By Reginald Tucker Many U.S. residential construction markets remain red hot, while nonresidential segments are still grappling with aftershocks related to COVID-19 and hits to commercial facility utilization. That was the main thrust of “Construction Market Trends—Mid-2021,” a recent webinar presented by ITR Economics.

By Reginald Tucker Many U.S. residential construction markets remain red hot, while nonresidential segments are still grappling with aftershocks related to COVID-19 and hits to commercial facility utilization. That was the main thrust of “Construction Market Trends—Mid-2021,” a recent webinar presented by ITR Economics.

Moderated by Connor Lokar, a senior forecaster with the firm, the webinar addressed the runaway growth of residential construction and how long the industry can expect it to continue. The presentation also alluded to what the eventual slowing growth trend might look like peering ahead to 2022.

Following are excerpts of the webinar pertaining to the residential market outlook (the commercial market recap follows in part two of this feature, which is slated for the June 21/28 edition).

When ITR last provided an update on the U.S. construction business back in October of 2020, the outlook was somewhat tempered. The U.S. residential construction market was riding a strong wave heading into the start of the year, and then the pandemic hit. At the time, analysts were hesitant to make any mid-to-long-term predictions based on all the uncertainty the industry was feeling at the time. “In May last year, the world as we knew it was crumbling,” Lokar said.

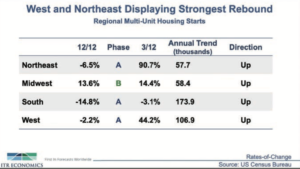

Fast forward to the middle of 2021, and the outlook on the U.S. construction residential market is more sanguine. “Some things have changed since the last time we did one of these updates,” Lokar stated. “We had anticipated some weakness on the multifamily side, which we saw, but then we’ve seen some positive developments there regarding permits. We had also anticipated ongoing favorable conditions in the residential housing market. Here we are a year later where we have a better feel for things as far as where we’re heading. Housing did indeed remain red hot, and we expect it’s going to stay there.”

Fast forward to the middle of 2021, and the outlook on the U.S. construction residential market is more sanguine. “Some things have changed since the last time we did one of these updates,” Lokar stated. “We had anticipated some weakness on the multifamily side, which we saw, but then we’ve seen some positive developments there regarding permits. We had also anticipated ongoing favorable conditions in the residential housing market. Here we are a year later where we have a better feel for things as far as where we’re heading. Housing did indeed remain red hot, and we expect it’s going to stay there.”

While continued growth is expected in the residential market, ITR Economics said observers should not be alarmed if those growth rates decelerate somewhat in the short term. In other words, slower growth does not equate to negative growth. “The market is going to stay exceptionally robust from a growth standpoint,” Lokar explained. “As we look through the remainder of this year, though, things are going to start to slow down a bit. Obviously, we know supply chains are struggling to keep up, even on the single-family side of the board.”

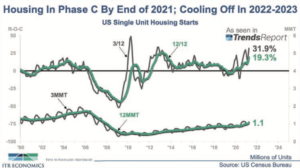

Nonetheless, ITR Economics said it expects the housing market to continue to post some strong numbers, particularly single-family activity (see Housing Phase C chart). “Housing has been unbelievable,” Lokar said. “We’re now above, on an annualized rate, 1.1 million starts for single-unit housing starts. We will continue to see quarter-over-quarter growth rates for new residential housing construction.”

Not just growth, but “obscene” growth, according to Lokar. Looking at the three- month moving total, starts are up 31.9% from February to April. Based on that activity, ITR projects growth in housing starts for 2021 will be in the neighborhood of 21%-22%. It’s that high rate of growth that will make any menial “slowdown” almost imperceptible. “It’s actually going to be in phase C that we will see slowing growth of the business cycle by the end of 2021,” he explained. “You’re probably not going to be able to perceive that slowdown, quite frankly, with growth rates up north of 20% at the end of the year. As we transition into 2022 and 2023, however, we anticipate activity will slow down rather significantly.”

