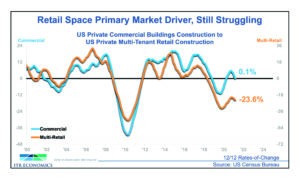

By Reginald Tucker (This is the second of two parts.)—In many respects, the residential and commercial construction markets can be viewed as a tale of two cities. Residential, on one hand, has held steady as sequestered homeowners and renters opted to spend their disposal dollars on flooring, appliances and furniture as opposed to extravagant vacations. Conversely, several commercial end-use segments are still slow to get off the mat after the knockout punch from the pandemic—particularly corporate/office, brick-and-mortar retail and hospitality.

By Reginald Tucker (This is the second of two parts.)—In many respects, the residential and commercial construction markets can be viewed as a tale of two cities. Residential, on one hand, has held steady as sequestered homeowners and renters opted to spend their disposal dollars on flooring, appliances and furniture as opposed to extravagant vacations. Conversely, several commercial end-use segments are still slow to get off the mat after the knockout punch from the pandemic—particularly corporate/office, brick-and-mortar retail and hospitality.

Thankfully, all is not gloom and doom. As the overall economy continues on its gradual recovery, there are a few bellwether commercial markets that are expected to regroup. That’s according to “Construction Market Trends—Mid-2021,” a recent webinar presented by Connor Lokar, senior forecaster with ITR Economics.

Following are excerpts of the presentation pertaining specifically to the non-residential U.S. construction market.

Retailers, contractors and other relevant parties serving both the commercial and residential flooring markets typically see the pendulum swing in opposite directions with respect to growth cycles. The current track of each of these key end-use markets is no different. “Whereas we expect housing starts to slow down a little bit next year, we’re going to see non-residential markets really start to rev their engines again in 2022 and 2023,” Lokar stated. “Why? Consumers starting to spend as they did before the pandemic, with folks traveling more. That will certainly impact the hospitality side of things. We also see people going back into the office, which impacts the corporate market. Good things are happening and that’s setting the stage.”

Retailers, contractors and other relevant parties serving both the commercial and residential flooring markets typically see the pendulum swing in opposite directions with respect to growth cycles. The current track of each of these key end-use markets is no different. “Whereas we expect housing starts to slow down a little bit next year, we’re going to see non-residential markets really start to rev their engines again in 2022 and 2023,” Lokar stated. “Why? Consumers starting to spend as they did before the pandemic, with folks traveling more. That will certainly impact the hospitality side of things. We also see people going back into the office, which impacts the corporate market. Good things are happening and that’s setting the stage.”

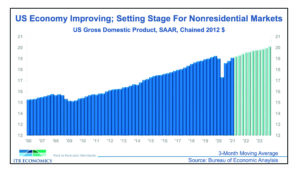

Evidence of this anticipated uptick in commercial flooring activity, according to ITR, is supported by trends in U.S. gross domestic production (GDP). Based on the trend lines, ITR predicts a rise in utilization that will impact various commercial segments. The combination of increasing demand on distribution along with higher demand from the manufacturing sector is expected to drive development across what Lokar calls “key verticals” in the market.

“So, if you’re a contractor, a general contractor or a component provider, know that growth is coming,” he said. “It’s not necessarily here yet, but the signs are pointing in that direction. Non-residential construction is the caboose that’s being towed behind the tempo of the broader U.S. economy.”

When it comes to gauging the outlook for the commercial construction market, GDP, according to Lokar, is not so much a “leading” indicator as it is a “lagging” indicator. Historically, he noted, recessionary low points ultimately hit considerably sooner than non-residential construction market development eventually bottoms out. Conversely, when overall economic conditions begin to improve, it usually takes about 12 months for signs of a more robust and meaningful recovery to occur in the commercial market.

When it comes to gauging the outlook for the commercial construction market, GDP, according to Lokar, is not so much a “leading” indicator as it is a “lagging” indicator. Historically, he noted, recessionary low points ultimately hit considerably sooner than non-residential construction market development eventually bottoms out. Conversely, when overall economic conditions begin to improve, it usually takes about 12 months for signs of a more robust and meaningful recovery to occur in the commercial market.

