June 24/July 1, 2019: Volume 35, Issue 1

By Reginald Tucker

Fierce competition from alternative hard surface categories—combined with a diminished number of laminate displays in many independent specialty retail showrooms across the country—kept the category’s growth in check for much of 2018.

Fierce competition from alternative hard surface categories—combined with a diminished number of laminate displays in many independent specialty retail showrooms across the country—kept the category’s growth in check for much of 2018.

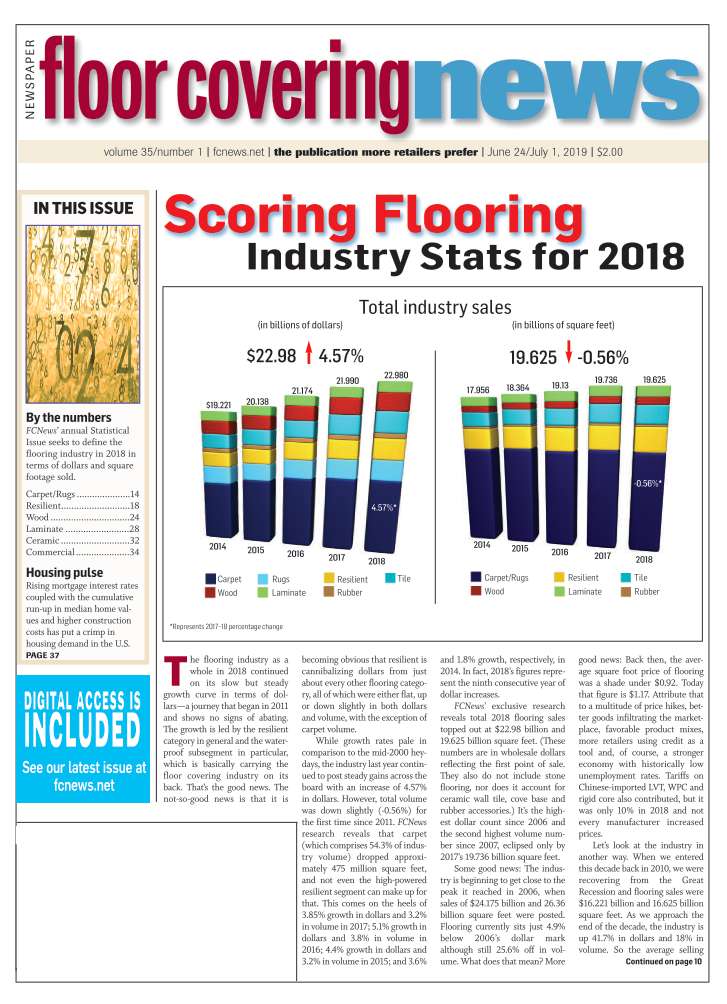

FCNews research shows laminate flooring sales dipped to just over $1.103 billion last year, a 1.7% decrease from 2017. It also represents the second consecutive year of sales declines in the category.

Likewise, volume took a hit as square footage sold fell to roughly 1.012 billion square feet, a 2.1% decrease over the prior year on top of a 1.9% decrease in volume sold in 2017.

To put things in greater perspective, laminates’ part of the overall flooring market fell to roughly 4.8%, down from 5.1% of total industry dollars in 2017. With respect to volume, the category represented approximately 5.1% of total square footage sold, down slightly from 5.3% in 2017. Going back 10 years, laminate represented roughly 5.7% of total industry sales and 4.4% of volume.

The falloff is even more pronounced when measuring laminates’ performance against competing hard surface categories. Last year, for example, the category accounted for about 9.5% of total hard surface sales and 11.2% of hard surface volume sold. That’s down slightly from 10.6% of sales and 11.6% of volume in 2017, respectively. But just five years ago, laminates’ share of total hard surfaces was 15% in dollars and 17% of square footage.

It’s no coincidence that the laminate category has lost the most market share over the past five to 10 years; over that same time span, certain segments of the resilient flooring category have increased share. “Without a doubt the biggest issue facing the laminate category is competition from WPC/LVT/SPC,” said Dan Natkin, vice president of hardwood and laminate, Mannington. “These categories have grown tremendously in the past 10 years and have presented some headwinds for laminate.”

Other laminate flooring manufacturing executives—even those who participate in the competing rigid floor covering segment—agree. “Clearly the biggest pressure on laminates is the competition from rigid core vinyl in all its forms,” said Derek Welbourn, CEO of Inhaus, manufacturer of the Sono ceramin-based line as well as company-branded laminate flooring. “As the industry statistics clearly show, these resilient products are continuing to claim market share against all categories and, in particular, laminate flooring.”

