The U.S. economy is dealing with record inflation, led by sky-high gas prices, food and transportation costs to name just a few bellwether categories. At the same time, the stock market is flirting with bear territory as virtually all the major indices have shifted wildly over the past few quarters. On top of that, the U.S. is still dealing with ongoing supply chain issues originally brought on by the global pandemic. And let’s not talk about the broader global impact that the war in Ukraine has had on many different industries and countries. It’s a recipe that has many conjuring up the dreaded “R” word.

The U.S. economy is dealing with record inflation, led by sky-high gas prices, food and transportation costs to name just a few bellwether categories. At the same time, the stock market is flirting with bear territory as virtually all the major indices have shifted wildly over the past few quarters. On top of that, the U.S. is still dealing with ongoing supply chain issues originally brought on by the global pandemic. And let’s not talk about the broader global impact that the war in Ukraine has had on many different industries and countries. It’s a recipe that has many conjuring up the dreaded “R” word.

But what has perplexed so many experts and pundits is all this is occurring amid record low unemployment, a still-healthy jobs market and robust consumer spending. Alan Beaulieu, president of ITR Economics, looked to help industry members make sense of all this complexity during a recent keynote presentation at the 2022 Starnet convention. Boasting a 94.7% forecast accuracy rate, ITR consistently provides reliable economic intelligence to help businesses reduce their risk while driving practical and profitable business decisions. Indeed, the company has a long history of helping business make informed decisions—oftentimes in the midst of turbulent economic times. The goal, according to Beaulieu, is to help organizations and industry leaders identify new markets of opportunity; make critical decisions when opportunities arise; plan more strategically when exploring hiring and investment opportunities; and increase their competitive advantage through better understanding historic business cycle trends and benchmarking.

Following are excerpts of his presentation:

Are we headed for a recession this year?

“That’s one of the big questions we hear when talking to clients,” Beaulieu stated. “There’s no lack of people saying, ‘Yeah, we’ve entered into a recession.’ But what amazes us at ITR is the vastly different outlook people had just a few weeks ago. [Back in early May] it was really hard to get people to believe the economy was going to slow down; they were going gangbusters. What we are seeing is a deceleration of the rise in macroeconomic activity—it’s a slowdown, not a breakdown.”

What’s more likely, according to Beaulieu, is the U.S. economy is approaching a “normalization” of activity—an environment whereby economic growth is coming down off the lofty levels seen in late 2020 and into 2021. “The U.S. economy is slowing down because the ‘sugar high’ from the Great Stimulus event has passed and the government is not keeping it up,” Beaulieu said. “I want everyone to understand that the economy is slowing down but not slipping into recession.”

While ITR Economics attests to the fact that first quarter gross domestic production (GDP) was down 0.36% from the fourth quarter of ’21, the firm believes there were mitigating circumstances. As Beaulieu explained: “Inventory levels, especially in the automobile industry, dropped—which reduced GDP. And then the government didn’t spend as much during the period, which also reduced GDP. And then there was also the trade imbalance, which was at a record high level, and that had a negative impact on GDP. But what they didn’t get right in the media was that exports out of the United States in the first quarter of ’22 were at a record high level.”

A rise in exports during the period actually bodes well for the U.S. market, Beaulieu noted. “We had more exports going out of the country, which means good things for domestic manufacturers, shippers and everybody else who’s involved in that process,” he explained. “And if we bought more than we ever had before, that means there’s a whole lot of demand going on. And that demand is a sign of strength in the economy. So both sides of the equation were saying there’s a strengthening in the economy. It’s just a technical matter that pushed GDP down.”

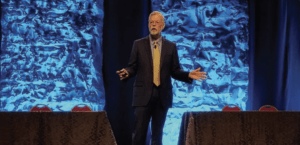

More importantly, ITR Economics emphasized the distinction between factors that influence consumer/investor confidence (i.e., the stock market and other leading indicators) vs. factors that have a direct impact on economic activity. As Beaulieu explained: “There is a pessimism building in the business and banking community; that pessimism leads some noteworthy institutions to project a recession in the U.S. later this year. There is also pessimism in the business environment, which is manifesting as a decline in confidence. I can understand where the growing lack of confidence comes from, and there is no need to disparage those who collect and report the data. My only issue is that business leaders may fall victim to that decline in confidence and, therefore, participate in unnecessarily pessimistic groupthink. Now is not the time to tighten up your asset deployment; rather, now is the time to strategically expand resources for maximum gain.”

