June 26-July 2, 2018: Volume 34, Issue 1

By Ken Ryan

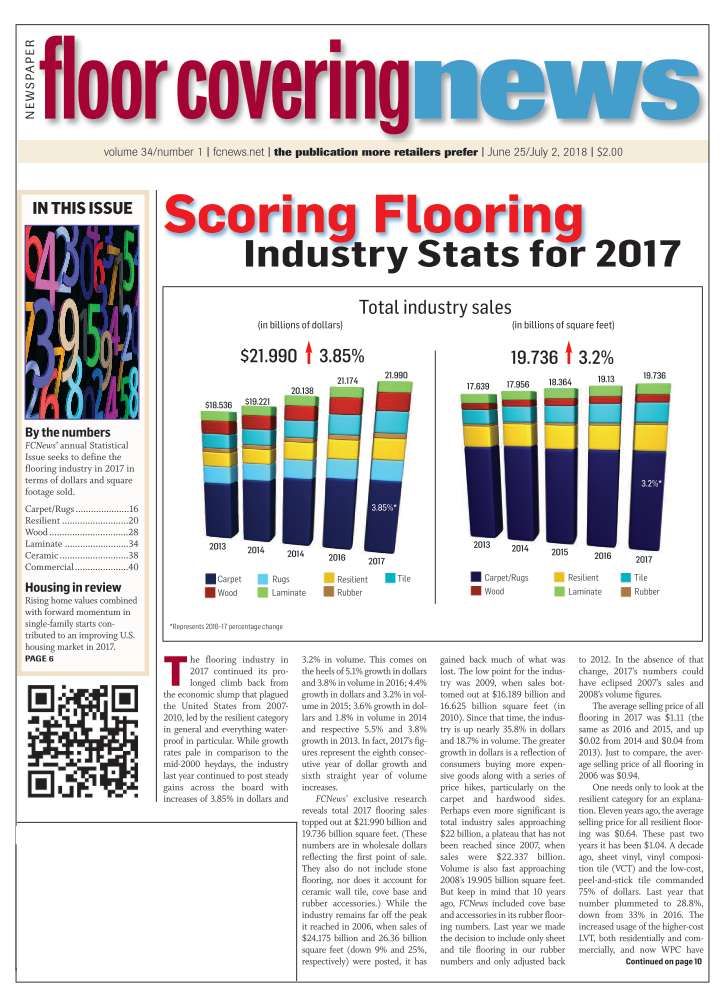

The U.S. ceramic tile industry registered its eighth consecutive year of growth in 2017, buoyed largely by a strengthening economy, sizeable gains in the construction and housing sectors, falling unemployment numbers and favorable interest rates.

FCNews research shows sales rose 5.8% to $2.921 billion while volume increased 5% to 2.426 billion square feet. The 2017 numbers were similar to 2016 when sales jumped 5.7% and volume increased 5.5%, reflecting the continued strength of a category that is the third-largest sector in flooring in terms of dollars, representing 13.3% of all flooring sold in 2017, up from 13% in 2016. In terms of volume, ceramic tile represented 12.35% of total industry volume, up from 12.1% in 2016. Only carpet/rugs and resilient account for larger pieces of the flooring pie.

The eight-year winning streak follows a rather dark period (2007-2009) when the cate- gory fell an almost incomprehensible 20% or more for three consecutive years before beginning its comeback in 2010. The nadir took place in 2009, when the ceramic market fell 24.2% in sales to $1.347 billion while volume dropped 22% to 1.28 billion square feet. Fast forward to 2017—ceramic sales have risen 116% since 2009 while volume has increased 89.5%.

While the overall economy—and housing in particular—is showing robust activity, ceramic is taking advantage with gains that only LVT has surpassed among flooring product segments. “Housing starts are crucial for the ceramic tile industry,” Donato Grosser, industry consultant, told FCNews. “During the recession, housing starts fell by 70% and ceramic tile sales fell by more than 30%. Now, housing starts are progressing at a moderate pace. When the sector cools off, it will not do too much damage.”

The combination of still relatively low interest rates, high home equity and a backlog from the economic crisis of 2008–2010 has been instrumental in the flooring industry growing at rates exceeding that of the nation’s gross domestic product (GDP), which grew 2.3% in 2017. Ceramic has been a main catalyst for flooring’s spurt.

“It is almost the perfect storm of economic data that is enabling ceramic tile to continue its double GDP growth rates,” said Raj Shah, president of MSI International. “The U.S. continues to be significantly below the long-term average of residential investment as a percentage of GDP. If we can get back to our long-term average, then we can expect almost a 20% increase in the overall industry size.”

From a residential perspective, there is a strong parallel between tile consumption and new housing starts. To that end, new housing starts greatly contributed to the growth of the ceramic category in 2017, most notably in Florida, Texas and California. There are other trends at play as well. “Single- family homes have generally grown larger in size over the years, providing an opportunity for tile consumption to reach new levels,” said Jason Roshel, product director for Dal-Tile. “These bigger homes tend to use larger quantities of tile because of its style and effortless maintenance. Additionally, we are seeing an increase in wall tile application.”

Role technology plays

Beyond the economy and housing, ceramic tile is taking a disproportionate share within the flooring industry, in part because it is becoming mass marketable due to improvements in technology that have led to applications on countertops, walls and outdoors. Specifically, advances in ink-jet printing have allowed companies to mimic the popular looks of hardwood that so many consumers demand.

