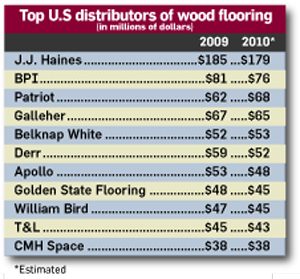

Following a weak business climate in 2009 and a 2010 first quarter adversely affected by snowy weather on the East Coast, J.J. Haines, Glen Burnie, Md.,  got an unexpectedly strong jolt from the government tax incentives for home buying.

got an unexpectedly strong jolt from the government tax incentives for home buying.

“Our second quarter was extremely strong because of the tax credit incentives,” said Scott Roy, vice president of sales. “Our Bruce hardwood business benefited tremendously from it.”

It was short-lived, however. The New Year’s Eve party that was the tax credit incentives gave way to a New Year’s Day hangover that has reverberated throughout the industry.

“We underestimated the boom in June from the tax incentives and we underestimated the sudden drop in July and August,” Roy said.

His sentiments are being echoed by distributors spanning both coasts and throughout the South. There are a few theories about the sudden drop, but suffice it to say most distributors are feeling the pinch.

Rick Holden, executive vice president of Derr Flooring, Willow Grove, Pa., said you do not spend 30 years in the flooring distribution business without weathering a few economic storms. This one, though, is unlike any Holden has seen. “In the past there was always an area you could identify that, while it may not be recession-proof, you knew the recession wouldn’t affect it as much. You could focus your attention on that one sector. This one, all three market segments have been hit extremely hard,” he said.

Holden added that the only wood products selling are specials or low-end products. “Anything that is inexpensive, whether it is discontinued product or specials we bought from the mill, is selling,” he said. “The good product in the mid range has suffered tremendously.”

Others agreed: “If it is premium priced, it’s not selling,” said Jeff Garber, vice president and general manager, Ohio Valley Flooring, Cincinnati.

“Wood is in disarray,” said Jeff Striegel, president of Elias Wilf, Owings Mills, Md. “The market is 60% to 65% oak now. The biggest decision people make now is deciding what color—light, medium or dark. Brazilian cherry, which was most of the exotics market, has collapsed.”

Hoy Lanning, CEO, CMH Space Flooring, Wadesboro, N.C., added, “3-inch solid oak and engineered red oaks and hickories are selling. Exotics, which were selling so well two years ago, are not selling. People are going back to the basics.” Derr Flooring said its wood business declined 10% in 2009 from 2008. It is likely to be down again in 2010, and the prospects for a quick turnaround do not seem likely. When asked if the results of the midterm elections might spur consumers, Holden said, “It is not going to change the fact there are 3 million foreclosed homes out there and banks aren’t lending. When it is perceived that there is a better business environment out there, when consumer confidence goes up, then things may change. But you have to create a different environment than what we have now.

“New home construction is not great and commercial does not look good as far as we can see,” Holden continued. “Even if a builder started on a new construction project today we won’t see that for one to two years. If you broke ground today on a new home, you might see flooring go in at around 100 to 120 days, and that would be pushing it. It’s those kinds of things that keep us a little slower to recover.”

Some distributors put the onus on retailers, with BPI vice president John Anderson saying, “Dealers with any traffic are selling scared. They are talking price and not trading customers up to better value products. This will have to change before we see any appreciable increase in several categories.”

Galleher, a Sante Fe Springs, Calif., distributor, saw its wood business drop 2% in 2009 from 2008, which is admirable compared with double-digit drops elsewhere. Jeff Hamar, president, said the real estate market in California does not bode well for a quick recovery. “Anything you bought in 2004 out here is worth less today than when you bought it. Peak to trough the median value of your home has gone down 50% from 2005 through today. Summer ’05 was the high water mark. 2006 was flat to slightly off, 2007 was down 10% and 2008 and 2009 were off big time.”

Tri-West, Sante Fe Springs, Calif., can empathize with Galleher regarding the California market. “Our industry is so tied to housing that until we can get that straightened out, it is going to be a slow recovery,” said Dan Proctor, president.

Hamar said Galleher’s business “has perhaps stabilized, marginally up over last year.” Most of its gains are from taking share away from weaker competitors. “We’re making money again, we’re having some fun, and the market will come back.”

Not all distributors are bemoaning the weak market. Paul Castagliuolo, executive vice president/general manager, Belknap White Alcco, Mansfield, Mass., said his company just wrapped up its fiscal year Aug. 30 slightly ahead of 2009’s figures. “We had a solid year,” he said. “Where we made hay is on the margin and keeping costs contained. Wood continues to be the product of choice for us with Bruce and Mirage continuing to be good sellers.”

Further north, NRF Distributors, Augusta, Maine, was bullish following its annual buying show, which was held in Connecticut (see related story). “We never sold so much as we did this show,” said Terry Gray, vice president of marketing. “Everyone was really positive. There wasn’t this ho-hum feel like last year.”

CMH’s Lanning said there are some differentiated hardwood products coming out, specifically citing Anderson and some of its private-label offerings. “They are new, different and exciting, and they are at favorable price points that retailers can sell and make a good margin.”

-Ken Ryan