The subject of reshoring — the return of manufacturing to America that had previously been outsourced to other countries — has taken on a renewed sense of urgency as a result of supply-chain deficiencies exposed by the coronavirus pandemic and, more recently, the crippling backlogs at many of the nation’s critical shipping ports. It’s a situation that has impacted virtually every consumer product category, flooring included.

To help better understand the repercussions of this phenomenon and the wholesale impact on trade, U.S.-China relations as well as both current and potential foreign direct investment activity in America, FCNews managing editor, Reginald Tucker, sat down with Harry Moser, founder and president of the Reshoring Initiative. The mission of the organization is to bring millions of good, well-paying manufacturing jobs to the United States by helping companies more accurately assess their total cost of offshoring.

The discussion centered on three primary issues:

Response to the shipping woes. In the wake of the current backlogs at the nation’s critical shipping ports, many floor covering retailers and distributors who still rely on imported flooring products are having a difficult time fulfilling customer orders. Instead of canceling customer orders amid the long delivery delays, retailers are encouraging their distributors and manufacturing partners to provide local, U.S.-made alternatives, including domestically produced laminate flooring, hardwood, luxury vinyl tiles or planks and, where appropriate, ceramic tile.

Unintended consequences of trade wars. Many proponents of the Made-in-the-USA movement say the previous administration’s firm position on China had a net positive effect on U.S. manufacturing by forcing companies that previously outsourced product from China to reshore manufacturing activities here at home. However, some U.S.-based companies merely shifted production from China to other Asian countries, namely Vietnam, Cambodia and Taiwan, as a means to circumvent the tariffs.

President Biden’s policy approach to China. The previous administration was known for its tough stance on China, citing everything from what it called a lopsided trade imbalance, unfair trade practices, copyright infringement and alleged dumping, to name a few. The strained relationship between the U.S. and China culminated in a protracted trade war and the imposition on a host of bilateral tariffs. Some of those tariffs—particularly on imported SPC/WPC/LVT flooring products—are still in place today.

Following are excerpts of the interview.

Do you view the current predicament at the shipping ports as an incentive or a ‘wake-up’ call for companies to either establish and/or expand manufacturing facilities here in the U.S.?

Yes, absolutely. In the last 20 years, we have experienced international incidents and natural disasters, including: the Fukishima nuclear accident in Japan; Thai floods; LA dock strike; COVID-19; the Suez Canal blockage; and general shipping delays. It should be clear across all industries that long supply chains are riskier. It should be especially clear in industries with high shipping costs vs. labor content.

We’ve seen a dramatic increase in reshoring by U.S. companies, and out of those cases between March 2020 in the end of 2020, 0% of the suppliers mentioned COVID-19 as one of the causes for them to bring it back. Roughly half of what was produced in China was actually COVID-19-related things such as masks, gowns, gloves, penicillin and ventilators—the things we couldn’t get here in the States. But there were some U.S. companies who got spooked and said, “Oh, I see what’s happened to the medical industry. They got screwed because they were too dependent on other places, especially China.” Executives said, “I’m not going to let that happen to us. So let’s bring some, but not all, of the manufacturing back to the U.S.”

What some companies discovered, as a result of the pandemic and the ensuing shipping issues, was they went too lean in their manufacturing over the years. It’s my opinion that many didn’t go lean enough. For instance, if you consider the basic tenets of lean manufacturing—which is to eliminate waste and only do what brings value to the customer—shipping stuff halfway around the world does not bring value to the customer. A truly lean company would import almost nothing and handle almost all of its production here. The logic being: if they produced the bulk of what they manufacture here in the U.S., then they would only have small inventories that they could replenish quickly. Within a week they could get more from the factory, instead of two months from the factory overseas. Therefore, they wouldn’t have run out. Also, when you shorten your supply chain and keep your inventories low, you can use the savings to help pay the incremental cost difference of sourcing locally. Freight rates are currently two to four times the level they were just a year ago.

