June 10/17, 2019: Volume 34, Issue 26

By Ken Ryan

If you are just returning from a five-year sabbatical from the flooring industry you might not recognize the area rug business circa 2019.

If you are just returning from a five-year sabbatical from the flooring industry you might not recognize the area rug business circa 2019.

Dwindling are the days when the average specialty flooring retailer devoted racks of handmade, high-end Persian and Oriental rugs for discerning customers. E-commerce has changed the way consumers shop for rugs, and as a result the market has become more fragmented with price points being increasingly compressed.

This is not to suggest the area rug business isn’t adapting in the face of these challenges. Industry observers say manufacturers and specialty dealers have responded by marketing custom-created rugs to keep pace with all the changes. The challenge for today’s specialty dealer is the sheer number of places a consumer can find a commodity rug—furniture stores, general merchants, home centers, the local convenience store and, of course, the web. “In the last five years, e-commerce has been the biggest disrupter of the rug industry,” said Bart Hill, senior vice president product development and operations, Mohawk Home. “Then there has been retail consolidation, mainly larger chains. We used to do a lot with Sears and Kmart. We are losing a retailer a year, which is significant. Then there is the continued influx of machine-made rugs sourced primarily from Turkey which has driven down price points.”

From a percentage standpoint rugs are essentially flat in 2019 year-to-date vs. the corresponding period in 2018, research shows. The category is outperforming carpet in the residential segment on a percentage basis on the strength of hard surfaces, which has led to add-on sales for rugs.

Flooring executives said 2019 started out OK for rugs before hitting a soft spot in the second quarter. Unit demand is still faring well, but deflationary pressures have hurt average selling prices. “The Internet has changed the rug business and made it super competitive,” said Jared Coffin, vice president of product management for The Dixie Group (TDG).

TDG is a good example of what many mills are doing in today’s landscape. Although not a typical rug company, all three Dixie Group brands (Masland, Fabrica and, to a lesser extent, Dixie Home) sell custom-made rugs. The growth category for TDG has been fabricating off its broadloom collection where it can customize, say, a 9 x 11 1⁄2-foot rug to fit the approximate size of a customer’s room. “That business is up 10%-15%,” Coffin told FCNews.

Similarly, Anderson Tuftex markets the fact it can take any A/T carpet style and turn it into a rug that will complement any room in a consumer’s home. Customers can choose from a standard rug size or customize it to fit their specific needs, the company said.

Similarly, Anderson Tuftex markets the fact it can take any A/T carpet style and turn it into a rug that will complement any room in a consumer’s home. Customers can choose from a standard rug size or customize it to fit their specific needs, the company said.

