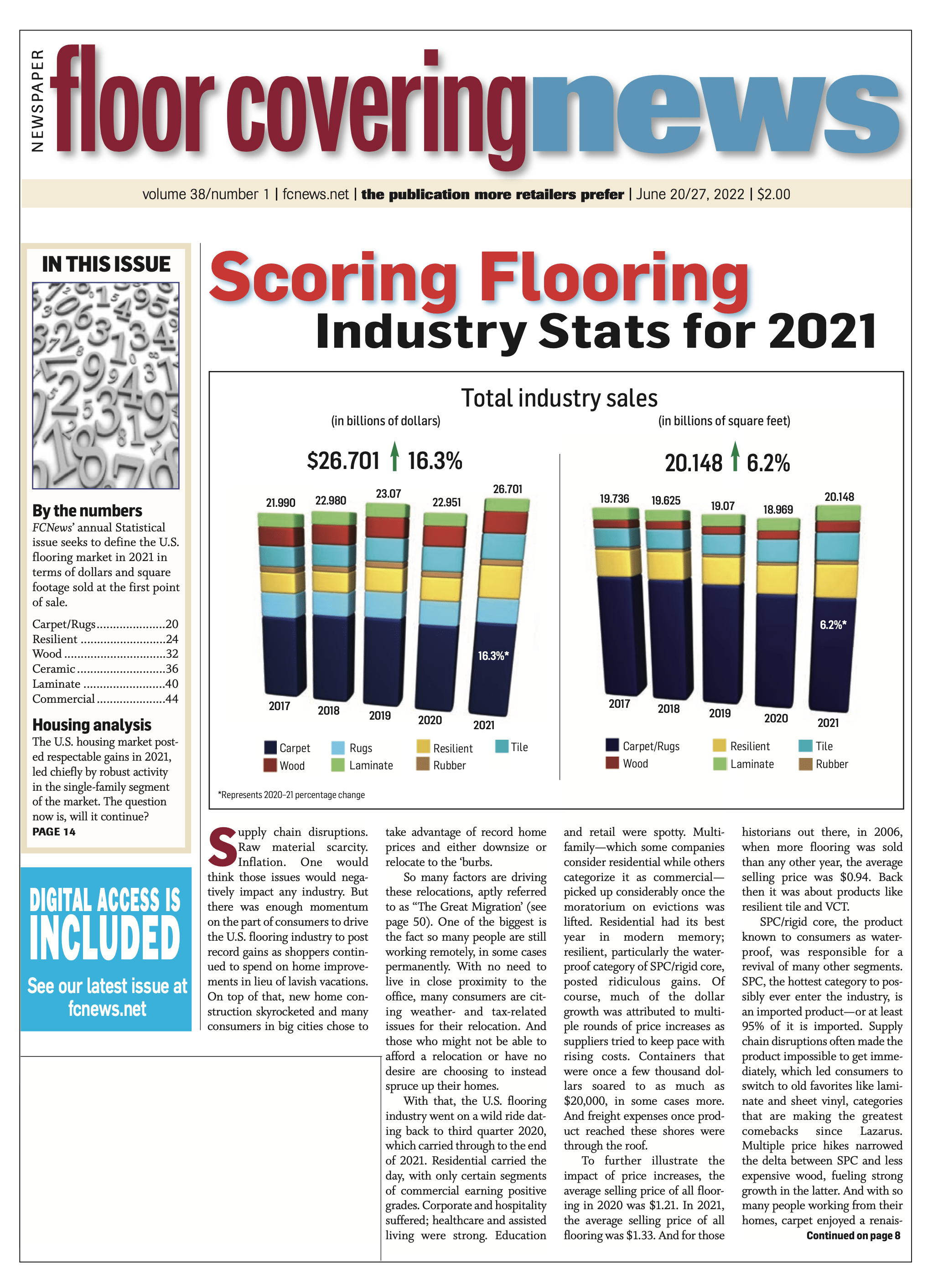

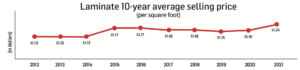

The resurgent laminate flooring category continued on its upward trajectory in 2021 as sales reached $1.304 billion, FCNews research shows. That represents a 7% increase over 2020’s numbers, which have been revised upward since the publication of last year’s Statistical Issue. That $1.304 billion also represents the highest level of laminate sales seen since 2006.

Volume-wise, the category grew at a slower rate (3.1%) compared to sales, reflecting higher prices for resins, melamine and fiberboard materials—some of the primary ingredients that go into the production of laminate flooring.

