May 13/20, 2019: Volume 34, Issue 25

By Reginald Tucker

Fort Worth, Texas—Although hardwood remains arguably the most aspirational flooring product today, it is increasingly facing intense competition from look-alike products such as LVT, WPC and SPC. The most effective way to recoup market share, proponents say, is to make a more compelling case for retailers and, ultimately, consumers to go for the real thing.

Fort Worth, Texas—Although hardwood remains arguably the most aspirational flooring product today, it is increasingly facing intense competition from look-alike products such as LVT, WPC and SPC. The most effective way to recoup market share, proponents say, is to make a more compelling case for retailers and, ultimately, consumers to go for the real thing.

That was the prevailing message that came out of the 2019 National Wood Flooring Association (NWFA) convention and expo, which took place here earlier this month. While many of the specialty hardwood flooring contractors, manufacturers and distributors in attendance here believe hardwood has significant advantages over competing hard surface products, recent trends reflect a tangible decline in market share.

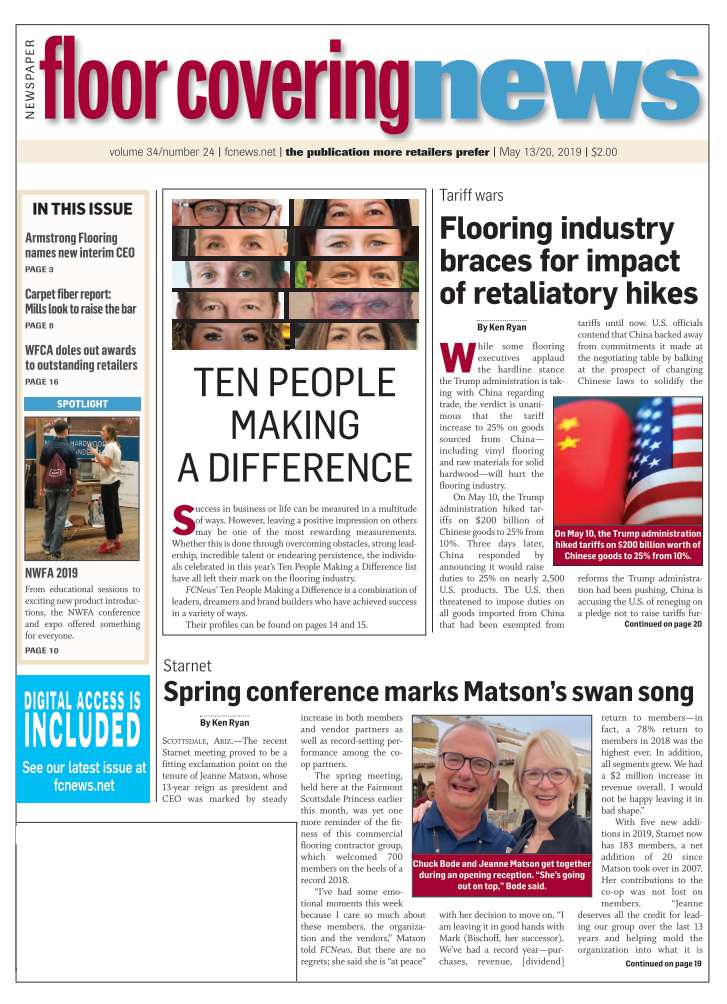

“All our research shows consumers prefer and want real wood products in their homes, but market sales show noticeable shifts to non-wood products,” Michael Martin, NWFA president and CEO, told FCNews. “The truth is wood has a great story to tell. Consumer research tells us they want flooring products that are beautiful, durable, easy to maintain and add value to the home. Hardwood checks all these boxes.”

It’s not enough that wood is ceding some market share to competing hard surface categories designed to emulate wood; the proliferation of so many wood-look products in the market today is also causing a lot of confusion among consumers who are looking for the real thing. Hence the newly launched “Real Wood, Real Life” marketing campaign NWFA recently launched to combat misperceptions about the various products now being positioned as real wood.

“At the end of 2017 we published a research study on consumers to get their insights and perceptions about wood floors,” Martin recalled. “What we discovered was two-thirds of consumers want wood floors. However, we found many consumers don’t know the difference between wood floors and other products. The intent was to take that research and design a campaign around it.”

But before the NWFA could proceed, it realized it first needed to devise a formal definition of what constitutes a real wood floor. So late in the fourth quarter of 2018, the association published an official release describing real wood flooring as follows: “Any flooring product that contains real wood as the top-most, wearable surface of the floor.” (This includes solid and engineered wood flooring, as well as composite engineered wood flooring.)

“The first two definitions are pretty self-explanatory—solid vs. engineered—with the third being engineered composite,” Martin explained. “We also felt we could not ignore any floor that had a real piece of wood on the wear layer—no matter what’s on the back, whether it’s composite, plastic, resin or otherwise. As long as it has a real wood surface, it falls under the definition of a real wood floor. What doesn’t fall under that definition is a photograph of wood on a piece of paper that’s then sealed onto a piece of plastic—that’s not wood.”