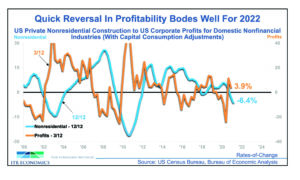

“We believe it could happen early 2022,” Lokar predicted. “We’ve hit the bottom, and soon we will begin to see more movement in construction spending next year, which we expect will carry well into 2023.”

With the worst of the pandemic-driven recession seemingly behind us (fingers crossed), ITR is encouraging contractors and retailers to push forward with their commercial growth plans. The firm points to, among other things, a gradual return to corporate profitability as well as positive movement in architectural project billings.

“It’s kind of the first glimpse of light at the end of the tunnel—one that we can be confident is not a train but actually the good times ultimately starting to get closer,” Lokar explained. “We very well may have already hit our low point from a rate-of-change basis. We’ve witnessed—it would appear—the worst in terms of quarter-over-quarter decline. We foresee new opportunities for retailers, designers and contractors to put quotes and bids out there, as these are going to create business for you. Things have gotten as bad as we think they’re going to from a rate-of-change standpoint, and we’re starting to see things pick up.”

“It’s kind of the first glimpse of light at the end of the tunnel—one that we can be confident is not a train but actually the good times ultimately starting to get closer,” Lokar explained. “We very well may have already hit our low point from a rate-of-change basis. We’ve witnessed—it would appear—the worst in terms of quarter-over-quarter decline. We foresee new opportunities for retailers, designers and contractors to put quotes and bids out there, as these are going to create business for you. Things have gotten as bad as we think they’re going to from a rate-of-change standpoint, and we’re starting to see things pick up.”

However, Lokar noted it’s important to remember that recovery does not always manifest itself in the form of an immediate turnaround. Rather, he described recovery as “the bleeding slowing down,” not necessarily stopping. “What we’re seeing is that things are going to start to firm up more noticeably in the second half of this year,” he said. “Then business is going to get stronger from a growth standpoint as we head into 2022 and 2023.”

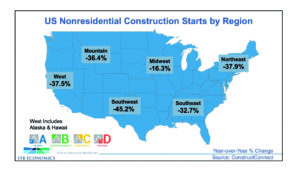

Furthermore, the commercial recovery currently under way will resume at a different pace based on the various regions across the U.S. Take the Midwest construction market, for example. Statistics provided by ITR Economics show this region is furthest along into its recovery trend, with business down 16.3% compared to 30% to 40% declines seen across the rest of the country in pre-COVID-19 times. “I would look forward to these [numbers] starting to improve, which means there’s going to be more opportunities for contractors out there, especially if they have some work committed,” Lokar said. “Perhaps they can prioritize and get a little bit pickier with projects they’re chasing, where they’re not just kind of blindly trying to grab volume to make sure they’re keeping the lights on and cash flow moving. It’s an opportunity to try to look for those better fits.”

Return to corporate profitability

That timing based on this approach is especially important given the improvement in the aforementioned corporate profit trends. “Corporate balance sheets are remarkably healthy right now, and the amount of cash out there waiting to be deployed is massive,” Lokar said. “As the business environment, confidence and the uncertainties continue to dissipate here in 2021, businesses are going to start thinking about their next moves and start deploying some of that capital in various capacities. Invariably, we’ll see some of that flow to facility investment as we move forward.”

That timing based on this approach is especially important given the improvement in the aforementioned corporate profit trends. “Corporate balance sheets are remarkably healthy right now, and the amount of cash out there waiting to be deployed is massive,” Lokar said. “As the business environment, confidence and the uncertainties continue to dissipate here in 2021, businesses are going to start thinking about their next moves and start deploying some of that capital in various capacities. Invariably, we’ll see some of that flow to facility investment as we move forward.”

This positive outlook bears out in the trend lines. ITR research showed U.S. domestic corporate profits are up quarter over quarter compared to the private non-residential construction market. “If you just shift this orange line forward and line up these highs and lows, you can see that this prior low is corroborating what we anticipate will be a 2021 business cycle low at the end of this year,” Lokar explained. “This is signaling, potentially, a very quick reversal as companies start to spend again.”

His advice to the industry? Continue plugging ahead. “Contractors and retailers can look for jobs they can complete more profitably as opposed to dealing with what is becoming a more competitive bidding environment compared to where we were 12 to 15 months ago,” Lokar said. “We’re seeing more consistency in the leading indicators on the non-residential side that we didn’t observe back in October.”