This phenomenon was due, industry observers say, to the fact that laminate suppliers across the board had to contend with rising material costs for the components and ingredients that make up laminate flooring. “The dollars grew a little higher than the footage based on that phenomenon,” said David Moore, senior product director, wood and laminate, Mohawk. “It’s the sheer nature of the raw material increases we passed along in the form of price hikes, which affected the average selling price.”

This phenomenon was due, industry observers say, to the fact that laminate suppliers across the board had to contend with rising material costs for the components and ingredients that make up laminate flooring. “The dollars grew a little higher than the footage based on that phenomenon,” said David Moore, senior product director, wood and laminate, Mohawk. “It’s the sheer nature of the raw material increases we passed along in the form of price hikes, which affected the average selling price.”

Barbara June, who took the reins as president of the North American Laminate Flooring Association (NALFA) last year, agreed. “Year over year we saw a slight drop in volume from NALFA members, roughly 5% due mainly to supply chain constraints,” she explained. “However, the sales figures grew in total dollars and in average selling price—largely due to dramatic increases in raw material costs.”

While NALFA members may have been down 5% in volume, the overall industry was up, primarily due to non-NALFA members selling to the big boxes, which accounts for more than two-thirds of the industry in terms of units.

Other industry observers concurred, noting how the relationship between pricing on the cost side of the equation and unit growth can somewhat skew activity in the category. This is especially true considering the robust activity the laminate flooring sector witnessed in mid-to-late 2020 and early into 2021 as competing hard surface imports became more scarce due to supply chain constraints.

“The year 2020 was definitely an anomaly with an astronomical demand spike that happened in Q2 2020 as shelter-at-home consumers were flocking to home centers,” said John Hammel, senior director of hardwood and laminate, Mannington. “Demand for laminate flooring has continued to be strong since mid-2020, but raw material supply issues capped the level of growth in 2021.”

Truth be told, though, price increases are not the only reason for laminates’ growth in dollars last year. Changes in product mix also played a role in increasing the overall dollar value of the market as demand for thicker products was evident in 2021. “For sure, laminate has increased in sales price due to escalation in production costs and shipping, but there have been added features and benefits that have added some cost—resulting in a greater net value,” said Derek Welbourn, CEO of Inhaus.

Kyle McAllister, director of hardwood and laminate category, Shaw, agreed. “While some of that growth was attributed to increases in raw materials, I would argue that a lot of it was attributed to performance,” he explained. “The average selling price is going up because of performance, which means we did see some organic growth (dollar-wise) in 2021 for the category.”

Share of hard surface pie

While laminate did experience modest gains in 2021—even though a fair percentage of those additional revenues can be attributed to material price increases—the category’s share of the overall flooring market actually dipped a tad. In terms of sales, laminate represented just 4.9% of total industry revenues last year—that’s down slightly from 5% in 2020; 5.5% in 2016; and 6.6% in 2011, FCNews research shows.

The same can be said for laminate’s share of total hard surface sales and volume. In 2021, laminate accounted for 8.2% of total hard surface sales and 10% of hard surface volume. That puts the category behind resilient (53.6%), ceramic (19.6%) and hardwood (17%) with respect to dollars. Laminate also trails most of its hard surface counterparts in the square footage department, with the exception of hardwood and rubber. Here, laminate accounts for roughly 10% of hard surface volume sold, surpassed, again, by resilient (29.2%) and ceramic (12.3%). Laminate did, however, gain an ever-so-slight edge over hard- wood (9.8%) but a much larger lead over rubber (0.6%).

Channel segments shift

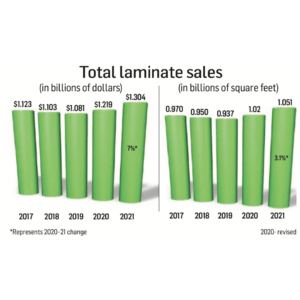

It will come as no surprise to anyone that home centers continue to account for the bulk of laminate flooring sales in the U.S. market. FCNews research shows the likes of Home Depot, Lowe’s and Menards increased their respective shares of laminate flooring sales to represent 39%, 23% and 6% of category sales, respectively, in 2021. Alternatively, specialty retail’s share of laminate sales in 2021 was estimated to have fallen to 13.4%, down from roughly 20% in 2020. “Home centers dominated laminate in 2021,” Mohawk’s Moore noted.

But that’s not necessarily the result of any perceived failings at the specialty retail level. “The overall demand comparison by sales channel was somewhat skewed in 2021 vs. 2020, since specialty retail stores were closed while home centers remained opened in Q2 2020,” Mannington’s Hammel noted. “On a year-over-year comparison, specialty retail picked up some of the share they lost in 2020 to get closer to a historical split between the two channels. However, home centers still had the large majority of the sales in 2021 vs. specialty retail.”