“The first two definitions are pretty self-explanatory—solid vs. engineered—with the third being engineered composite,” Martin explained. “We also felt we could not ignore any floor that had a real piece of wood on the wear layer—no matter what’s on the back, whether it’s composite, plastic, resin or otherwise. As long as it has a real wood surface, it falls under the definition of a real wood floor. What doesn’t fall under that definition is a photograph of wood on a piece of paper that’s then sealed onto a piece of plastic—that’s not wood.”

The NWFA convention served as the ideal platform to generate greater awareness of the new campaign. Utilizing two primary vehicles—the Homeowner’s Handbook to Real Wood Floors and woodfloors.org—the association is looking to educate wood flooring contractors, retailers and distributors on what they can do to promote the message in their local markets. Along with the new handbook and website, NWFA has produced a campaign “toolkit” for retailers and contractors to make it easier for them to tailor the “Real Wood, Real Life” marketing message to their unique businesses. NWFA is making available to contractors and retailers creative assets such as digital and print ad materials, campaign logos, trade show tabletop signage, media outreach materials and product fact sheets. NWFA has also provided retailers with social media posts they can use in their online marketing efforts.

Sobering statistics

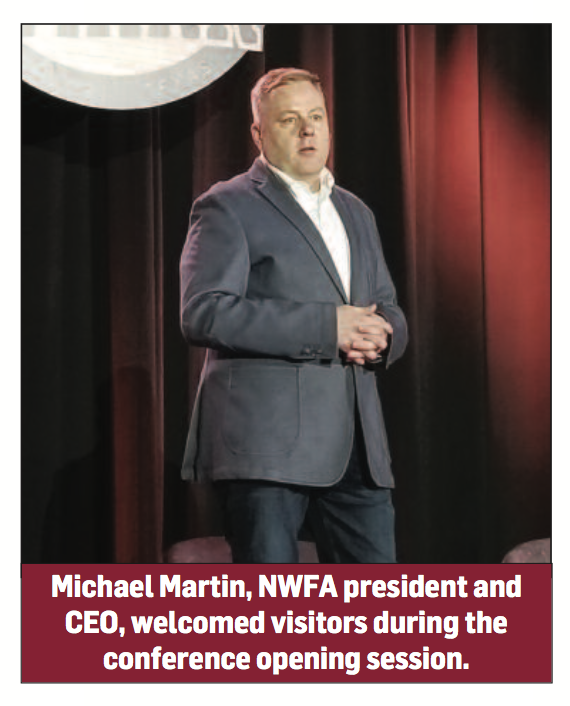

Bruce Zwicker, former president and CEO of Haines and now independent industry consultant, delivered an enlightening keynote address that drove home just how much resilient flooring—both flexible and rigid core products—are nipping share from the total floor covering pie, not just hardwood. Specifically, he cited research showing LVT grew by 25% in the U.S. last year, accounting for roughly 12% of the total flooring market. By comparison, he said hardwood—although it represents roughly 13% of the total flooring price— grew by only 3%.

The rapid rise of LVT/LVP is putting hardwood contractors in a tough spot. “I’ve done some LVT projects, but I limit it to below-grade applications,” said Chris Zizza, outgoing NWFA chairman and co-owner of C&R Flooring in Westwood, Mass. “But in all other areas of the home, I recommend the customer put down real wood.”

Another telling statistic reflects decreases in domestic wood flooring production. Zwicker’s research shows imports account for almost 50% of U.S. consumption, with China representing at least a third of all imports. Looking specifically at wood, however, China represents 50% of wood imported but 85% of LVT/multilayered flooring. Even more telling, wood imports were 30% of the U.S. market compared to 52% last year. In 2006, wood imports accounted for just 15% of the market. “U.S. producers are not very profitable, and there is over-capacity,” Zwicker told attendees. “In response, manufacturers scaled back production, raised prices and sold all or part of their wood divisions.”

Other findings: Prefinished hardwood has grown to represent nearly 60% of all wood flooring sold in the U.S. market today, with unfinished accounting for 40%. That’s nearly a reversal of the breakdown from eight to 10 years ago. In terms of end use, Zwicker estimated 20%-30% is new construction; 60%-65% is residential replacement; and roughly 10%-15% is commercial.

Other findings: Prefinished hardwood has grown to represent nearly 60% of all wood flooring sold in the U.S. market today, with unfinished accounting for 40%. That’s nearly a reversal of the breakdown from eight to 10 years ago. In terms of end use, Zwicker estimated 20%-30% is new construction; 60%-65% is residential replacement; and roughly 10%-15% is commercial.