As more retailers participate in the explosive rigid core sector, they are devoting more of their floor space to these products and less to others, namely laminate. “During laminates’ heyday between 1996 and 2003-04, the average retailer had five-plus laminate displays on the showroom floor,” said Drew Hash, vice president, hard surface product/category management, Shaw Floors. “Now you’re lucky to see one laminate display on the showroom floor.”

As more retailers participate in the explosive rigid core sector, they are devoting more of their floor space to these products and less to others, namely laminate. “During laminates’ heyday between 1996 and 2003-04, the average retailer had five-plus laminate displays on the showroom floor,” said Drew Hash, vice president, hard surface product/category management, Shaw Floors. “Now you’re lucky to see one laminate display on the showroom floor.”

Mannington’s Natkin agreed. “At independent retail, we have seen some choosing to dedicate less space to the laminate category, instead focusing in on two or three key brands they know and trust.”

Not everyone is in agreement that the laminate category has fallen off to the degree that many suggest, however. “We continue to estimate high market share for laminates in North America than what is published,” Inhaus’ Welbourn stated. He puts 2018 volume in the 1.2 billion-square-foot range. “The added features have driven more top-end sales, escalating the average sales price of laminate.”

Other executives such as Travis Bass, executive vice president of sales and marketing for Swiss Krono, a private-label supplier, believes volume was even higher than that in 2018. “We believe the market to be approximately 1.3 billion square feet and in excess of $1.2 billion in sales.”

Changing dynamics

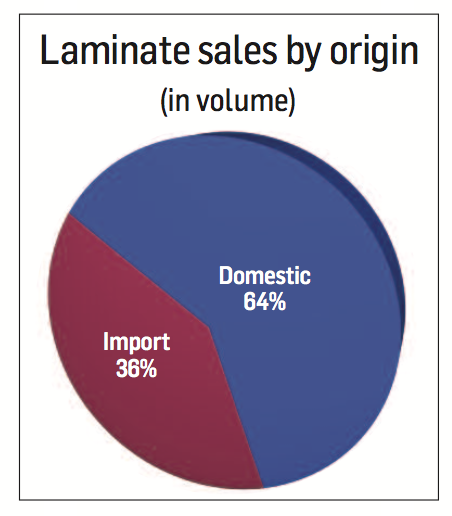

Along with the overall shift in hard surface preferences, there has also been some movement internally within the laminate category as it pertains to how and where the product is being sold, distributed and consumed. For instance, laminates’ share of the commercial sector continues to dwindle (combined Main Street business and specified commercial business account for only 1.1% of sales) while residential replacement and builder applications are holding steady. FCNews research showed a slight uptick in new construction applications (12% of sales) with residential replacement activity—the leading end-use sector for laminates—hovering around 87% of sales.

“Residential remodel is still the strongest market for laminate, but we’re seeing growing acceptance among the builder community,” Mannington’s Natkin said.

In that same vein, industry observers reported greater activity at the home center level as big boxes dedicate more space (and SKUs) to flooring. FCNews research shows that Home Depot and Lowe’s collectively generated roughly $13 billion in total flooring sales in fiscal 2018. With respect to laminate in particular, there has been strong activity among entry-level laminate products in the $0.99 to $2.49-per-square-foot range. For 2018, FCNews research showed the major big-box chains—including Home Depot, Lowe’s and Menard’s—grew their collective share of laminate flooring sales to 51% of the market, as the specialty retail segment’s share dipped slightly to roughly 28%. The industry also saw other mass merchants—including the likes of warehouse clubs and Lumber Liquidators—increase their  respective shares of the market.

respective shares of the market.

The good news for specialty retailers is the kinds of laminate products in which they choose to specialize generally represent higher-margin opportunities. “We’re seeing more activity with the 12mm laminate products at specialty retail vs. the less expensive 8mm products you generally find at the home centers,” Shaw’s Hash explained. “Not only do the thicker products translate into bigger profits for our retail partners, but they also mean better-performing products for the consumer.”

