The industry’s biggest hardwood flooring manufacturer by brand just got a little bigger.

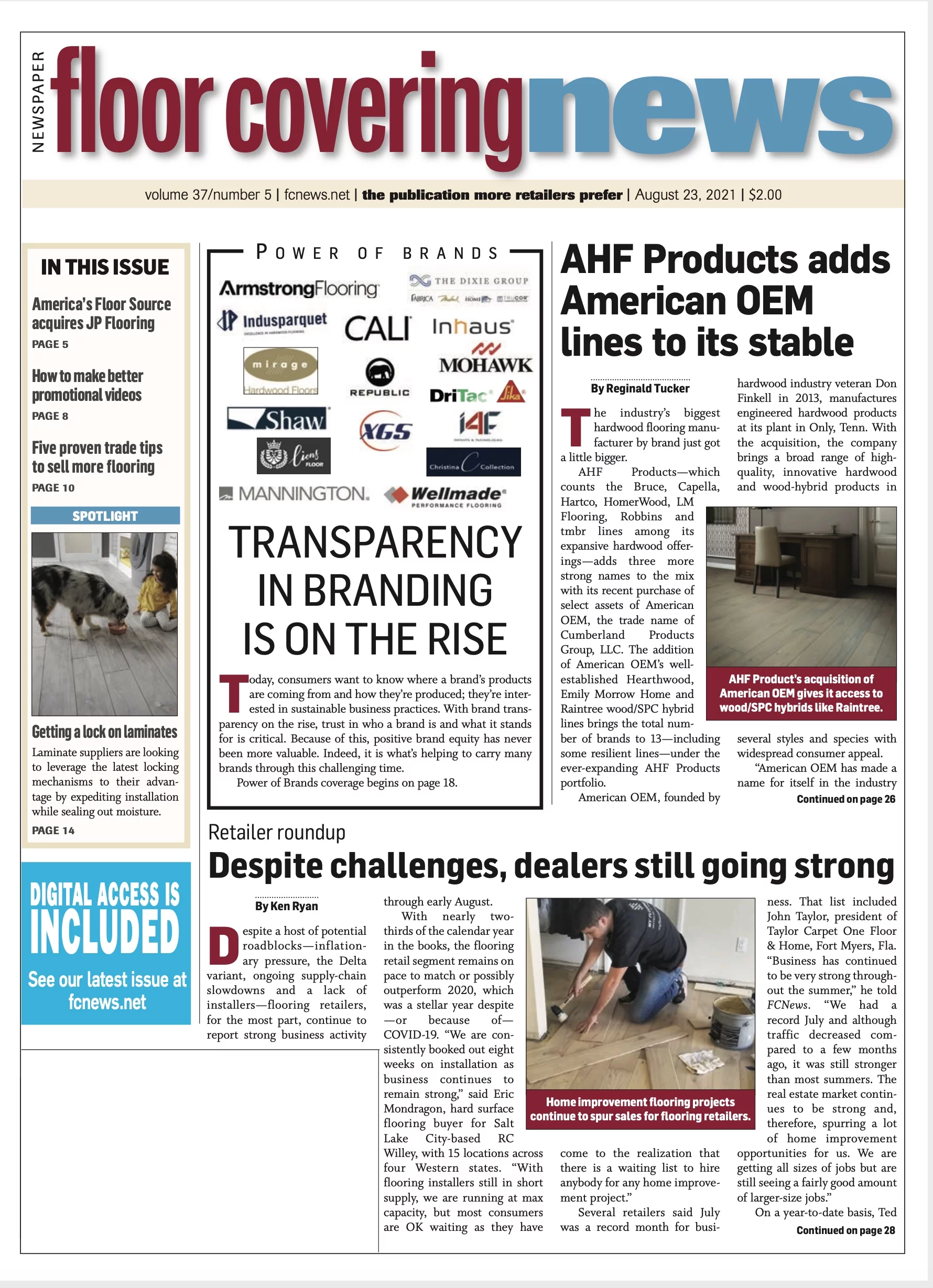

AHF Products—which counts the Bruce, Capella, Hartco, HomerWood, LM Flooring, Robbins and tmbr lines among its expansive hardwood offerings—adds three more strong names to the mix with its recent purchase of select assets of American OEM, the trade name of Cumberland Products Group, LLC. The addition of American OEM’s well-established Hearthwood, Emily Morrow Home and Raintree wood/SPC hybrid lines brings the total number of brands to 13—including some resilient lines—under the ever-expanding AHF Products portfolio.

