By Ken Ryan

The early stages of 2020 revealed the kind of promise the carpet industry had longed for: innovative new offerings breathing life into a segment that had been losing share to hard surfaces for more than a decade.

But then, soft surfaces—like every other flooring segment—ground to a halt with the swift arrival of COVID-19. According to industry estimates, the residential carpet segment fell nearly 30% in the second quarter, after a 6% drop in the first quarter that coincided with the early stages of the pandemic. “Q2 was one of the most challenging quarters I have had in my career, and residential carpet was not exempted,” said Curt Hutchins, president of residential carpet for Mohawk.

The encouraging news is the flooring industry snapped back quickly, and residential carpet jumped 2% in the third quarter. As Hutchins noted, “In Q3 we really saw a significant pickup relative to Q2, with each month getting stronger.”

At press time, residential carpet was down roughly 11%-15% compared with the year-ago period; however, industry observers say carpet, based on current projections, should finish down mid-single digits for 2020. If that holds true, it will be in line with 2019, when residential sales slipped 6.5% from 2018 while volume fell 6.8%, according to FCNews estimates.

COVID-19 impact

Unlike many other industries, flooring has actually benefitted by the sheltering in place that triggered many home renovation projects. Initially this was evident through mass merchants in DIY segments such as paint and outdoor/garden. That soon spilled over to flooring, and by June the residential flooring segment was showing strength. “The entire third quarter was very strong, and the carpet segment actually showed growth vs. the prior year for the first time in a long time,” said T.M. Nuckols, president, residential division, The Dixie Group.

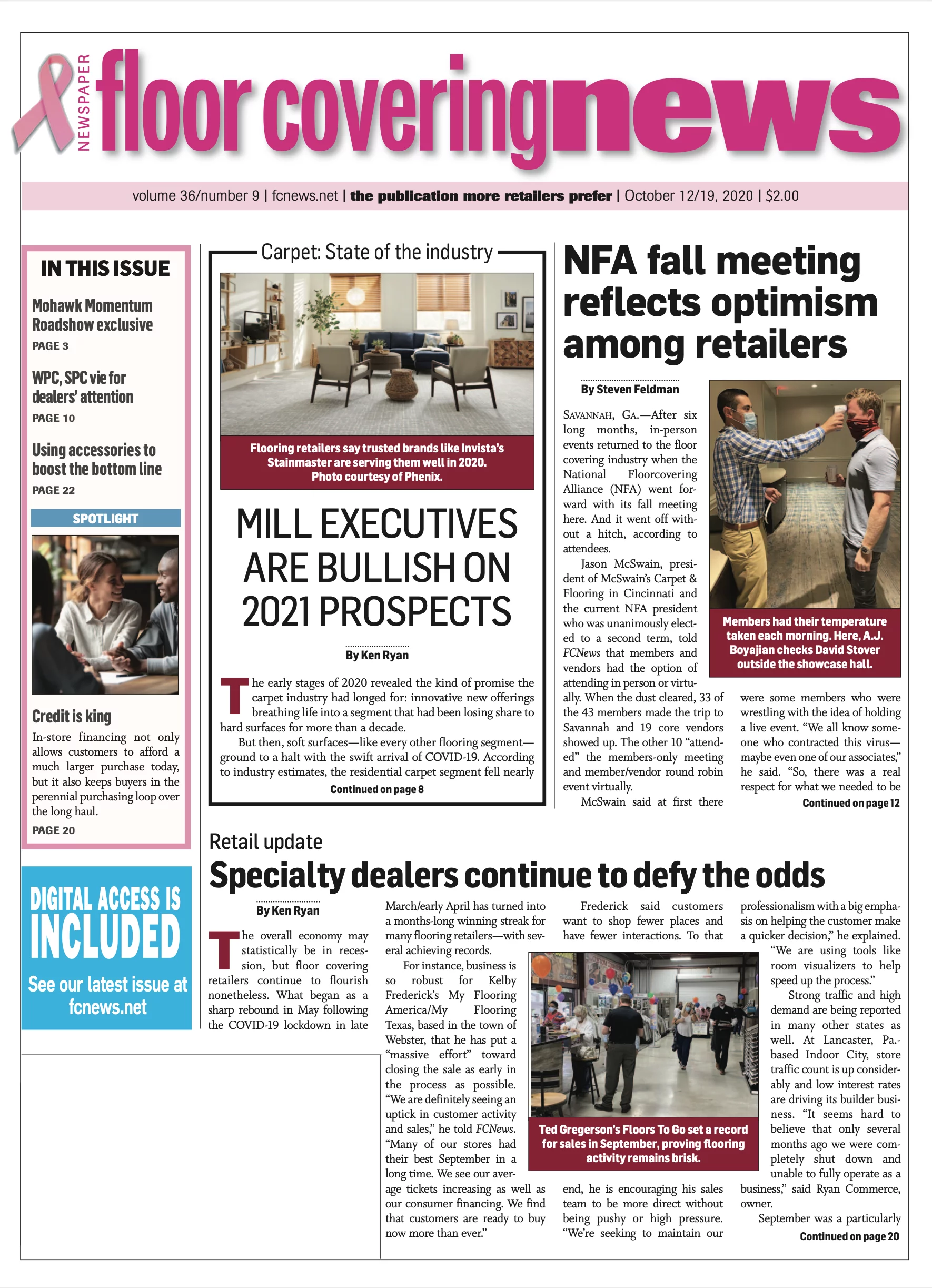

Trends taking shape in 2020 as a result of COVID-19 are likely to continue for years. To that end, Invista is encouraging its Stainmaster dealers to take advantage of the home improvement movement. “Research shows that as happy as people are that the economy is opening back up, they don’t expect to return to normal life anytime soon, which means their homes really will be a haven,” said Jenny Wilburn, senior content marketing manager, Invista. “Retailers are seeing growth in carpet sales, with consumers more likely to replace their older carpets rather than their older hard surfaces.” This is especially true thanks to the higher cost to replace carpet with hardwood.