Domestic vs. imports

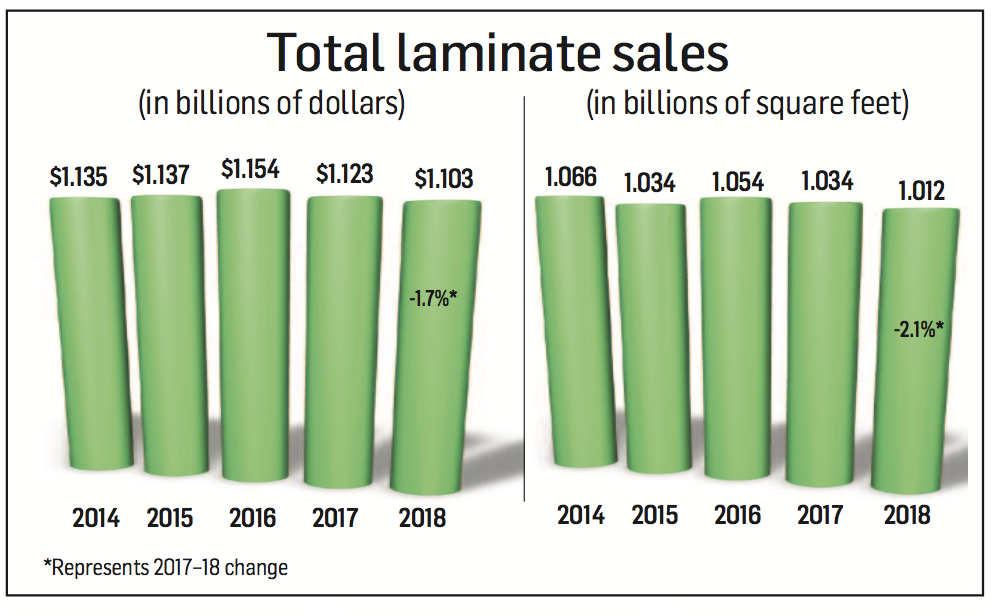

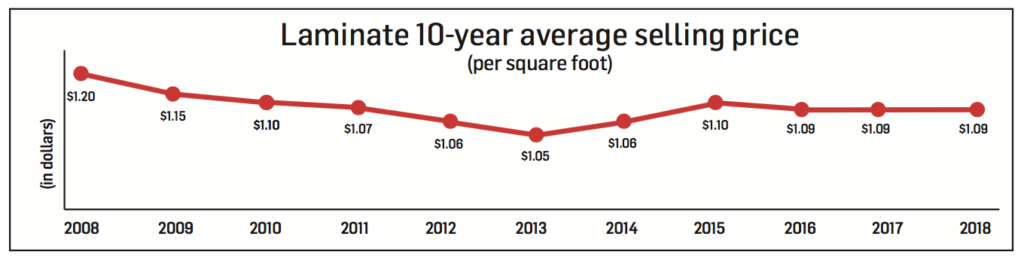

The high volume of entry-level laminate flooring products moving through the home center channel—combined with fewer brands being represented at the specialty retail level—has impacted the supply chain dynamics in recent years. As stateside suppliers look to remain profitable in a market segment where the basic wholesale price of the product hasn’t budged much, there has been an increasing reliance on private-label manufacturers located in the U.S. Companies like Clarion and Swiss Krono, for example, have invested millions in their stateside operations to meet demand for what they view as a steady home center business. At the same time, they continue to make higher-end goods for some major American suppliers.

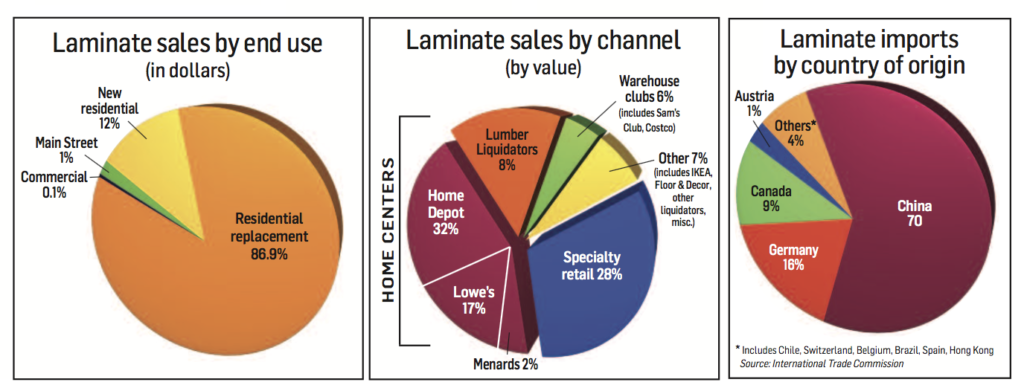

Nonetheless, the U.S. market is still attractive for laminate manufacturers based in Europe, China and, to a lesser extent, Canada. While imports have fallen off somewhat over the past two to three years, inbound shipments still represent a respectable portion of laminate flooring products making their way to U.S. shores.

