Anderson, S.C.—While last year was difficult for the U.S. ceramic tile market due to the COVID-19 health crisis, 2021 is off to an excellent start, according to the Tile Council of North America (TCNA).

U.S. Tile Consumption Overview

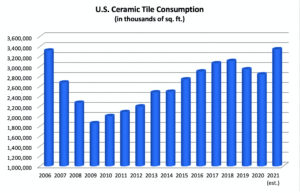

Through Q1 2021, total U.S. ceramic tile consumption was up 17.8% by volume vs. Q1 2020. If the current pace continues for the full year, U.S. consumption could reach a record-high of 3.34 billion square feet.

The following table shows U.S. tile shipments, imports, exports and total consumption in thousands of square feet.

| Year | U.S. Shipments (incl. Exports) | Imports | Exports | Total Consumption* | % Change in Consumption vs. Previous Year |

| Q1 2021 | 225,283 | 532,542 | 9,772 | 748,054 | 17.8** |

| 2020 | 902,290 | 1,966,443 | 31,009 | 2,837,724 | -3.5 |

| 2019 | 895,332 | 2,077,038 | 31,782 | 2,940,588 | -5.4 |

| 2018 | 940,300 | 2,196,935 | 29,746 | 3,107,489 | 1.5 |

| 2017 | 990,972 | 2,099,307 | 28,492 | 3,061,787 | 5.7 |

The chart below shows total U.S. consumption of ceramic tile (in square feet) over the last several years and an estimated total for 2021 based on the current pace of consumption.

Imports

In Q1 2021, the U.S. imported 532.5 million square feet of ceramic tile, up 26% from Q1 2020.

Imports made up 71.2% of U.S. tile consumption by volume in Q1 2021, up from 69.3% the previous year.

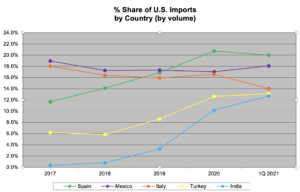

Spain, having replaced China last year as the largest exporter to the U.S. by volume, retained the top position in Q1 2021 with a 20% share of U.S. imports, a slight decrease from its 20.7% share last year.

Mexico was the second largest exporter to the U.S. by volume, comprising 18.1% of imports through Q1, its highest share since 2017.

Italy was in the third position with a 14% share of imports, down from 16.6% last year, and its lowest level on record.

The five countries from which the most tiles were imported in Q1 2021, based on volume, were:

| Country | Sq. Ft. Q1 2021 | Sq. Ft. Q1 2020 | % Change |

| Spain | 106,436,560 | 79,400,653 | 34.0% |

| Mexico | 96,285,536 | 82,024,151 | 17.4% |

| Italy | 74,607,903 | 77,265,459 | -3.4% |

| Turkey | 69,867,509 | 57,201,853 | 22.1% |

| India | 67,721,584 | 36,016,905 | 88.0% |

| All Countries | 532,542,412 | 422,565,010 | 26.0% |

However, on a dollar basis (CIF plus duty) Italy remained the largest exporter to the U.S. in Q1 2021, comprising 27.4% of U.S. imports, followed by Spain (23.1%) and Mexico (11.6%).

The five countries from which the most tiles were imported based on total U.S. dollar value (CIF plus duty) in Q1 2021 were:

| Country | $ Val Q1 2021 | $ Val Q1 2020 | % Change |

| Italy | 147,641,671 | 152,198,727 | -3.0% |

| Spain | 124,423,504 | 96,381,813 | 29.1% |

| Mexico | 62,536,154 | 57,562,515 | 8.6% |

| Turkey | 51,095,685 | 42,716,106 | 19.6% |

| India | 49,065,717 | 24,661,867 | 99.0% |

| All Countries | 538,123,676 | 448,225,602 | 20.1% |

The average values of tile (including CIF plus duty) from the five countries from which the most tiles were imported by volume in Q1 2021 were:

| Country | Sq. Ft.

Q1 2021 |

$ Val

Q1 2021 |

Val/Sq. Ft. Q1 2021 | Val/Sq. Ft. Q1 2020 |

| Spain | 106,436,560 | 124,423,504 | $1.17 | $1.21 |

| Mexico | 96,285,536 | 62,536,154 | $0.65 | $0.70 |

| Italy | 74,607,903 | 147,641,671 | $1.98 | $1.97 |

| Turkey | 69,867,509 | 51,095,685 | $0.73 | $0.75 |

| India | 67,721,584 | 49,065,717 | $0.72 | $0.68 |

| All Countries | 532,542,412 | 538,123,676 | $1.01 | $1.06 |

U.S. Shipments

U.S. shipments (less exports) in Q1 2021 were 215.5 million square feet up 1.5% vs. Q1 2020.

Representing 28.8% of all tile consumed in the U.S. by volume, domestically-produced tile remained far ahead of all individual countries exporting tile to the U.S. In fact, domestically-made tile’s market share was more than double that of Spain’s, the largest exporter to the U.S., which comprised 14.2% of all tile consumed in the U.S. by volume.

In dollar value, Q1 2021 U.S. FOB factory sales of domestic shipments were $326.1 million, up 1.3% vs. Q1 2020. Domestically-produced tile made up 37.7% of total U.S. consumption by dollar value.

The dollar value per square foot of domestic shipments in Q1 2021 was $1.51, down from $1.52 in Q1 2020.

U.S. Exports

U.S. ceramic tile exports in Q1 2021 were 9.8 million square feet up 11.4% vs. Q1 2020. The vast majority of U.S. exports in square feet went to Canada (69.9%) and Mexico (16.3%).

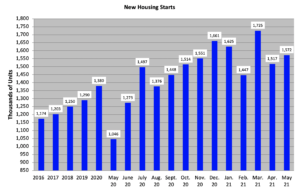

Housing market highlights

As of May 2021, total new home starts were at a seasonally-adjusted annual rate of 1,572,000 units, a 3.6% increase from the previous month and a 50.3% increase from May 2020.

Total new home starts are on pace to increase for the 12th consecutive year and be at their highest point since 2006.

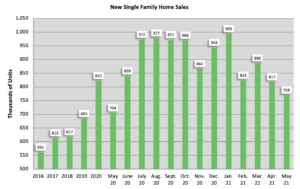

New single-family home sales

New single family home sales are on pace to increase for the tenth year in a row and reach their highest level since 2006.

As of May 2021, new single family home sales were at a seasonally adjusted annual rate of 769,000 units, a 5.9% decrease from the previous month but a 9.2% increase from May 2020.