By Ken Ryan If not for an anomalously bad second quarter created by the COVID-19 pandemic, the carpet category may well have celebrated an upturn in 2020 after several mediocre years. Alas, the period from mid-March 2020 through the end of May—which included the end of the first quarter and most of the second, during which manufacturing plants paused and scores of retail showrooms closed—canceled any victory parade.

By Ken Ryan If not for an anomalously bad second quarter created by the COVID-19 pandemic, the carpet category may well have celebrated an upturn in 2020 after several mediocre years. Alas, the period from mid-March 2020 through the end of May—which included the end of the first quarter and most of the second, during which manufacturing plants paused and scores of retail showrooms closed—canceled any victory parade.

In the second quarter of 2020, residential carpet sales plummeted 23% in volume and 27.4% in dollars, according to FCNews research. While residential finished the year on a positive note with volume up 9.5% in the fourth quarter and dollars increasing 13.2%, it could not make up for the second quarter disaster. As for commercial, it never answered the bell after getting flattened in the second quarter. Following a slight loss in the first quarter of 2020, commercial volume and dollars were down 20% or higher in each of the final three quarters.

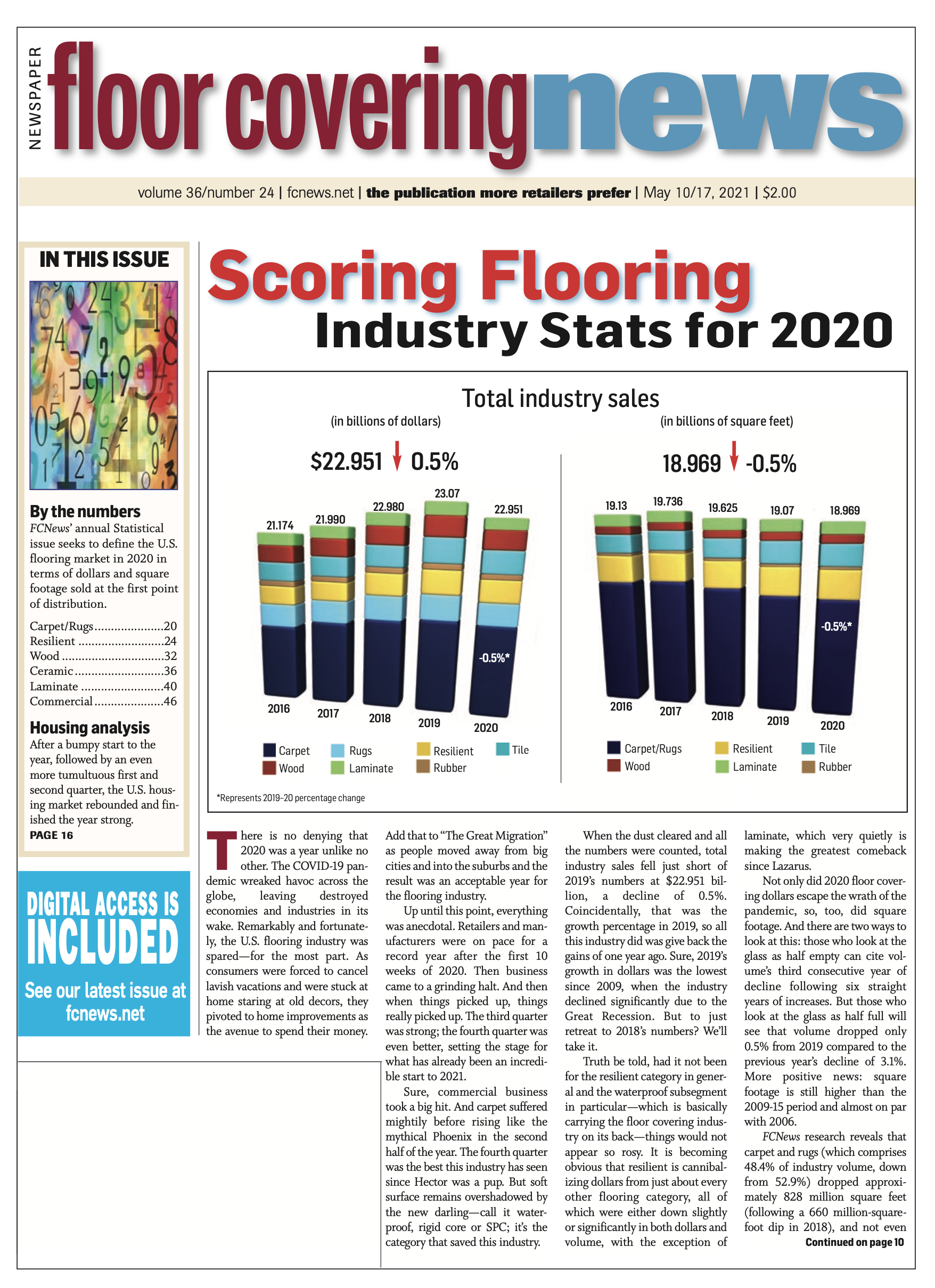

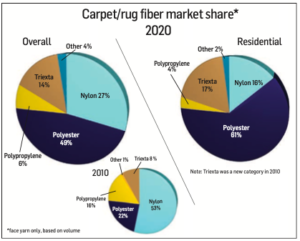

When all the numbers were crunched for 2020, FCNews research shows overall carpet sales fell 12.5% in dollars to $7.355 billion compared with $8.40 billion in 2019. Volume, which includes rugs, was down 9% to $9.18 billion. Total area rug sales fell an estimated 2% to $2.576 billion in 2020, according to industry estimates.

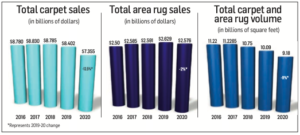

Despite this crash, carpet still remains the largest flooring segment, accounting for 48.4% of the overall 18.969 billion square-foot flooring market in 2020. But how things have changed. Just five years ago, for example, carpet/rugs made up 60% of the flooring industry in terms of volume. Ten years ago, in calendar year 2010, soft surface held a sizable 66.2% share of total volume. In that decade between 2010 and 2020, soft surface’s share as a percentage of flooring has lost 17.8 points.