But that’s not necessarily the result of any perceived failings at the specialty retail level. “The overall demand comparison by sales channel was somewhat skewed in 2021 vs. 2020, since specialty retail stores were closed while home centers remained opened in Q2 2020,” Mannington’s Hammel noted. “On a year-over-year comparison, specialty retail picked up some of the share they lost in 2020 to get closer to a historical split between the two channels. However, home centers still had the large majority of the sales in 2021 vs. specialty retail.”

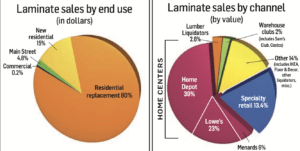

By virtue of this breakdown, however, it’s safe to say the bulk of products moving through the home center/big-box channel typically trend toward the opening end of the price spectrum (i.e., the 7mm and 8mm product offerings that are so appealing to renters and DIYers). This despite the average wholesale price for laminate rising from $1.19 in 2020 to roughly $1.24 per square foot at the first point of sale in 2021. Ten years ago, the average selling price was $1.07.

At the same time, the market is continuing to see a greater distinction between the types of products sold at home centers and other retail outlets, especially specialty retailers and the major buying groups. Many laminate offerings at the big boxes retail for less than $2.39 per square foot, anecdotal research shows. By comparison, most specialty retailers are promoting laminate products that are 10mm to 12mm in overall thickness—products that command slightly higher profits. These step-up products allow specialty retailers to earn more margins as they typically fall in the $3.99 to $5.49 range.

It’s worth noting these upper-end products also make it more difficult for consumers to shop for similar laminate floors in the box stores because it’s not an apples-to-apples comparison.

It’s worth noting these upper-end products also make it more difficult for consumers to shop for similar laminate floors in the box stores because it’s not an apples-to-apples comparison.

More importantly, this multi-tiered, targeted approach also helps manufacturers that service different channels reduce conflict that could arise when similar brands are offered through home centers and specialty retailers alike. Higher-end offerings, proponents say, help prevent price shopping and further cannibalization within the category while allowing manufacturers to participate in more segments of the market.

End-use consumption

While some of the functional dynamics of the laminate sector have shifted in recent years, not much has changed in terms of the end-use sectors responsible for the bulk of laminate flooring consumption. For instance, residential replacement, the primary source of laminate sales, held steady at around 80%, while new residential applications saw only a mild uptick, about 1%, to 15% in 2021.

On the non-residential side of the business, Main Street applications held steady at approximately 4.8% of sales. And while the well-documented performance of laminate flooring continues to improve—particularly when it comes to higher overall wear ratings and dent resistance—that hasn’t necessarily translated into increased commercial flooring specifications. The specified commercial flooring market for laminate (roughly 0.2%) remains relatively low compared to other segments and categories.

“We feel that there has been increased activity in new residential construction and in Main Street commercial,” Inhaus’ Welbourn said. “The numbers are modest, but a meaningful increase for specialty retail that generally services these sectors. We estimate a shift of about 2% for each category.”

Domestic vs. import

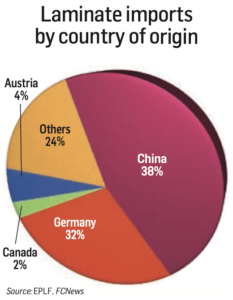

One of the most dramatic shifts that the laminate flooring sector witnessed in 2021 occurred on the import side of the equation. Shipments from China—which is still facing restrictive forces in the form of ongoing duties and tariffs—was estimated to have fallen off by four percentage points to 38% last year. That’s down from 42% in 2020 and nearly 48% of imports in 2019. Like many of the other competing hard surface categories— namely hardwood, SPC, WPC and the like—other Southeast Asian countries absorbed much of the capacity China lost.

One of the most dramatic shifts that the laminate flooring sector witnessed in 2021 occurred on the import side of the equation. Shipments from China—which is still facing restrictive forces in the form of ongoing duties and tariffs—was estimated to have fallen off by four percentage points to 38% last year. That’s down from 42% in 2020 and nearly 48% of imports in 2019. Like many of the other competing hard surface categories— namely hardwood, SPC, WPC and the like—other Southeast Asian countries absorbed much of the capacity China lost.

“We saw a decline in Chinese imports from 2019 to 2020, but the general Chinese import vol- ume in 2021 closely matched 2020,” NALFA’s June stated.

