I am aggravated. That’s never a good thing. I am annoyed at the media, and basically any economist whose last name isn’t Beaulieu at ITR Economics. Yeah, that about covers it.

I am aggravated. That’s never a good thing. I am annoyed at the media, and basically any economist whose last name isn’t Beaulieu at ITR Economics. Yeah, that about covers it.

I’ve been pretty much disgusted with the mainstream media ever since the start of COVID-19, when it seemed its one goal was to scare the bejesus out of everyone. Now, without the ability to use COVID-19 as a tool to keep everyone on edge, the media, coupled with some ill-informed economists, are pushing recession every chance they get. For them it’s all about doom and gloom.

I’m no expert. I have an Economics degree, but the only thing I remember from college is supply and demand. So when I want the truth about what’s really happening with the economy, I turn to the flooring industry’s go-to prognosticators, the Beaulieu brothers of ITR Economics. Why not? They boast a 94.7% accuracy rate.

Brian Beaulieu recently penned a blog that I found interesting. (For the record, ITR does not forecast a recession until late 2023.) The blog centered on headlines that major news organizations have published over the years. The purpose of the blog was to warn business owners that headlines are a poor planning tool for anything. “Major news organizations don’t get it right, certainly not all the time,” he wrote. “They quote famous names, sell their product, and all too often emotions are formed, impressions develop and decisions are made.” The point is if you listen to the agenda-driven media, you might make decisions that could negatively impact your business. Beaulieu lists some headlines and quotes that the media jumped on during the Great Recession some 13 years ago.

• George Soros says U.S. banks “basically insolvent” – Reuters, April 6, 2009. The financial sector ETF (XLF) established a monthly low in February 2009.

• Warren Buffett: U.S. Economy in “Shambles” With No Sign of Recovery – CNBC, June 24, 2009. U.S. total industrial production’s low occurred in April 2009; the GDP low was in 2Q of ’09.

• Debt crisis unsettles European economy – The Washington Post, February 6, 2010. European Union GDP declined for one quarter (1Q10) before resuming its ascent.

• Dow’s Brief Fall of 1000 Points Sets Off Anxiety – The New York Times, May 6, 2010. The S&P 500 declined further, hitting a monthly low in June, then closed up 28.1% one year later.

These headlines are from credible sources and quote credible people, but they are not looking at leading indicators and consumer trends and the host of other factors ITR Economics looks at every day.

Yes, the market has been volatile, and S&P 500 declines make people fear the future because of a perceived “wealth effect.” But here is ITR’s assessment:

- The stock market pain is concentrated primarily in the riskier sectors, like technology.

- Energy is up double digits year-to-date, while several defensive sectors (utilities, consumer staples) are hovering right around correction territory; Healthcare is in correction territory.

- We are at risk of further overall market weakness–particularly within tech and tech-like stocks–probably through the summer.

- The weakness is likely to fade beginning late this year or early next year, and when it does the onset of recovery will come quickly, punishing those who exited the market recently or are thinking about doing so now.