During 2020, COVID-19 also accelerated the cleaner home trend, observers say, and mills have seized on that effort with a bevy of products focusing on cleaning and disinfecting.

“With many consumers spending more time in the home, we are continuing to see an increased desire for warmer, more welcoming hues,” said Mike Sanderson, vice president of marketing, Engineered Floors. “The cleanability and disinfecting of surfaces in the home has become a large concern for customers. There is greater emphasis placed on how well and how easily their floors can be cleaned.”

To address these concerns, Shaw Floors is educating its retail customers on how to conduct conversations with consumers on the topic of clean; for example, recommending hot water extraction every 18 months—or more frequently if desired—as a deep cleaning best practice. “What’s more, a lesser known fact about carpet is it has a greater advantage than hard surfaces for people with allergies/allergy sensitivities,” said Theresa Tran, vice president of retail channel, Shaw Floors.

Tran said reducing unwanted noise has long been a concern when purchasing flooring. While sheltering in place this year, she said consumers have become more aware of noise concerns. “The rise of remote learning/working has led to this increased focus, and soft surfaces offer the best solutions of any flooring category when it comes to sound.”

Price hikes abound

Beyond the health issues, COVID-19 created many challenges for manufacturers in the early spring, with many having to shut plants for an extended period of time—which, in turn, caused a backlog in supply. When plants reopened, high absenteeism rates and social distancing measures slowed production. The higher costs resulting from the slowdown combined with strengthening demand helped set the stage for price increases of 3%-8%.

Seizing share

Carpet has been losing share to hard surfaces for more than a decade, yet some mill executives say they see that rate of erosion slowing, perhaps even reversing course in the near future. TDG’s Nuckols said he believes carpet will level out at about 35% of residential flooring, “and we are getting pretty close to that now.”

Pami Bhullar, director, retail development, North America, for Invista/Stainmaster, reported seeing a balancing out between carpet and hard surfaces. “Many consumers are choosing carpet for their bedrooms and family bonus rooms for a cozier feel, especially as they spend more time at home,” he explained.

Beyond just hoping for it, reversing hard surfaces’ momentum will require bringing innovative products to market that are functional, healthy and sustainable. “Sustainability is much more at the forefront of consumers’ thinking today,” Mohawk’s Hutchins said. “The onus is on us as an industry to bring some of the most creative, innovative products to market to convince consumers that this is not the same carpet they bought 10 years ago.”

Higher-end goods have fared well as consumers show a willingness to pay a premium on products that may appear in only one or two rooms. “People have prioritized investing in their homes, and we see that in our products,” Hutchins said. “Customers are coming into retail stores with an intent— there’s not a lot of window shopping. The conversion rate is good as higher-end products translate into sales.”

Latest innovations

The pandemic did not stop carpet mills from developing fresh ideas for 2020. Some examples include the following:

The Park Series collection from Tarkett includes its new 100% solution-dyed Primus PET-DuraSoft fiber. According to the company, this new carpet yarn system offers a new quality of softness and durability with the ability to blend Primus PET fiber and SuperSoft fiber into a single yarn system. The result: superior texture retention and performance with a cotton feel.

Foss Floors stands out with its premium Peel & Stick line of carpet tiles that provide a heavier face weight. “We are a non-woven manufacturer, and I think that is to our advantage,” said Sam Ruble, vice president of sales. The products are made from 100% PET from post-consumer drinking bottles. In addition, Foss Floors has a zero-loss recycling policy and all scraps are recycled back into fiber to be used again. “We are green, and we have all-around performance capability with our fiber.”

Stanton has notable introductions in its Atelier Vertex collection—Apex, Meridian and Zenith. All three styles are offered in a color palette that is suitable for a variety of design aesthetics. They are machine tufted and offer the added performance benefits of 3M Scotchgard SD nylon.

Mohawk/Karastan made significant investments in its manufacturing capacity, allowing it to launch innovative products such as KaraLoom. This Karastan brand brings a tufted pattern with a woven look, high styling and striking colorations. Also new are the EverStrand Soft Appeal patterns, offering bolder, modern designs with nice accent colors, and the new SmartStrand Silk patterns that aim to bring the softest patterns with a clean finish.

Shaw Floors’ Caress collection, which features higher-end soft surface styles, is positioned as offering “refined and effortless” style for the discerning consumer. Caress styles work as a wall installation or pairs as a custom rug with The Gallery premium hardwood collection. Bellera features Endurance High-Performance fiber and LifeGuard spill-proof backing.

Engineered Floors’ introductions include DW Select, a collection of styled patterns, textures and colors to the Dream Weaver product family. DW Select features the mill’s proprietary twistX technology, which uses a patented process to enhance wearability.