A tale of two halves

It seems unfathomable that carpet’s 2020 numbers were down double digits in dollars when headlines of late have conveyed a resurgence in the category. And all of that is true as 2020 truly was a statistical aberration. While the segment posted positive numbers in the third and fourth quarters, it could not overcome the massive second-quarter drop.

It seems unfathomable that carpet’s 2020 numbers were down double digits in dollars when headlines of late have conveyed a resurgence in the category. And all of that is true as 2020 truly was a statistical aberration. While the segment posted positive numbers in the third and fourth quarters, it could not overcome the massive second-quarter drop.

Mill executives, of course, would prefer to focus on the second half of 2020, especially the fourth quarter, when residential carpet sales soared 13.2% and units gained 9.5%. Carpet, as with all flooring surfaces, benefited by the home renovation surge that continues to this day.

Ironically, while it was COVID-19 that put parts of the flooring industry—and much of American life—on lockdown beginning last March, it also ushered in the shelter-in-place trend, which ultimately lifted the entire flooring industry as consumers eschewed vacations and entertainment expenses for home renovations. Flooring, including carpet, got a share of that spend.

Observers say it is easy to see why carpet resonated with homeowners during the pandemic. “I think people just literally spending more time at home find carpet more comfortable,” said Curt Hutchins, president of residential carpet, Mohawk. “Many people put hard surfaces in their homes initially because it looks good and is clean, but our sense is that it’s not as comfortable when you are living in it—it’s very loud, and things echo off hardwood floors.”

Brad Christensen, director of soft surface category management, Shaw Industries, echoed that sentiment. “Because of the design aspect, the reduction of noise, spending time and living in your home, we see that carpet has become a choice for people. Because of the noise-abatement attributes of soft surface, carpet has become more important.”