Exhibitors…assemble

NWFA exhibitors did their part to entice hardwood flooring contractors and specialty retailers with their latest collections as well as additions to existing best-selling lines. At the American OEM booth, for example, the spotlight was on trendy new colors and patterns along with a line of engineered composite wood floors.

“We’ve added more colors to upper-end Appalachian Springs line, which features a sliced white oak veneer,” said Allie Finkell, executive vice president. “It offers an aged antique look with circular saw blade marks, then we add the highlights and low lights to give it more variation. It’s designed to look like reclaimed wood from the old textile mills in the Carolinas. We’ve received really great feedback.”

American OEM also took the wraps off Woodlands, a 3⁄8 inch-thick product available in 5-foot long planks. “It comes in four hickory looks, four oaks and features light wire brushing and good mix of tones,” Finkell explained. “And at $3.99, it offers a great price point for the consumer.”

The company also tested the waters with Raintree, a product line featuring a real wood veneer over an SPC rigid core. It comes in a 75-inch-long x 7 1⁄2- inch-wide plank format with four-sided locking system and attached backing pad. Although it made its official debut at Surfaces, this was its first appearance at the NWFA expo—the domain of the hardwood flooring enthusiast.

“We’re really proud of the way this looks,” Finkell said. “We have brought our expertise in finishing and staining to this hybrid category, and when it’s installed it looks just like our Hearthwood products. I was curious to see what the reception would be among all the wood nerds here, but people feel there’s a great market for this. People can get a look they want in wood and not have to compromise.”

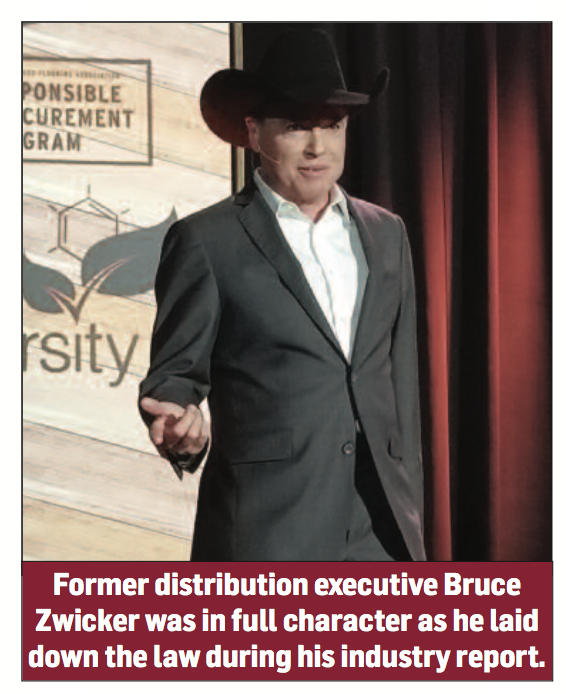

There was also quite a bit of action and excitement at the Anderson Tuftex booth, where the spotlight was on newly launched Ombre and Metallics. The former utilizes a four-pass process of texture, stain, high- lights and lowlights to create a full gradient of color washes across each plank, while Metallics—as the name implies—entails actual metallic particles infused into the stain treatment similar to techniques employed in the automotive paint industry.

“Our specialty is doing unique things you can’t do on a site-finished floor,” said Matt Rosato, hardwood category manager. “A lot of people are looking for differentiated products, especially with this customer base.”

“Our specialty is doing unique things you can’t do on a site-finished floor,” said Matt Rosato, hardwood category manager. “A lot of people are looking for differentiated products, especially with this customer base.”

More importantly, the occasion marked Anderson Tuftex’s NWFA debut as a combined entity. “It’s been a great show for us,” Rosato stated. “We’re planning an even bigger presentation for next year.”

NWFA also marked the official debut of AHF Products, the spinoff company created when Armstrong Flooring sold its wood division to AIP back in November. For Brian Carson, the company’s newly appointed CEO, the focus was on brand promotion.

“We have the Bruce brand, the best consumer brand in the industry,” he told FCNews. “We’re going to be putting more focus into that, more merchandising for the specialty retailer. We will also be transitioning from Armstrong brand to the Hartco brand, which dates back to 1946. That legacy and heritage is a natural fit. We’re also going to be relaunching the Robbins line, which dates 125 years. That’s going to be for retailers who want some exclusivity around their territory.”

There was also a fair amount of activity at the Mullican booth, where the company’s popular Wexford products generated attention. As Pat Oakley, vice president of marketing, explained, the allure is all in the manufacturing technique. “It’s live sawn in Virginia and finished at our engineered plant in Tennessee. We take the center of the log and cut it in one direction, which gives you a ‘cathedral’ graining. It’s a real high-end look.”

Mullican also showcased unique finishes made possible via a process called carbonization. This technique employs a heat-treating process to deliver interesting visual characteristics. “It essentially gives you a reactive stain look without actually using chemicals to do it,” Oakley explained.