Are there any statistics you’ve seen—anecdotal or otherwise—that suggest more U.S.-based companies are merely shifting sources of supply to other Asian countries vs. bringing the bulk of production back to the U.S.?

Some production moved from China to Vietnam and Cambodia in order to avoid the tariffs, but you can’t ignore the trends. We saw record reshoring in 2020—109,000 jobs returned to the U.S., up from 41,000 in 2019. Furthermore, a Sequential Thomas survey showed increasing rates of companies bringing work back to America. And according to a BDO Board Pulse survey, 24% of companies said they intend to relocate factories to another country, with 22% preferring the U.S. A Yahoo Finance survey showed 82% of U.S. companies currently outsourcing are looking to bring production home. It is up to us to show the companies that they can bring back millions of jobs without increasing prices or losing profitability if they do the math. It’s going to come down to the trade-offs.

Some production moved from China to Vietnam and Cambodia in order to avoid the tariffs, but you can’t ignore the trends. We saw record reshoring in 2020—109,000 jobs returned to the U.S., up from 41,000 in 2019. Furthermore, a Sequential Thomas survey showed increasing rates of companies bringing work back to America. And according to a BDO Board Pulse survey, 24% of companies said they intend to relocate factories to another country, with 22% preferring the U.S. A Yahoo Finance survey showed 82% of U.S. companies currently outsourcing are looking to bring production home. It is up to us to show the companies that they can bring back millions of jobs without increasing prices or losing profitability if they do the math. It’s going to come down to the trade-offs.

Probably the only thing that’s intrinsically more expensive here in the U.S. is the labor. Land is about the same, but electricity is often cheaper here. Energy in general is cheaper. With wood flooring, U.S. producers typically ship materials to China and they mill it over there. Why not mill it here? The raw material wood is cheaper here because it doesn’t have to be shipped so far. So, the only real, major difference is labor. And so it comes down to how do all the other costs and risks stack up relative to the difference in labor. It boils down to determining what the labor costs are in the U.S. as a percentage of total manufacturing costs.

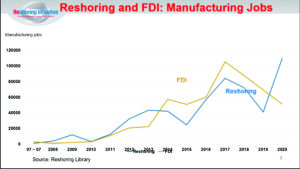

Bottom line: It is becoming clear that shorter supply chains are stronger and often more competitive. Repeated surveys show a high percentage of original equipment manufacturers (OEMs) are localizing—producing and sourcing more in the market. Rising offshore wages and recognition of total cost drove the reshoring surge from 2010 to 2017 (see chart). In 2021, the momentum is surging again with China tariffs, dramatically higher freight costs and, more importantly, COVID-19, which revealed grave shortages of products due to overdependence on imports.

Do you expect the Biden Administration to maintain a tough trade position on China, or do you predict a reduction or repeal of tariffs that were imposed on certain Chinese flooring products under Trump?

The objective of Trump’s tariffs was to reduce the trade deficit with China—it failed in that regard. In fact, under Trump, the trade deficit grew substantially. We also saw, as a result of the trade war with China, reshoring jobs fall off substantially in 2018 and 2019. Many executives saw Trump as very unpredictable—they couldn’t get a handle on which products from what countries would face tariffs, or for how long and at what percentage rate. A tariff rate of 15% or 25% makes a huge difference in terms of your economics. And so many companies said, “We’re not going to build a new factory here just yet, or we’ll just stop investing.” As a result, foreign domestic investment in the U.S. dropped off dramatically during 2018-19. Reshoring slowed down, too, because executives said, “I can’t make my mind up, because I don’t know what the rules are going to be.” Decision makers require certainty; they need to know what the rules are so they can make rational decisions. And Trump being Trump didn’t give them that certainty. He didn’t get the ball over the goal line.

Biden has been clear he is keeping all China tariffs in place—for now—as well as many non-China tariffs. That’s partially because it’s the right thing to do, especially if it looks like they’re going to stay in place for four years. But if China comes along and cuts him a sweetheart deal, he can always say, “It was such a good deal I had to change my mind.” But basically, I’m sure he wants to provide some sense of continuity.