By Reginald Tucker—Certain sectors of the commercial market are expected to continue to face some headwinds heading into 2022, but there are signs of improvement on the horizon. That’s according to research unveiled in “Construction Market Trends for 2022,” a recent webinar conducted by ITR Economics.

By Reginald Tucker—Certain sectors of the commercial market are expected to continue to face some headwinds heading into 2022, but there are signs of improvement on the horizon. That’s according to research unveiled in “Construction Market Trends for 2022,” a recent webinar conducted by ITR Economics.

The presentation, moderated by Connor Lokar, senior forecaster with ITR Economics, looked at several key leading indicators for the commercial market—i.e., architectural billings, non-residential construction starts, corporate profitability and end-use segment trends, among others. The general consensus, according to ITR, is commercial construction is beginning to turn the corner—good news for those serving this critical sector.

“Our forecast calls for a high single-digit growth rate for non-residential construction next year,” Lokar said. “It’s not that we expect to see things turn around as soon as the calendar flips, but we are expecting recovery next year. We expect to see a slowing of the bleeding through the balance in this year, and then things really getting better next year.”

ITR is basing that optimistic outlook on indices that point to either: a) an improvement in the rate of new construction contracts; or b) the resumption of projects put on hold during the height of the COVID-19 pandemic and in the immediate aftermath.

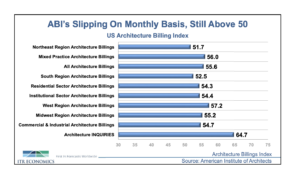

Take the U.S. Architecture Billing Index (ABI), for example. Virtually all indices for architectural billings across regions of the country—an indicator reflecting the activity of commercial projects—exceed “50.” (That suggests a positive sentiment among firms involved in commercial work.) Among the strongest ABI categories are: West region (57.2); Midwest region (55.2); and South region (52.5). Furthermore, positive architectural billing indices are evident in categories such as “mixed practice” projects (56); institutional sector billings (54.4); and commercial/industrial architecture billings (54.7).

“Any number above 50 indicates things are better this month compared to the month prior,” Lokar explained.

Even more telling is the “Architecture Inquiries” index, which currently sits at 64.7. That’s a clear indication, according to Lokar, that project managers are more optimistic about business conditions and are planning accordingly.

“Calls are still happening—folks are still sniffing around,” he said. “They’re trying to figure out if it makes sense to more forward now or delay their projects a bit longer into the first half of next year.”

Mixed view of end-use markets

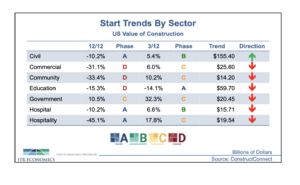

While ITR Economics is confident that the U.S. commercial market is generally poised for a rebound in 2022, it’s not expecting all end-use sectors to recover at the same rate or even in the same time frame. For instance, civil, hospitality and healthcare sectors—as measured by “value of construction”—are currently in the “recovery” phase. By contrast, the government sector is considered in the “slower growth” phase while education, community and general commercial are in the “recession” phase, ITR statistics show.

Looking at the value of construction (start trends by sector) stats more closely, several key markets are emerging. For example, industrial, manufacturing and medical are showing signs of recovery, while the office sector still lags behind. Private retail construction—an area hard hit by the pandemic—is also showing signs of recovery as the downward trend seen in 2020 is beginning to level off (see chart).

Looking at the value of construction (start trends by sector) stats more closely, several key markets are emerging. For example, industrial, manufacturing and medical are showing signs of recovery, while the office sector still lags behind. Private retail construction—an area hard hit by the pandemic—is also showing signs of recovery as the downward trend seen in 2020 is beginning to level off (see chart).

“Historically, as we know, commercial markets are lagging sectors,” Lokar said. “Generally. by this point we would’ve seen maybe a bit more upside push than we’ve seen to this point for non-residential. Normally we see about a one-year lag time between the macro economy at large, GDP in particular, which bottomed out in the second quarter last year. And if we add 12 months to that, things should be breaking free from a non-residential project standpoint. Many executives I’ve spoken to feel things are going to gradually get better as we move forward into 2022. We were seeing that in non-residential construction starts.”

So, which sectors are expected to fare better than others? So much is a function of geography and local economic conditions, according to ITR, but there are certain conclusions that can be drawn. “If you look at civil works, we’re seeing more spending on hospitals and, to some extent, education,” Lokar explained. “Government spending is actually up, 10.5%, from a starts perspective. On the other hand, hospitality starts are down 45% annually. However, we do see favorable three 3/12 quarterly rates of change for all of these sectors. Some things are breaking through on an annualized basis that aren’t necessarily showing up from a 12/12 perspective. Bottom line is we are seeing generally better rates of change here. It’s showing that some things are starting to happen—which means we’ll see some of those opportunities coming up with perhaps some greater frequency here in the latter portion of 2021. That’s going to get better as we move forward.”

The big question mark in commercial, of course, is the office sector. With the COVID-19 delta variant putting a crimp in many corporations’ plans to bring more workers back to the office, analysts are finding it difficult to predict how this sector will fare in 2022.

“A lot of folks were expected to be going back to the office this fall—that was the timing that a lot of employers had counted on,” Lokar said, citing prominent employers such as Google, Apple, etc. “Not the case for Microsoft, which indefinitely suspended the return of workers to the office on account of the delta variant issue. We saw a lot of other employers signal similarly in that regard. I think we’re going to see some extended malaise in this recovery trend for office construction.”

(For more on this story, look for the Oct. 11/18 edition of FCNews.)