Hammered by the recession and pressured by competing products, the U.S. laminate flooring market dropped for the third consecutive year. But just how much is largely debatable. Many factions have the category down significantly to the tune of 20%. Others peg the drop in the mid-teens.

Hammered by the recession and pressured by competing products, the U.S. laminate flooring market dropped for the third consecutive year. But just how much is largely debatable. Many factions have the category down significantly to the tune of 20%. Others peg the drop in the mid-teens.

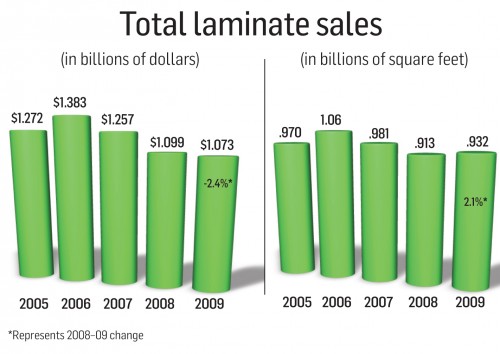

But FCNews research revealed a completely different story. After conferring with just about every significant laminate flooring supplier to the U.S., and after being made privy to confidential sales figures for the purpose of this report, we believe the market was down less than 5%. We are reporting a 2.4% dip from $1.099 billion in 2008 to $1.073 in 2009. And executives at two major laminate manufacturers, Pergo and Kronotex, actually believe the category was up in 2009. When the dust cleared, laminate had a 6.6% share of the flooring market.

As for volume, FCNews pegs the market at 932 million square feet—5.5% of total industry volume—largely attributed to the influx of lower-priced Chinese imports and a home center channel supplied primarily with inexpensive goods from Pergo and Kronotex. Other suppliers to Home Depot include Faus via the DuPont brand and the Home Legends special order program.

FCNews research showed a major shift in retail channel share, which may explain the confusion over market size. The 20% estimate of decline may be accurate if one is solely looking at the specialty retail channel. But what many may fail to take into account is the scope of volume being done in alternate channels. For example, FCNews learned that about 13% of the business is now done through price clubs such as Costco and Sam’s Club courtesy of companies like Pergo and Quick•Step.

And while companies like Shaw and Mohawk lost bays in the home center channel, they were picked up by Pergo and Kronotex.

Last but not least is the impact Lumber Liquidators is making on the category. Last year the company reported doing 18% of its $545 million in laminate. That’s $98 million. The year prior, the company reported doing 13% of its $482.2 million in the category, or $62.7 million.

So, Lumber Liquidators now commands over 9% of laminate sales in the U.S. Add that to the price clubs and you have almost a quarter of the industry. Home centers account for between 40% and 50% of sales. And then there’s the private-label component, or direct import by distributors and large retailers. So specialty retail is becoming much less a factor in the category.

So, Lumber Liquidators now commands over 9% of laminate sales in the U.S. Add that to the price clubs and you have almost a quarter of the industry. Home centers account for between 40% and 50% of sales. And then there’s the private-label component, or direct import by distributors and large retailers. So specialty retail is becoming much less a factor in the category.

With that said, the average square foot price of laminate is plummeting. Last year, FCNews estimated the price dropped about a dime from $1.24 to an all-time low of $1.15.

The horizon

While the economy and housing market are showing signs of stabilization, no one is ready to predict a laminate resurgence just yet. “It is still shaky ground out there,” said Milton Goodwin, vice president, laminate and ceramic, Armstrong. “There’s gravitation toward the lower end since people are being more careful with their money. That’s not unusual. It started with the collapse of the economy and it has gotten worse.”

Goodwin and other industry leaders said the biggest challenge for laminate has been price. “Low demand and overcapacity, which puts pressure on price despite the fact that the cost of the product is going up,” he said. “You have rising costs being laid up against over capacity so it is very challenging to make sure you are maintaining margins.”