Uptick in billings

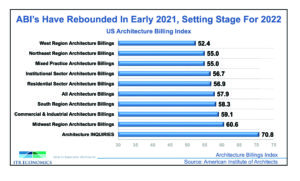

Another sign of the return to positive movement in commercial activity in certain regions of the U.S. is the trend in architectural billing indices. ITR research showed billings slowly began to rise in late summer/early fall of 2020, only to retreat this past winter. Fast forward to early spring—billings are taking off.

“Architectural billings finally hit their stride here in the last couple of months,” Lokar said, pointing to the data. (Note: Any number above 50 indicates more actual billings for architects across the country compared to the month prior.) “That rising tide line—which reflects early project stages—is really starting to show some signs of life.”

Health of end-use sectors

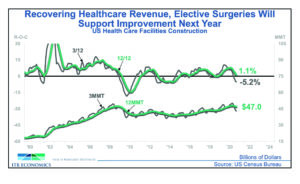

As we climb out of the pandemic, some commercial end-use sectors are rebounding faster than others—healthcare being one of them. It should come as no surprise given the correlation between the pandemic and the outsize need for medical care due to treatments and hospitalizations associated with COVID-19. However, another factor expected to drive higher spending by healthcare agencies and providers is an anticipated increase in non-pandemic-related services as patients who may have postponed standard check-ups or other procedures during the height of the pandemic begin their gradual return to doctors’ offices.

As we climb out of the pandemic, some commercial end-use sectors are rebounding faster than others—healthcare being one of them. It should come as no surprise given the correlation between the pandemic and the outsize need for medical care due to treatments and hospitalizations associated with COVID-19. However, another factor expected to drive higher spending by healthcare agencies and providers is an anticipated increase in non-pandemic-related services as patients who may have postponed standard check-ups or other procedures during the height of the pandemic begin their gradual return to doctors’ offices.

“As things begin to normalize, we expect healthcare is going to get better next year as elective surgeries get back online and cash flow improves,” Lokar stated. “We saw a pretty big pullback in this sector for the first time in several years, but we’re going to start to see that bounce back next year.”

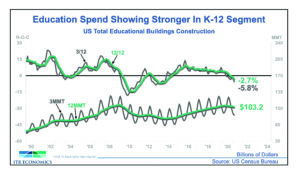

The education sector—another key barometer of the health of the commercial construction market—should also emerge as a strong performer next year, especially K-12. “Within the educational umbrella, K-12 will be significantly stronger,” Lokar said. Increased state and local funding, along with stimulus dollars, will contribute to targeted spending in this area, he noted.

When it comes to projected spending at higher education levels, however, it’s a bit of a mixed bag. “Clients I’ve talked to on the university side said it’s hit or miss,” Lokar explained. “Some colleges are taking advantage of the downtime to spend on improvements and repairs, but others have completely shut the spigot off and stopped spending.”

When it comes to projected spending at higher education levels, however, it’s a bit of a mixed bag. “Clients I’ve talked to on the university side said it’s hit or miss,” Lokar explained. “Some colleges are taking advantage of the downtime to spend on improvements and repairs, but others have completely shut the spigot off and stopped spending.”

The picture appears a bit brighter when it comes to leisure travel. As more people are vaccinated against the coronavirus—and as their comfort level in boarding a plane rises—more consumers are expected to take vacations after being couped up for so many months.

Along with a return to the friendly skies, ITR said it expects to see a rise in demand for hotel, leisure, restaurant and workers associated with eating and drinking establishments. Still, the firm noted, much depends on: a) the willingness of a hesitant labor force to get back to work in these segments; and b) whether lodging/hospitality establishments have the stomach (or wherewithal) to allocate limited dollars to hiring and capital improvements amid a tepid recovery.

Then there’s the office/corporate sector—arguably the hardest-hit construction market. “I’ve read that it could be as much 20% of the workforce permanently working in a remote at-home setting—which could be potentially devastating for the commercial office segment,” Lokar said. “We think it’s going to take a couple of years for a lot of this excess square footage to get stocked back up. A lot of companies that are leasing space are actively looking to negotiate down and out of a space that they already committed to. However, we’re not bearish to the point where we think physical office space is dead forever.”