A cursory view of statistics provided by the European Producers of Laminate Flooring (EPLF) bears this out. Last year, manufacturing members of the EPLF (including Classen, Alsapan, Berry Alloc, Egger, Haro, Faus, Kaindl, Balterio, Swiss Krono and Krono Flooring, among others) achieved worldwide sales of European-produced laminate flooring totaling 4.9 billion square feet, down 4.6% compared to 2017. This indicates that even with a downward trend in some regions, the global laminate market remains at a high level.

North America in particular continues to be a profitable sales region for the European laminate flooring sector, although weaker figures from Canada have mitigated those results. At 476 million square feet, total sales for North America in 2018 are off about 10.4% against the previous year. With around 330 million square feet sold in 2018, the U.S. market exhibited a slight reduction of 2.4%, while Canada recorded just under 146.3 million square feet for 2018, representing a  drop of 24.5%.

drop of 24.5%.

By comparison, in Western Europe, the “home market” of the EPLF, sales declined further in 2018. Last year total member sales to the region reached 2.42 billion square feet, down 7.3% compared to the previous year. Meanwhile, EPLF sales to Latin America and Asia once again recorded the biggest increases. EPLF sales to Latin America grew 4.7% to approximately 200 million square feet in 2018 with Chile, the largest individual market, rising 5% compared to the previous year. Mexico recorded 42 million square feet, down from 46.3 million square feet in 2017, while Colombia registered 22.6 million square feet, up from 17.2 million square feet the year prior.

In Asia, EPLF producers achieved total sales of around 323 million square feet, up 2.8% over the previous year.

Silver linings

While the laminate flooring segment faces ongoing challenges from external forces and internal dynamics alike, suppliers continue to invest in the category. Mohawk Industries, for one, is looking to continue ushering the category into the next stage of its evolution via both its RevWood and Quick-Step NatureTEK offerings—products that tout enhanced durability as well as resistance to water incursion.

“We have a pretty good base here in the United States for production of RevWood products,” said Jeff Juzaitis, vice president, product management, Mohawk. “We have a breadth of design styles that satisfy almost every design whim. So that’s our focus—keeping the features at the forefront of the market and making sure we have price points across the entire range. We have the best partners out there in the marketplace to convey the story of RevWood to our end consumer who’s going to put it on the floor.”

It’s specifically the “waterproof” segment within the laminate flooring category that Mohawk sees the greatest potential. “In a world where everybody is being bombarded by rigid LVT, it’s really refreshing to have a different product category to talk about,” said Paul Murfin, senior vice president of distribution at Mohawk. “I would argue that this category of flooring is actually the fastest growing category in the industry today, growing faster than SPC or WPC. We are potentially looking at high-double or potentially triple-digit growth for this type of product.”

Quick-Step distributors like Owings Mills, Md.-based Elias Wilf tend to agree. “The laminate category has taken a pretty good hit over the past few years; WPC and rigid core floors certainly haven’t helped that,” said Jeff Striegel, president. “But the relaunch of Quick-Step in the form of NatureTEK just goes to demonstrate that if you keep a product current, fashionable and in line with the attributes that consumers are actually interested in and looking for, it still has a meaningful place on the floor both in the retail space and at the builder level.”

For companies like Shaw Floors, the greatest opportunity lies in step-up products. “Sales of our better-end, moisture-resistant products—which we classify as Repel—are doing very well in the market,” Hash explained. “Where we have had more challenges within the laminate category, quite frankly, is on the entry-level side where there’s more pressure from inexpensive 7mm-8mm products vs. the higher quality 12mm option, which accounts for a much smaller piece of the pie.”

The goal, according to suppliers like Shaw Floors, is to put more “distance” between the types of laminate products primarily sold at home centers and mass merchants vs. the more differentiated, higher-margin goods predominantly peddled by independent specialty retailers. “At Shaw we have launched 72-inch laminate boards, which have come a long way compared to a time when everything was 48-inch, fixed lengths,” Hash stated. “Also, with laminates today, the depth of the embossing is much better and the visuals are much stronger than they were in the past. When you take into account the apparent value of the products along with the visuals and the water-resistance story tacked on—it’s still a great value for the product.”

Swiss Krono’s Bass agreed, citing the vast improvements made in recent years. “With the product evolution into moisture resistance, laminate has solidified its place in the overall floor covering market. Moisture-resistant laminate gives the consumer a desired wood product with a wonderful environmental story and a great product with the best features and benefits of all floor covering choices.”