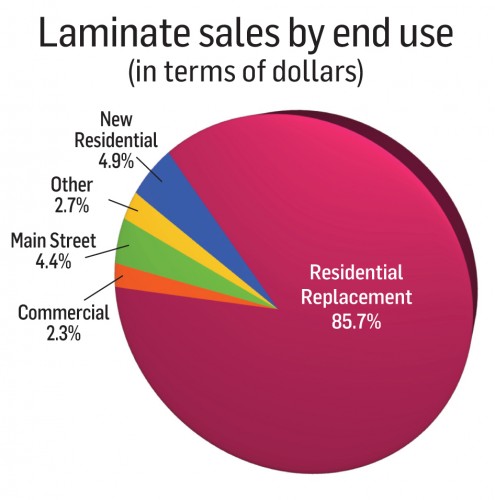

Kim Holm, president of Mannington, said if you’re looking for a bright spot it’s that there is not much laminate installed in new home construction. “So the demise of the builder market has not hurt business,” he said. “What has hurt laminate are the low-priced goods entering the marketplace and the increasing popularity of LVT. There is some terrific LVT out there and they are going after the same floors in the home as laminate.

Like everything today, we all have too much capacity and we’re fighting for a smaller piece of the pie.”

The irony, said Roger Farabee, senior vice president of marketing at Mohawk Hard Surfaces, is that laminate is under duress from the very same categories from which it once took market share. Now it is payback time. “In general, as LVT has improved its looks and as people have become more value conscious, they have gravitated back toward vinyl, particularly LVT,” he said. “You have also seen people go back to carpet because of the price point. And you have also noticed some of the inexpensive wood products take share from higher- end laminate.”

David Sheehan, Mannington’s vice president, resilient and laminate business, sees LVT and fiberglass sheet vinyl continuing to take share back from the laminate category, at least in the near term.

2010 outlook

The laminate category may not be out of the woods yet, but the worst appears to be over, executives said. They point to stronger economic conditions as a catalyst. “The category is picking up a little bit. It’s not lighting the world on fire but as the economy improves I would expect laminate to follow along with it,” said Eric Erickson, vice president of marketing, laminate flooring, Shaw. Many executives interviewed by FCNews said they expect the U.S. laminate flooring market to begin to recover during 2010 as the rise in existing home sales propels the residential replacement market. However,  laminate flooring could continue to lose share, they said, as competition increases from high-end resilient flooring, engineered wood floors and click installed bamboo and cork. Prices could also remain weak due to rising competition from Chinese manufacturers, and U.S. and European manufacturer overcapacity.

laminate flooring could continue to lose share, they said, as competition increases from high-end resilient flooring, engineered wood floors and click installed bamboo and cork. Prices could also remain weak due to rising competition from Chinese manufacturers, and U.S. and European manufacturer overcapacity.

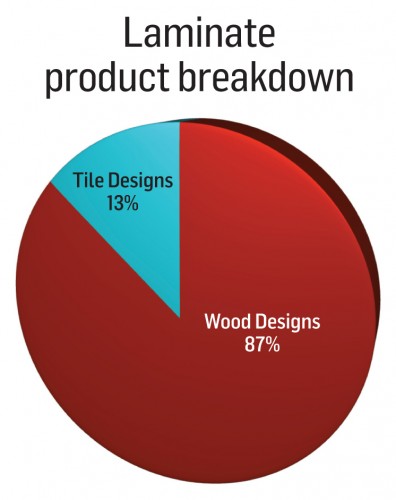

Wood vs. tile visuals

Product innovation, particularly with wood visuals, pre-finished and handscraped, are breathing life into the category, some say. “The consumer is seeing a more attractive product,” Holm said. “They perform well and now are getting even more realistic looks.”

Wood visuals represent between 85% and 90% of the laminate market, according to most flooring executives. Mohawk’s Farabee agreed. “We’re seeing from our own business that the growth is in the wood looks. Why? Inexpensive ceramic pricing in the Sun Belt and improved LVT looks, which is attractive for Northern customers who tend to gravitate toward vinyl anyway,” he said.

But not everything is going in that direction. In its biggest tile launch in laminate since 2006, Armstrong said it is charting new territory in stones and ceramics. “With all of these intros, we evaluated what was going on in the marketplace and saw an opportunity to improve on current technology and provide retailers with a differentiated product,” Goodwin said.