Given that many homes today are used as offices, classrooms and even playgrounds by different members of the family, there is a need to make each room more suitable for its purpose. “For example, putting new carpet down in the game room upstairs for the purpose of sound abatement or making the living room more comfortable for the whole family to relax in,” said Joe Young, soft surface category manager for Engineered Floors. “Creating a sanctuary in the master bedroom for the parents to retreat to, and even putting down ‘resi-mercial’ (commercial carpet in a residential application) carpet in the home office [are also trending].”

Softness and noise abatement are certainly two of the factors that drove carpet sales last year. However, the real catalyst has been the technology advancements that have elevated the category and paved the way for more patterns and vibrant colors to enter the mainstream, observers said. The process leading that charge is solution dyed. “Solution-dyed products’ lifetime performance and ease of maintenance have been a driving force for popularity with consumers,” said Jason Surratt, vice president, residential carpet business, Phenix Flooring. “With the color being an inherent part of the fiber itself, solution-dyed products have greater performance in terms of resistance to stains and soiling. It also has superior resistance to fading from sunlight and cleaning over time.”

Engineered Floors’ Young said the reality is that mills are making better carpet today with performance features that make it a viable option throughout the household, with solution dyed the fiber of choice. “Solution dyed alleviates the age-old fear of carpet staining, fading or bleaching over short periods of time,” he explained. “Solution-dyed carpets also provide more blended multicolors that smoothly transition visually from hard surface to soft surface. These performance and aesthetic enhancements only add to the comfort under foot that people have always loved about carpet.”

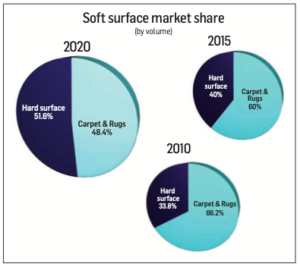

Commercial

Commercial carpet, which makes up an estimated 39.6% of the total carpet market, was down 21.7% in dollars and 21.4% in volume in 2020, marking the fifth consecutive year in which both sales and volume fell. FCNews estimates the commercial market at $2.91 billion for 2020, with specified contract sales coming in at $2.189 billion and Main Street at $721 million. [Note: For years, a large percentage of mills considered level-loop polypropylene a Main Street product, mostly installed in rental space/tenant improvement and low-end apartments and basements. Today, much of this business has been lost to low-end polyester cut piles. These cut-pile sales are reported as residential, not Main Street. As well, some mills break out Main Street from their specified business; others do not.]

Commercial carpet, which makes up an estimated 39.6% of the total carpet market, was down 21.7% in dollars and 21.4% in volume in 2020, marking the fifth consecutive year in which both sales and volume fell. FCNews estimates the commercial market at $2.91 billion for 2020, with specified contract sales coming in at $2.189 billion and Main Street at $721 million. [Note: For years, a large percentage of mills considered level-loop polypropylene a Main Street product, mostly installed in rental space/tenant improvement and low-end apartments and basements. Today, much of this business has been lost to low-end polyester cut piles. These cut-pile sales are reported as residential, not Main Street. As well, some mills break out Main Street from their specified business; others do not.]

Among commercial segments, the pandemic clearly hurt corporate (the largest segment) the most, as millions of workers were forced out of their offices during COVID-19 to work from home while scores of others lost their jobs altogether. According to a Congressional Budget Office report, the number of employed Americans won’t return to pre-pandemic levels until 2024—even as the broader economy is expected to fully recover by the middle of 2021.

Another concern for the corporate market is the ability to work remotely has allowed many people who are able to work from home to do so. According to John Burns Real Estate consulting, there were 5 million people in the U.S. who primarily worked from home (defined as 10-plus hours per week) prior to COVID-19. During COVID-19 in 2020, approximately 22 million worked from home. Post-COVID-19, John Burns data estimates 9 million people are expected to work from home—representing an 80% increase from pre-COVID-19 levels.

Hospitality, a normally reliable segment for carpet, was also gravely impacted by COVID-19. Business travel is typically the most lucrative for the leisure and hospitality industry, but the coronavirus pandemic changed that. Even the most optimistic predictions estimate it will take several years for business travel to return to pre-pandemic levels.