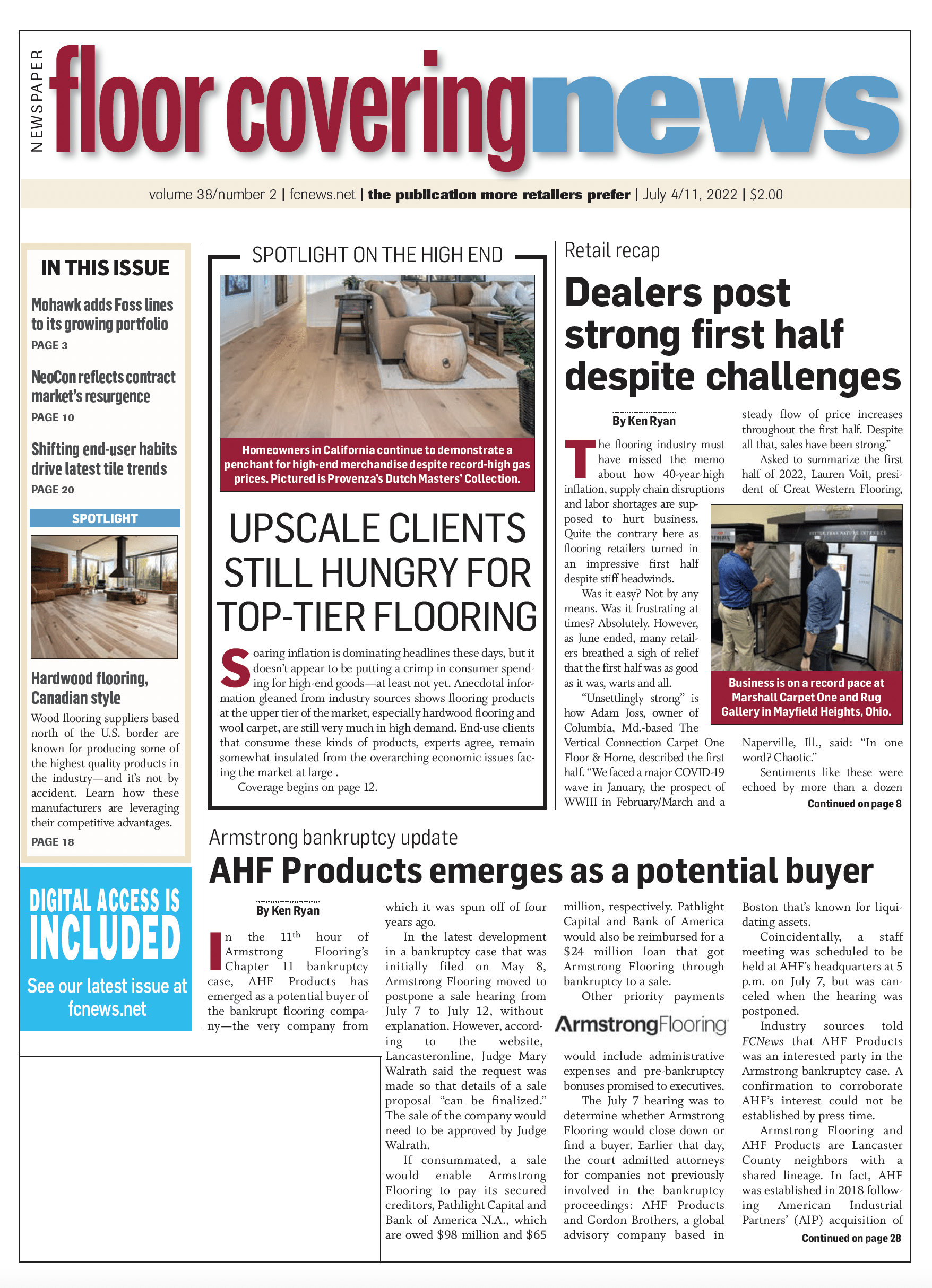

The next thing the media and its cohort economists will have you believe is that the high prices at the fuel pump will derail retail sales, leading us into a recession. “That would be tough to prove based on data; however, it is often propagated as a truth, so people perceive it as a truth,” Beaulieu said. “Our analysis shows that higher gasoline and diesel prices do not choke off retail sales. We complain about the price at the pump, but history shows that today’s prices are not likely to bring on a consumer-led recession.”

Truth be told, the slowdown in some sectors of the economy that we’re currently feeling (i.e., lower mortgage applications combined with lower total amounts financed) is the direct result of actions that the Fed has taken in recent weeks to put the so-called “brakes” on rising inflation as a means to facilitate a “soft landing.” The trade-off, experts say, is slower economic activity in some sectors of the economy. In short, it’s an “engineered” slowdown—not the result of a pullback in consumer activity based on negative chatter on the street.

The media is also misreading the tea leaves in suggesting the deceleration in the runaway spending we saw throughout late 2020 and into 2021 is a sign of impending recession. Again, dead wrong. “What’s happening is we’re going back to something called normal,” Beaulieu explained. “Something we haven’t seen in over two years.”

See why I’m annoyed?