What, precisely, will that impending “slowdown” look like? As we head into 2022, ITR expects growth in single-family home construction will slow to roughly one-fifth the rate we’re currently witnessing. Again, Lokar noted, modest growth is still growth. It’s all relative to the lofty rates we’re currently experiencing. “We sometimes trick our-selves into thinking that robust activity is going to last forever,” he said, noting that 20-plus-percent growth is nearly impossible to maintain. “We’re here to tell you that things are going to start to slow down as we move into next year.”

Regional activity analyzed

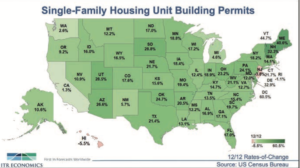

During the height of the pandemic, different states responded accordingly to the COVID-19 threat with respect to restrictions and safety guidelines. In that same vein, various states began their respective economic recoveries at different intervals based on the response of each state government. “When the total market is up over 20%, we’re going to see generally pretty comfortable growth rates across the country,” Lokar stated, citing a regional overview of single-family building permits (see chart). “It seems there is a little bit of COVID-19 relevance in terms of the hottest growth markets in the country. When I look at various states in terms of the severity and duration of the shutdowns, it shows just how obstructive some of those were to economic activity. This phenomenon may have driven population flows and perhaps potential homeowners into other markets that were more accommodating or a bit more relaxed.”

During the height of the pandemic, different states responded accordingly to the COVID-19 threat with respect to restrictions and safety guidelines. In that same vein, various states began their respective economic recoveries at different intervals based on the response of each state government. “When the total market is up over 20%, we’re going to see generally pretty comfortable growth rates across the country,” Lokar stated, citing a regional overview of single-family building permits (see chart). “It seems there is a little bit of COVID-19 relevance in terms of the hottest growth markets in the country. When I look at various states in terms of the severity and duration of the shutdowns, it shows just how obstructive some of those were to economic activity. This phenomenon may have driven population flows and perhaps potential homeowners into other markets that were more accommodating or a bit more relaxed.”

For example, the rate of growth in building permits in Washington state was 2.6%, compared to a national market growth rate of north of 20%. Ditto for California, another state that enacted severe lockdown restrictions. In that state, the rate of new building permits was 1.3%. As you pivot to the Midwest, Michigan and Illinois (also two of the stricter states) saw permits at 12.4% and 4.6%. In the Northeast region, building permits in Rhode Island were down 1.1% and New Jersey building permits were off by 3.8%. Juxtapose that with the rates seen in surrounding states with gener- ally much higher growth rates ranging from 18.4% (Iowa, for instance), to 23.2%.

“So, it seems that there’s a little bit of relevance there,” Lokar stated. “I’m certainly not rendering any sort of moral judgment on states’ decisions to restrict activity; it’s just an interesting observation. But when we look back over the past 12 months, it does appear that we see a little bit of COVID-19-affected numbers bleeding through.”

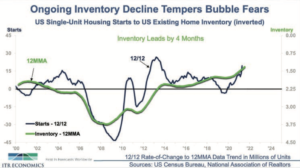

The significance of the building permit numbers, according to ITR, is it provides a fairly reliable barometer of near-term construction activity. The logic being: the issuance of permits precedes actual housing starts. According to statistics reviewed by ITR, the general gap between the issuance of a permit and the actual groundbreaking is about four months. Utilizing that data, the firm noted, companies can better forecast demand.

The significance of the building permit numbers, according to ITR, is it provides a fairly reliable barometer of near-term construction activity. The logic being: the issuance of permits precedes actual housing starts. According to statistics reviewed by ITR, the general gap between the issuance of a permit and the actual groundbreaking is about four months. Utilizing that data, the firm noted, companies can better forecast demand.

“This data point says, at a minimum, it’s full steam ahead into the third quarter,” Lokar explained. “That might ease some fears and maybe allow you to put your foot on the gas with hiring, purchasing that new fleet of trucks or loading up on whatever it is to help you to accommodate that growth now that you have the confidence in what the data points are telling you.”