To some degree, Main Street provided a respite for carpet in 2020. While schools, churches and other local businesses were on lockdown, opportunistic retailers seized on an opportunity to work on much-needed projects. While much of that work entailed hard surfaces, carpet tile and area rugs received some of that business as well.

Among flooring types, carpet tile continues to grow as a percentage of soft surface in commercial, accounting for nearly 75% of the commercial soft surface market, far outpacing broadloom/wall to wall and rugs.

‘Better goods’ thriving

In terms of overall dollars, residential soft surface continues to outperform unit volume. Price hikes in 2020 certainly contributed to the gains, but so did consumer preferences for so- called better-end goods.

According to executives, the sweet spot for these higher-end goods starts at $15 per yard wholesale but goes well into the $20s (i.e., $20 per yard or $2.22 square foot, material only). Due to the high usage of hard surfaces throughout the house, the areas where carpets are being used the most tend to be in heavier face weights with higher design patterns. These heavier weights come with correspondingly higher price tags. The Dixie Group’s primary fiber, for example, is nylon 6,6, with an average price point that is about three times the industry average, according to T.M. Nuckols, president of TDG’s residential division. “We design and create products that can command that premium, and the durability of nylon 6,6 is a big part of that equation.”

Higher prices were also aided by the multifamily segment, which artificially improved the net selling price of carpet as renters stayed in their apartments longer during COVID-19, resulting in fewer turns. The result was that mills sold goods with higher average selling prices as opposed to the lower-end carpet that normally goes into multifamily dwellings. The moratorium on evictions also constrained multifamily as fewer rental properties became available.

The encouraging takeaway for mills and their retail partners is that consumers are willing to give carpet a second chance after years of opting for hard surfaces. “As an industry we’re excited about the category itself from a long-term perspective,” Shaw Floors’ Christensen said. “There is a lot of optimism in the category right now, and everyone is enjoying the lift. The more people talk about soft surface, the more first-time buyers are realizing there are things that can enhance their lifestyles.”

Soft surfaces’ performance during the last three quarters, including the first quarter of 2021, has some executives wondering if it is sustainable. “When is it going to slow down?” Christensen asked. “I would have thought it would have slowed down already, but it just keeps going, fueled by disposable income. Some of our biggest retail customers say [2021] is the best year they have had.”

Others, like Jonathan Cohen, CEO of Stanton Carpet, said they see signs pointing to a promising future. “Relative to long-term trends, U.S. residential housing fundamentals are strong as a result of historically low mortgage rates, improved balance sheets, lack of spend on travel and dining along with a deep level of residential underbuilding,” Cohen explained. “We expect this combination of dynamics to benefit the R&R market for several years.”

Rugs

Just as carpet is experiencing a renaissance of sorts, the same kind of activity is seen in rugs. “Our first quarter rug business is up over 50% compared to last year and approximately 20% compared to 2018 and 2019 numbers,” said Lisa Lux, soft surface product designer for Anderson Tuftex. “Sales of our more premium products are up through the last part of 2020 and well into 2021.”

Just as carpet is experiencing a renaissance of sorts, the same kind of activity is seen in rugs. “Our first quarter rug business is up over 50% compared to last year and approximately 20% compared to 2018 and 2019 numbers,” said Lisa Lux, soft surface product designer for Anderson Tuftex. “Sales of our more premium products are up through the last part of 2020 and well into 2021.”

The way rugs are sold has changed rather dramatically in the past six or seven years. Most flooring stores no longer carry rugs the way they once did, which has driven prices down. At the same time, e-commerce is dominating the rug space as the fastest growing distribution channel. The pandemic further solidified e-commerce’s position as homeowners more freely ordered 3 x 5 and 4 x 8 rugs online.

Flooring retailers increasingly sell bound rugs made from broadloom as their de facto solution to being in the rug business without having to invest in racks of inventory. “The ability for the dealer and the consumer to fabricate rugs that meet the needs of the consumer beyond standard pre-made rug sizes has seen dramatic growth,” Stanton’s Cohen explained.