Barron Frith, president, CFL, concurred, noting: “Most of our laminate is coming from our Vietnam factories and not from China, so we can agree with this trend.”

In particular, Frith is seeing an uptick in demand for higher-end laminate products, many of which are made in the U.S. or imported from Europe. “We see demand for added-value products to remain strong and to be one of the main growth drivers for the category.”

Inhaus, which sources its laminate floors from Germany, sees the same trend. “Yes, there has been a general reduction in laminate from China as Germany and domestic producers have been competitive with cost, innovation and service,” Welbourn told FCNews. “Asia shipping congestion has been slightly more challenging—although everyone has faced logistics challenges, both domestic and internationally.”

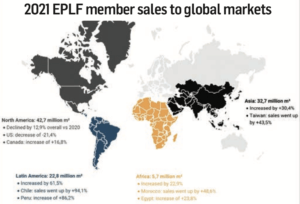

However, China wasn’t the only region that saw a decline in laminate flooring imports to the U.S. According to the European Producers of Laminate Flooring (EPLF), shipments to the U.S. fell off an eye-opening 21.4% compared to 2020. (Egger Flooring’s departure from the American laminate market alone accounted for some of the reduction, observers note.) Anecdotal research also shows fewer laminate products coming into the U.S. market from Canada as that country repurposes its existing capacity to serve customers within its borders—especially the big box stores there.

The exit of some manufacturers from the Canadian market also impacted exports of laminates into the U.S. So, where is all the capacity from European laminate flooring manufacturers going? Statistics provided by the association show Latin America witnessed the biggest influx of Europe-produced laminate in 2021, with the region generating a 61.5% increase in shipments last year. That’s roughly 245 million square feet of product. By comparison, EPLF sales of laminate flooring to customers in Western Europe were up 2.59%, while in Eastern Europe EPLF shipments to Russia were up more than 16% last year. While all this has been happening outside our borders, laminate flooring production in the U.S. has grown proportionately, observers say.

“Imports from China and Europe declined significantly, beginning in 2020, and have stayed at a relatively low percentage of the market,” Mannington’s Hammel explained. “In my estimates, U.S. producers picked up the largest percentage of the laminate flooring market.”

Local investment

Indeed, U.S. laminate suppliers are stepping up their game. For example, Mohawk has invested heavily in stateside laminate production, increasing capacity of its top-selling RevWood product offerings. The company initiated the first phase of its laminate flooring expansion plans in the fourth quarter of 2021, with the second phase to follow in 2023. According to the company, the new production lines will have the capability to produce the next generation of laminate flooring based on proprietary technologies. “We have invigorated the product category with improved visuals and waterproof performance,” said Jeff Lorberbaum, Mohawk chairman and CEO.

Ultimately, according to Mohawk, it’s all about boosting operational efficiency. “One thing that COVID-19 taught us was having the manufacturing being close to the retail outlet is good from a supply chain perspective,” Moore explained. “We are definitely increasing our domestic manufacturing capacity to meet the needs in the market.”

Not to be outdone, Mannington—which also produces laminate flooring out of its manufacturing facility in North Carolina—also continues to invest heavily in domestic production. Ditto for Swiss Krono, which supplies many big-name brands on a private-label basis.

Future potential

The resurgence that laminate flooring is currently enjoying in the U.S. market is expected to continue for the forseeable future—certainly as long as supply chain issues surrounding competing hard surface categories persist.

The resurgence that laminate flooring is currently enjoying in the U.S. market is expected to continue for the forseeable future—certainly as long as supply chain issues surrounding competing hard surface categories persist.

“Domestic laminate has certainly enjoyed a surge during the COVID-19 period and resulting global supply chain restraints both from availability and the dramatic transport cost increases we have seen from Asia and Europe,” said Kyle Brown, executive vice president of sales and marketing for Swiss Krono. “Though the consumer response to higher retail prices is uncertain at this point, we believe laminate will maintain its posture in the marketplace. Laminate is a mature product that has responded to the plastic threat by organic improvement to protect share. These improvements include better quality decors, more intricate textures and a rapid evolution of moisture-resistant/waterproof laminate offerings.”

Shaw’s McAllister agreed. “Consumers are going back to laminate,” he noted. “It provides realistic visuals and many other benefits. Plus, there’s a lot of U.S. manufacturing that goes along with it. At some point in time, you might see a downtick, but not anytime soon.”

Executives predict additional incremental growth for laminate in sectors previously underserved by the category. Inhaus’ Welbourn, for instance, is gauging increased interest in the building sector across both single-family and multi-family applications. “Laminate has seen significant growth in 2021, and we see this continuing for 2022,” he said.