To illustrate his point, Beaulieu cited statistics (see chart) showing the historical relationship between business confidence (the blue line) relative to monthly industrial production (the green line). Note: There are three low points, highlighted by the red circles on the chart. “The chart highlights the danger in following confidence indicators too closely,” he noted. “The lack of confidence (pessimism) lasted longer than the economic downturn. You will also see there are times when the confidence barometer declines for an extended period and U.S. industrial production keeps on rising. The lack of consistency is why we feel measuring confidence does not constitute a good basis for action.”

Business decisions, Beaulieu noted, are best based on reliable, proven empirical evidence. “ITR uses a plethora of mathematically derived leading indicators with known, provable lead times to U.S. industrial production and to thousands of other data series that span most industries and most economies. Indicators such as business confidence have their own utility at times and for specific purposes, but we caution against using confidence as a sole source of insight into the future.”

Retail sales trends

One of the many leading indicators ITR Economics examines in its forecasting models is retail sales trends. While it’s safe to say inflation is forcing some consumer segments to tighten their belts, on the whole consumers have thus far been able to withstand the impact of higher prices on fuel and transportation as well as many household items and necessities. While there is some data showing a slight pullback in consumer spending (it was down to 0.9% in the month of April vs. 2.1% in January), by and large shoppers are continuing to flex their purchasing power.

“Retail sales are, of course, going to slow down,” Beaulieu said, citing the absence of stimulus funding that was injected into the U.S. economy to prop up purchasing in the immediate aftermath of the pandemic. “We all knew that was not sustainable by any stretch of the imagination. The problem is when people see retail activity slowing down, they’re like: ‘Oh no. It must be that we’re heading into a recession.’ But that’s not the case at all. What’s happening is we’re going back to something called normal—something we haven’t seen in over two years.”

Another strong indicator of consumers’ propensity to continue spending, according to Beaulieu, is the resiliency of shoppers despite global events—specifically, the war in Ukraine. “You can’t tell just by looking at the leading indices precisely when Russia invaded Ukraine,” Beaulieu said. “There was no, ‘Whoa, we have to wait and see how this all plays out. We’re just not going to spend any money.’ That would be the type of thing you might think would push us into a recession. But we, the American consumer, just said, ‘Oh, that’s horrible.’ And then we just ordered more stuff. In fact, retail sales are doing well in many parts of the world. Don’t get me wrong; it’s a horrible war, but it’s one that has not changed our behavior. If the conflict widens, we don’t think that will change our forecast. We’ve been through a lot of war scenarios before. However, that all could change if nukes are used.”

Impact of inflation on borrowing, spending

As the Fed continues to tinker with interest rates in a move to put the brakes on record-high inflation, it has openly stated that it might be willing to make a deal: trade off lower inflation for (potentially) a slightly higher unemployment rate and (more than likely) slower economic growth overall. It’s a delicate dance, experts say, given the complex nature of not only the specific percentage of the increases but also the timing. Earlier this month the Federal Reserve announced a rate hike of 0.75%—this on top of a 0.50% hike in May. The Fed also hinted that an additional 0.75% hike is likely in the coming weeks.

In the interim, those consumers of modest means are finding themselves in the position of making hard choices when it comes to food, gas, transportation, etc. So far, though, it appears many consumers—while they are not happy about it—have been able to absorb those increases. In fact, despite hefty increases in several bellwether product/service sectors, consumer demand has not yet cooled. For instance, airfares have gone up nearly 40% compared to this time last year, but consumers are still willing to pay. In fact, the airlines have not been able to catch up to the demand—as evidenced by the now routine cancellation of thousands of flights. The reason? The airlines can’t hire enough pilots to fly the planes.