For those interested in the prospects for what the construction industry might look like a little farther down the road, perhaps the best barometer is the key gauge for builder sentiment—the latest National Association of Home Builders HMI index (see chart). The ascendant green line screams “go” at least through the end of 2021. “That’s signaling upside pressure on the housing market into the fourth quarter of this year, which is in line with our forecast,” Lokar said. “That’s before things start to turn over as we transition into next year.”

Beware the “B” word

With growth rates in housing at market highs, there’s talk among industry observers about a potential housing “bubble.” On this issue, Lokar said it’s important to keep things in the proper perspective. “While we don’t think the rate of growth we’re seeing currently is sustainable, it’s not necessarily that it’s some sort of bursting of a bubble as we look forward here into 2022 and 2023,” he explained. “At this point in time, nothing I’m seeing says we need to be concerned about any sort of bubble. One of the reasons I’m confident in that is by what we’re observing in the current home buying and selling market. Buyers are waiving inspections, they’re coming in at anywhere between $10K-$50K above list, depending on the market. That type of activity does not necessarily inspire confidence.”

With growth rates in housing at market highs, there’s talk among industry observers about a potential housing “bubble.” On this issue, Lokar said it’s important to keep things in the proper perspective. “While we don’t think the rate of growth we’re seeing currently is sustainable, it’s not necessarily that it’s some sort of bursting of a bubble as we look forward here into 2022 and 2023,” he explained. “At this point in time, nothing I’m seeing says we need to be concerned about any sort of bubble. One of the reasons I’m confident in that is by what we’re observing in the current home buying and selling market. Buyers are waiving inspections, they’re coming in at anywhere between $10K-$50K above list, depending on the market. That type of activity does not necessarily inspire confidence.”

Another leading indicator of the health of the residential market is current inventory levels. Builders see inventory levels rising, with units for sale expected to take anywhere from 30 to 90 days to move—a much slower pace than what we’re seeing in the current market. “That would lead to a pullback from a development standpoint,” Lokar noted.

The steady rise in mortgage rates is another measure of how hot the housing market is tracking. “They were at high twos, now there may be a high threes, low fours, low fives—which we know historically is not a very high rate, but we see that chain of events between rates going up, perhaps a negative buyer response,” Lokar explained. “That ultimately translates 11 months later to that pullback in single-unit starts.”

Multifamily movement

Industry watchers tend to place a lot of emphasis on single-family housing activity in order to get a firm view of the overall residential market. But it’s also important to track trends in the multifamily sector, even though it traditionally lags behind single-family activity. “What we saw recently was an explosion in multiunit permit issuance—massive, double-digit growth,” Lokar said. “What’s interesting is that the growth was more robust for multifamily units (two to four units) with duplexes to smaller townhomes exceeding five units coming in at a lower growth rate, albeit still positive. It’s our view that the multifamily market is perhaps chasing some of this demographic displacement out of densely populated urban areas into suburban or more rural locations.”

Industry watchers tend to place a lot of emphasis on single-family housing activity in order to get a firm view of the overall residential market. But it’s also important to track trends in the multifamily sector, even though it traditionally lags behind single-family activity. “What we saw recently was an explosion in multiunit permit issuance—massive, double-digit growth,” Lokar said. “What’s interesting is that the growth was more robust for multifamily units (two to four units) with duplexes to smaller townhomes exceeding five units coming in at a lower growth rate, albeit still positive. It’s our view that the multifamily market is perhaps chasing some of this demographic displacement out of densely populated urban areas into suburban or more rural locations.”

Much like the single-family housing market outlook, ITR also said it sees a slowing of multifamily activity beginning in early 2022. The big question mark is how the federal government, as well as individual states, handle the eviction moratorium—which is set to expire at the end of June.

“There’s a possibility that if the moratorium is lifted on June 30 and then on July 1 all of a sudden we’re looking at hundreds of thousands, if not millions, of evictions, there could be subsequent vacancies and downside rent pressure,” Lokar surmised.

Once the flurry of activity settles, ITR said it believes a more stable picture will emerge. “The growth we sustained in the last four or five quarters will resolve itself toward more normal growth rates,” Lokar said. “Our forecast calls for long-term normalization across portions of the economy for the next three years.”