in speculative workspaces or “market-ready” offices looking for cost effective upfront investments. “Broadloom, particularly hospitality-inspired, large-scale or plush patterns, can also be fashioned into area rugs for cost-effective rug solutions for those looking to create visual appeal or to use a mixture of flooring types in corporate settings,” Shaw’s Knowles explained.

Construction and renovation are rampant in healthcare, which remains among the most challenging environments for the A&D community to service. For one, it requires an understanding of the impacts building materials have on the health of those who work, visit and are cared for, experts say.

“We consider the floor to be critical in addressing infection control,” said Jocelyn Stroupe, director of healthcare interiors, CannonDesign, New York. “For that reason, resilient flooring is primarily the choice.”

Natural materials such as ceramic tile, hardwood, rubber and linoleum are considered healthy choices. “Rubber sheet, vinyl and linoleum are the mainstay in areas that require high sanitary levels, such as an emergency rooms, triage, operating rooms, treatment rooms, etc.,” said Mark Tickle, director of marketing, American Biltrite. “Rubber tiles, LVT tiles and planks have found their way into non-critical areas such as corridors, waiting rooms and patient rooms.”

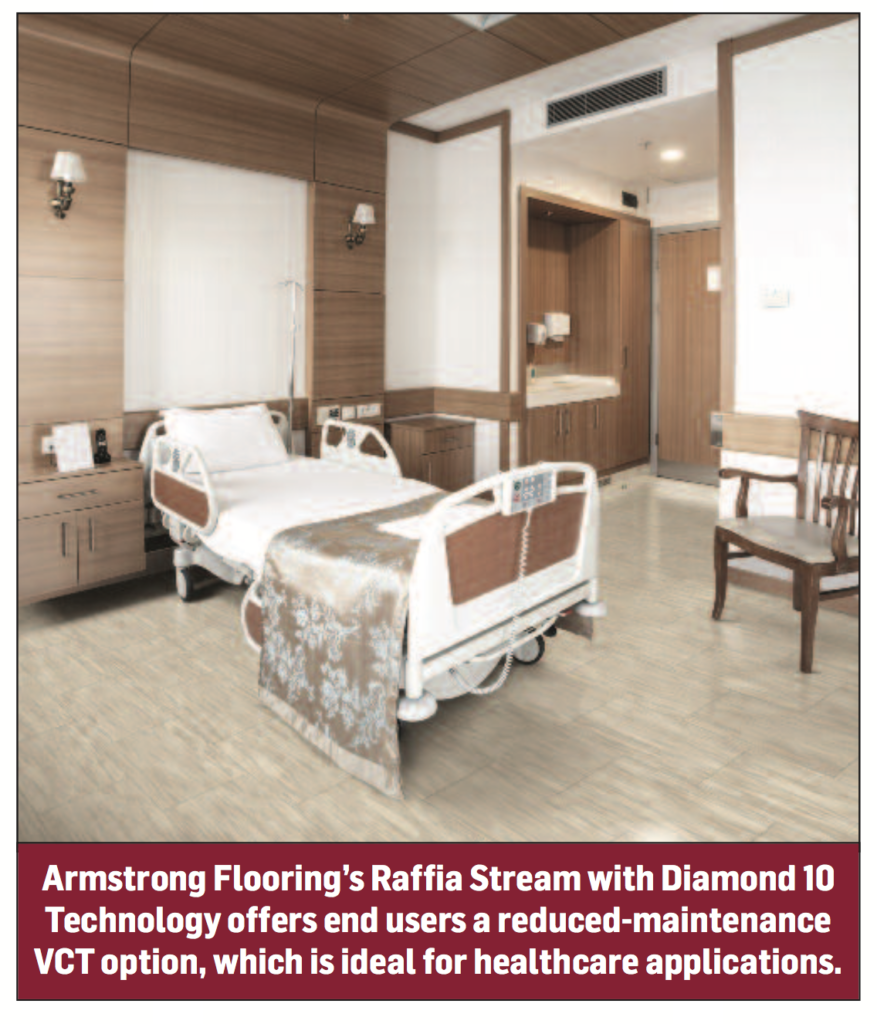

VCT is among the least expensive resilient floors, but its high life-cycle costs limit its usage in healthcare, observers note. Carpet tile is specified primarily in non-patient areas such as waiting rooms and medical offices, although some experts are bullish about growth prospects for senior living spaces. “The availability of large- scale patterning and more hospitality driven, and high-end luxurious aesthetics in carpet tile are driving its increase in popularity, along with the inherent moisture barrier,” Shaw’s Knowles explained.

Similar to healthcare, the hospitality business is seeing major investments being made in remodeling. Hospitality is one of the fastest growing sectors, as a bullish economy is helping drive business and leisure travel back to pre-recession levels. “All major hotel chains are continuing to grow, with new builds steadily occurring,” Dal-Tile’s Mattioli said. “Additionally, we have seen incremental new business from boutique hotels.”

Floor design varies widely, often depending on location and brand. For example, hotel chains are reportedly turning to materials that bring value to their brand while giving guests a feeling of warmth and cleanliness. “Hotel guests often prefer carpet in their guest rooms due to its feeling of warmth,” noted Cindy Kaufman, director of marketing, Interface Hospitality. (An estimated 25% of commercial carpet is sold in these spaces, the majority of which is broadloom.) “However, there is less of a perception of cleanliness when dealing with carpet. LVT is another solution because it’s easy to clean and maintain.”