As to the broader concerns that rising inflation could negatively impact consumer borrowing—to the point that it puts a deeper drag on the economy—Beaulieu said it’s not time to hit the panic button. “Yes, there are folks who are worried about interest rates going up—that it might hurt the consumer in the form of higher credit card and mortgage rates,” he explained. “The fact is the consumer can afford higher interest rates; it’s not going to stop us from borrowing money. It’s not going to stop us from doing the things we want to do. Just look at mortgage rates on an inflation-adjusted basis. Before COVID-19, interest rates were at a 40-year low. Then they fell down further because of all the stimulus money that was being pumped into the economy. This is the perfect time to be borrowing money; the American consumer can easily handle it. It’s not going to derail the economy. It’s not nearly as bad as people make it out to be.”

While some consumers (and even other experts) might be spooked by what’s happening, Beaulieu stressed the importance of keeping things in the proper perspective. “This is nothing like the set-up for the Great Recession,” he said. “There’s no collapse in housing prices coming. You’re going to find that in some places prices are going to slow very noticeably; some might even plateau in some places. But the reality is the consumer’s in good shape.”

Stock market activity

While those consumers who are fortunate enough to have socked enough money away for a rainy day and are enjoying full employment might be less exposed to the vagaries of the market, the same cannot be said for those heavily leveraged in the stock market. While Beaulieu did not sugarcoat the issue, he sought to frame the matter appropriately.

“Nobody likes to see the stock market move down, but it should not have come as a surprise to anyone,” he said. “If you follow ITR or an ITR-leading indicator for the financial world, there’s clearly more downside pressure. And when you look at the price-to-earnings ratio, it’s very high. There’s still too much of a gap between the two, which means there are more corrections to come. There’s a bear market coming—probably around 2025—but there’ll be corrections to be made in between.”

Outlook beyond 2022

Despite the current economic climate, ITR is not changing its forecast for continued growth—albeit slower growth—through 2024. “The second quarter of this year is going to be on the hairy edge, but don’t look for a recession this year.”

Or next year—or the year after that, if ITR Economics’ predictions hold true.

“There’s no reason for it, no reason to be worried about it,” Beaulieu stated. “The year 2024 is going to be a busy year for the macroeconomic environment. In 2025, the economy is going to slow down. And for 2026, we’re forecasting a macroeconomic recession, but nothing along the lines of a Great Depression. Just a regular old recession. And that means in 2027, you’re going to have the softest year of the decade. We predict you will be up in ’28 and ’29, and you’ll have a good year in 2030.”

In fact, in a study that ITR Economics conducted that forecasted economic activity through 2050, there’s more upside than downside. “We’re predicting the United States—the world’s largest and most powerful economy—is going to be vibrant through the year 2050,” Beaulieu said. “That doesn’t necessarily change all of a sudden in 2050; that’s just the end point when we stopped the study.”

As for the proverbial “soft landing” that pundits have been clamoring for, ITR Economics said it expects that will occur in the first half of 2023. In the meantime, the firm advises business owners and operators to stay the course.

“The reality is life is good for you,” Beaulieu stated. “Businesses are flush with cash; liquidity is high. You’re going to be busier throughout ’22 than you were in ’21. You’re in good shape.”

At the same time, Beaulieu recognized the very real challenges facing the economy. B2B activity is slowing, as is industrial production. And on a macro-economic level, 11 of the 12 leading indicators ITR analyzes to generate its forecasts are currently in decline. The good news is it only takes five leading indicators moving into positive territory (green) to signal a return to broader economic growth—and it appears that housing is poised to lead that charge. “The rate of change in housing starts just started to go up, and then it’s going to continue to go over,” Beaulieu said. “So that’s one green shoe.”

Another positive trend is the continued investment in the U.S., particularly the manufacturing sector. According to ITR Economics, reshoring of manufacturing jobs back to America is happening at a steady clip—which bodes well for the U.S. economy as a whole.

“The United States is still going to be producing a lot of things,” Beaulieu said, citing increased domestic production of pharmaceuticals and textiles, among others. “We’re doing all kinds of things that people said would never happen again in this country. Moreover, when you look at foreign direct investment coming into this country, the United States is the world’s largest recipient. We have been for years, and the one year we weren’t was 2020 because of COVID-19. We were shut down. There wasn’t a lot of money flowing around.”

Above all else, Beaulieu strongly encouraged leaders to lead intelligently, which requires they be properly informed. “The easiest thing for a leader to do is be influenced by the things going on around him or her,” he said. “I want you to just focus on the industry things that are going on and ignore the rest of the world.”