Online sales make their mark

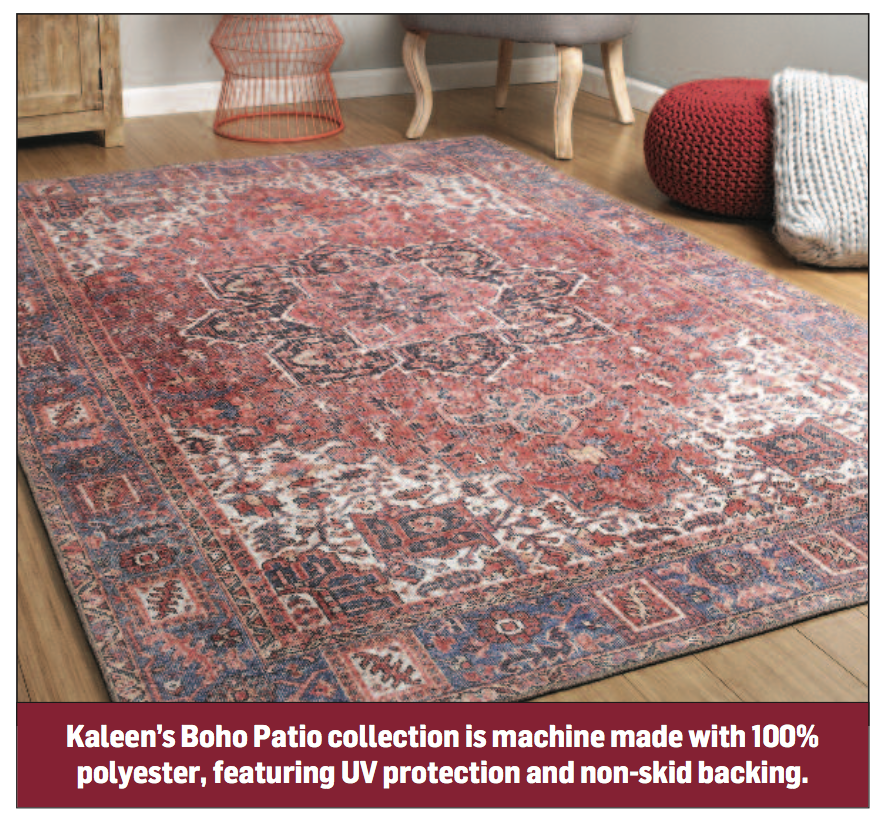

What has influenced the rug market the most is the role of e-commerce. With sites like Wayfair and Amazon offering 5 x 8 rugs for as little as $59–$79 compared to $299–$399 a few years ago—flooring stores cannot compete. “The top 80% of the business is $199 or below for e-com,” said Blake Dennard, senior vice president, Kaleen Rugs & Broadloom. “Smart brick-and-mortar dealers are not selling that [commodity] rug, they’re going after the better-end goods—the handmade, wool offerings. If you are going to take up space in your store you only have so many display arms to show your rugs; in that case, it’s better to move those higher-end goods to help compensate for the price erosion.”

Dennard said the days of walking into a carpet store and seeing 5 x 8 racks with 40 rugs in each display is pretty much over. “Those racks have come down. Retailers are instead doing sample programs and fabricating rugs out of their broadloom. That market has completely changed in the last five years.”

As the rug business shifts, dealers are offering private-label programs or selling higher-end goods. Cherry Hill, N.J.-based Avalon Flooring, with 14 stores in three Mid-Atlantic states, sees both good and bad forces influencing the rug market today. “The ‘bad’ is the race to the bottom on price points,” said Gerry Yost, director – area rugs and window treatments. “The ‘good’ is more customers are coming to retailers like ours because they bought a bargain rug and now would like something better, and they need help choosing a rug that will complement their décor.”

O’Krent’s Abbey Flooring in San Antonio has been selling rugs for more than 100 years. However, business has become more difficult over the last handful of years given the explosion of online retailers, according to company executives. “In order to deal with this consumer change, we have in turn focused increased efforts on custom rugs made from broadloom carpet in order to maintain margin and retain our hard surface customer’s rug business,” said Margie O’Krent, rug buyer. “In doing so, we have been able to keep our area rug sales volume flat in a year over year comparison.”

Mills are actually seeing greater demand for rugs these days because of the growth of the e-commerce model and the move toward custom-cut rugs.  “We are shipping more units in the opening price points, primarily driven by online growth,” said Gerard O’Keefe, vice president of sales, Nourison. “We have gone to a seven-day work week in our main distribution center to accommodate demand and are in the process of adding more distribution capacity. Meanwhile, the emergence of large national players in online retail and an overcapacity in supply chains, combined with changing consumer buying habits toward rugs have led to an erosion of price points. This, along with the inevitable return [on investment] requirements, puts operational pressure on all companies to get to a particular sales number.”

“We are shipping more units in the opening price points, primarily driven by online growth,” said Gerard O’Keefe, vice president of sales, Nourison. “We have gone to a seven-day work week in our main distribution center to accommodate demand and are in the process of adding more distribution capacity. Meanwhile, the emergence of large national players in online retail and an overcapacity in supply chains, combined with changing consumer buying habits toward rugs have led to an erosion of price points. This, along with the inevitable return [on investment] requirements, puts operational pressure on all companies to get to a particular sales number.”

Focus on differentiation

As custom programs proliferate, mills are trying to differentiate their offerings with larger rug sizes and extra wide-width broadloom combinations. “Programs like our 50 to Infinity come into play as really viable solutions for the brick and mortar players,” O’Keefe said. “It provides a great opportunity to offer something that differentiates them and keeps them out of the fray of competing with e-commerce.”

Mohawk and its Karastan brand aim to differentiate their products through unique fiber extrusion abilities as well as rug fabrication with an emphasis on 10- and 12-foot cuts. “We control our own destiny with our raw materials supply,” Hill explained. “For us it’s about adding textures—providing that value equation. We have to be innovative on the front end. We are a fashion business where color, design and texture are still very important.”

Mohawk believes it has the added advantage of doing most of its manufacturing (80%) in the U.S., which is increasingly important in this age of tariffs against U.S. trading partners. “We still see signs of life for rugs,” Hill added. “We’re seeing pent-up demand in the home furnishings category that has been soft, and we expect a pickup in the second half of 2019. Overall, we are bullish on the category even though there are still issues with global economic factors.”