“We’re seeing expansion where tile is used for walls and countertops,” said Bob Baldocchi, chief marketing officer and vice president, business development, Emser Tile. “A lot of product we put on floors is also suitable for walls, with 12 x 24 formats and wood-look tiles being the most popular. Ceramic/porcelain and application usage is blurring together. The use of product beyond the floors is happening in all classification of the business. While some products we develop are ceramic, the trend can be seen nearly across the board in terms of what materials are being used to create amazing looks.”

While ceramic sales continue on a healthy trajectory, the average selling price has remained relatively steady for the last four years. Observers cite a directional tug of war that is keeping the average-selling price relatively flat. Among the mitigating factors impacting pricing: less trim is being used today (in favor of profile strips); the growth in wall tile usage; better pricing on 4 x 16 and 3 x 6 white ceramics, and competitive, entry-level price points and competition from LVT/WPC/rigid core product segments. On the flip side, the reasons behind average-selling price increases include: more indoor/outdoor applications; greater feature wall tile usage, and large formats and countertop slab materials. In the end, observers agree average-selling prices for 2017 was virtually unchanged from 2016.

Commercial market

Positive growth was apparent across several commercial segments in 2017, among them corporate offices, healthcare spaces, educational facilities and hospitality. The multi-family segment was strong as well, experiencing growth throughout the year. In general, technology is largely impacting the commercial market with advancements that provide outstanding performance capabilities.

Commercial projects and spending continued on its growth path seen from the last three years. However, growth in the commercial sector was slowed partially due to continued labor issues in the marketplace.

Imports vs. exports

In 2017, imports comprised 68.9% of U.S. tile consumption in square feet, up slightly from 68.6% in 2016. China was once again the largest exporter to the U.S. in volume, a position it has held since taking over the top spot from Mexico in 2015. Chinese imports accounted for 31.3% of U.S. imports (in square feet) in 2017, according to the Tile Council of North America (TCNA). This was up from 29.4% the previous year, and it’s the highest percentage China has ever held of the U.S. import market, research shows.

While the peso has fallen significantly vs. the U.S. dollar over the last five years, ceramic tile imports from Mexico have declined sharply, TCNA reported. Shipments from Mexico comprised 18.9% of 2017 U.S. imports, down from 23.4% in 2016 and off from 27% of U.S. imports just two years ago. Italy was the third-largest exporter of tile to the U.S., making up 18.1% of U.S. imports, down from 19.4% in 2016. The next largest exporters to the U.S. in 2017 were Spain (11.7% import share) and Turkey (6.2%).

On a dollar basis (including duty, freight and insurance), Italy remained the largest exporter to the U.S. in 2017, accounting for 33.7% of U.S. imports.* China was second with a 26.6% share, and Spain was third at 13.9%. U.S. shipments of ceramic tile rose 4.1% in 2017 to a record high of 946.5 million square feet. Domestic production, which has increased each of the last eight years, has been boosted recently by the expansion and opening of additional manufacturing facilities in Tennessee.

Domestically produced ceramic was by far the tile of choice of consumers, as 31.1% of all tile (by square footage) consumed domestically in 2017 was made in the U.S. The next highest countries of origin were China (21.6% of all tile consumed in the U.S.), Mexico (13.1%) and Italy (12.4%).In dollar value, U.S. FOB factory sales of domestic shipments in 2017 were also at a record high of $1.43 billion, up 6.1% vs. 2016. (FOB port means the seller pays for transportation of the goods to the port of shipment, plus loading costs. The buyer pays the cost of marine freight transport, insurance, unloading and transportation from the arrival port to the final destination.) Domestically produced tile comprised 39.3% of total U.S. tile consumption by dollar value, almost double that of Italian tile imports, which made up 20.5%.

Challenges

While the ceramic tile market has risen for eight consecutive years and bears little resemblance to the 2007-09 period, its growth has nonetheless been constrained by a continuing shortage of labor and—to a lesser extent—the massive growth of LVT and its subsegments such as WPC and rigid core.

The installation shortage has hurt the tile industry more so than others, observers say, because of the difficulty in finding qualified tile setters. However, not everyone is ready to call the labor shortage a calamity. While acknowledging that a lack of qualified installers is driving inflation, MSI’s Shah maintained the paucity of labor shortage is also reducing overall unemployment which is helping the industry. He also suggested that the growth of LVT is not hurting ceramic tile, which is not necessarily the consensus out in the market. “LVT has been a game changer in the industry and is really taking share of laminate and hardwood,” he said. “Ceramic tile has the ability to be used on walls, counters, outdoors, etc., and thus has been able to continue to grow in this environment. Technology is enabling much larger, wider and thicker tiles that can be used on floors, as facades, on countertops, walls as stacked stone, or bricks and outside pavers.”

Some observers believe that while the popularity of LVT- related tile may stunt ceramic’s growth in the short term, the durability of LVT long term is still a question mark. “In a few years, LVT growth may slow as consumers realize that the product does not keep up, it looks like ceramic and is not fireproof,” Grosser explained. “I expect more tile usage, especially tile panels (3½ x 10 feet), on walls particularly in commercial installations.”

Most industry observers expect ceramic tile to continue its positive trajectory in the years ahead, citing the fact that the U.S. is still one of the lowest-per-capita consumers of ceramic tile, and therefore there is still a great deal of upside.

(Editor’s note: The product’s value is calculated at point of entry into the U.S. In other words, it is recorded when it lands on U.S. soil. So, much of ceramic tile’s increase was attributed to suppliers beefing up their inventory levels and not reaching first point of sale.)