Indeed, the hottest flooring in hospitality spaces is LVT. “Many LVT products offer an acoustic backing option to help with sound performance,” said Whitney LeGate, director, commercial LVT, Mannington Commercial, citing the company’s Quantum Guard Elite line. “LVT is a long-term flooring option that doesn’t wear out quickly.”

Indeed, the hottest flooring in hospitality spaces is LVT. “Many LVT products offer an acoustic backing option to help with sound performance,” said Whitney LeGate, director, commercial LVT, Mannington Commercial, citing the company’s Quantum Guard Elite line. “LVT is a long-term flooring option that doesn’t wear out quickly.”

LVT is a popular option in retail spaces, a segment renown for staying on top of interior design trends. Flooring choices run the gamut, as end uses range from national and regional retail chains to local grocery stores, restaurants and other establishments. Sales to the sector declined in 2018, observers say, as online shopping continued to stifle retail construction and reduced the number of brick and mortar stores.

“While the retail segment has been a little softer than expected, we are seeing positive signs in key areas,” Dal-Tile’s Mattioli said. “Car dealerships, fitness centers and quick-service restaurants are areas of growth that are positively impacting the tile market.”

Then there’s the education sector, where interior design is fast becoming a major point of emphasis. Research shows K-12 represents the lion’s share of this market, which accounts for approximately 75% of flooring sales; the remainder is generated from higher education, according to industry estimates.

Most of this work involves hard surfaces, accounting for an estimated 50% to 60% of flooring sold to K-12 spaces. Product types vary as grade schools encompass a wide range of end uses ranging from classrooms and athletic facilities to offices.

LVT—the leading resilient product—checks a lot of boxes for K-12 and higher education building needs and almost every area of the school offers growth opportunities, observers say. Premium floors—such as ceramic and porcelain tile and terrazzo—are coveted for their durability and utilized for high-traffic areas such as corridors, lobbies and toilet rooms. Rubber and linoleum are positioned as green flooring choices while sealed or polished concrete allow schools to replicate industrial looks found in retail stores and restaurants.

And lest we forget carpet, as education surpassed hospitality as its second largest commercial segment, representing approximately 30% of sales. Modular tile makes up the overwhelming majority of installations while broadloom is limited to small areas. “Carpet tile offers sophisticated design options that broadloom can’t cost effectively replicate,” Shaw’s Knowles explained.