American OEM, founded by hardwood industry veteran Don Finkell in 2013, manufactures engineered hardwood products at its plant in Only, Tenn. With the acquisition, the company brings a broad range of high-quality, innovative hardwood and wood-hybrid products in several styles and species with widespread consumer appeal.

“American OEM has made a name for itself in the industry with style and innovation, and we look forward to integrating these capabilities and brands into AHF Products and our strong stable of brands and customers,” said Brian Carson, CEO and president, AHF. “American OEM provides us with new products and capabilities produced right here in America, thereby offering reduced lead times at a point when it’s more important than ever to our customers.”

As part of the deal—the financial terms of which were not disclosed—Finkell will remain on board and will continue to oversee plant operations and product development for the American OEM brands. “We are thrilled to be a part of AHF Products and help contribute to its growth,” Finkell stated, citing operational synergies between the two companies. “We approach business in a similar fashion as AHF Products; product development is a collaborative effort between American OEM and its customers, in much the same way AHF Products approaches the market. This has been one of the reasons for AHF Products’ success over the last two years since its formation.”

AHF Products’ purchase of certain assets of American OEM provides tangible benefits for both companies. For one, AHF gains access to American OEM’s specialty manufacturing technologies. “The plant in Only, Tenn., has some absolutely fantastic styling capabilities, including stain-on-stain finishing,” Carson explained. “Another thing American OEM brings is an innovation called WetWorx, which is basically a 360-degree waterproof technology for engineered hardwood flooring. We’ll be looking to leverage those capabilities even further in the marketplace moving forward.”

The purchase also boosts AHF Products’ stateside manufacturing capacity—a big issue in today’s environment where imported shipments are a real challenge. American OEM’s plant, which has an annual capacity of 8 million to 10 million square feet of engineered hardwood, supplements AHF Products’ Somerset, Ky., facility, which also specializes in engineered production. “The Tennessee plant gives us additional U.S. capacity right at a time when everybody’s looking for more local capacity due to the freight, duties and issues with lead times,” Carson stated.

Furthermore, AHF gains access to retailers, distributors and end users it didn’t have relationships with previously. “Our goal is to grow those relationships, not change them,” Carson explained. “We spend an enormous amount of time and energy to keep our retailers and distributors segmented via brands, products and features and benefits. While we gain more production capacity, our capabilities are complementary—not duplicative. It’s what I call ‘addition by addition.’ In the end, it’s going to create more value for our partners across the supply chain.”

More importantly, AHF Products retains the “brain power” Finkell brings to the table given his vast industry experience. “It was very important to us that Don stayed with the business,” Carson said. “His creativity and ability to conceive innovative concepts—and then execute and build on those concepts—makes us stronger. It’s really a perfect match.”

At the same time, the American OEM brands will be able to capitalize on AHF Products’ market position as the leader in hardwood flooring. “We have the scale that will allow greater investment in both businesses,” Carson stated. “We have the wherewithal to invest and really get behind some of the American OEM brands to help them grow faster.”

More options for retailers

Beyond the acquisition’s inherent benefits for AHF Products and American OEM, it’s the floor covering retailer that stands to perhaps gain the most. With more options, differentiated products, tailor-made solutions and overall greater access to stateside inventories, flooring dealers will have more choices to offer consumers and end users. “The response we’ve had from retailers and distributors thus far has been phenomenal,” Carson said. “They are genuinely excited about the opportunities moving forward—as we are.”

From a strictly merchandising point of view, the acquisition opens up creative avenues for retailers to market hardwood and wood/SPC hybrid products. This dovetails nicely with the trend toward greater hard surface consumption. “It’s safe to say you’ll see new displays come out in support of the new brands, and we’ll also be adding fresh, new collections as time goes by,” Carson explained. “You might even see new product platforms, but I’m not going to divulge it all right now. You’ll just have to stayed tuned.”