By Mara Bollettieri

What’s in a name?, Shakespeare famously asked. It’s more than a label; it’s about identity, reputation and, ultimately, trust. Not only does a brand represent a company name, but it also represents everything that comes with it and how it distinguishes itself

from other products and/or services.

What’s in a name?, Shakespeare famously asked. It’s more than a label; it’s about identity, reputation and, ultimately, trust. Not only does a brand represent a company name, but it also represents everything that comes with it and how it distinguishes itself

from other products and/or services.

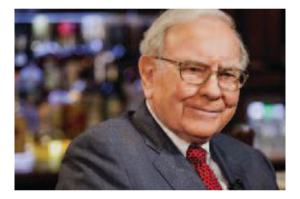

COREtec—which has the power of four strong brands supporting it—knows this all too well. The synergies between Berkshire Hathaway—led by world-renowned investor Warren Buffett—along with the powerful name recognition and stature of manufacturers such as Shaw Industries and USFloors are at the very core of what defines a strong brand in the mind of the consumer.

Here’s a closer look at how each brand relates to the other.

USFloors

USFloors is largely credited with giving the flooring industry its first resilient offering featuring a 100% waterproof rigid core—aptly named COREtec. Launched in 2013, COREtec has not only spawned various iterations within the brand—each successively featuring innovations that aim to improve on the preceding collections—but also imitators looking to cash in on the latest craze. But USFloors is working relentlessly to maintain its leadership position while continuing to evolve the technology, launching successors such as COREtec Plus Premium,

COREtec Plus HD and COREtec Plus XL.

Berkshire Hathaway

Berkshire Hathaway

Headquartered in

Omaha, Neb., Berkshire

Hathaway holds major shares of numerous global companies, many of which

are household names. The corporation also has minor shares in others, namely GEICO, Dairy Queen, Fruit of the Loom, Kraft Heinz, Duracell and Benjamin Moore & Co., to name a few.

All totaled, Berkshire Hathaway—which boasts a market value of $491.6 billion—owns more than 60 companies, according to Forbes, which ranks Berkshire first on its America’s Largest Companies list and No. 4 on its list of the World’s Largest Public Companies. Its much-ballyhooed purchase of Shaw Industries in 2000 elevated the manufacturer to an even higher level of prominence.

More importantly, the purchase revealed the driving philosophy inherent in Berkshire Hathaway’s investment strategy—it only invests in or purchases companies in which it truly believes makes in impact of the lives of the people who purchase their products.

Warren Buffet

Reverentially referred to as the “Oracle of Omaha,” Warren E. Buffett, CEO and chairman of Berkshire Hathaway, is one of the most successful business investors in the world. One could argue the powerful business magnate is a brand in and of himself. According to Forbes, the 87-year-old investor is currently worth $82.7 billion.

Reverentially referred to as the “Oracle of Omaha,” Warren E. Buffett, CEO and chairman of Berkshire Hathaway, is one of the most successful business investors in the world. One could argue the powerful business magnate is a brand in and of himself. According to Forbes, the 87-year-old investor is currently worth $82.7 billion.

In 1962, at the age of 32, Buffett decided to invest in Berkshire Hathaway, a textile manufacturing firm that was on the decline. By 1965, he was in control of the company and changed management completely. This allowed him to make it the foundation of the holding company that it’s recognized for today.

Buffett heralded the success of USFloors in Berkshire Hathaway’s 2017 recap letter to shareholders. “USF’s managers, Piet Dossche and Philippe Erramuzpe, came out of the gate fast, delivering a 40% increase in sales in 2017, during which their operation was integrated with Shaw’s. It’s clear we acquired both great human assets and business assets in making the USF purchase.”

Shaw Industries

Shaw Industries, interestingly, also started as a small business. Back in 1946 it operated as the Star Dye Co., which dyed tufted scatter rugs. Fast forward to today, the Dalton-based behemoth manufactures and distributes a host of flooring materials, including carpet, resilient, hardwood, laminate, tile and stone, synthetic turf and more to both commercial and residential markets worldwide. The company, led by Vance Bell, chairman and CEO, has around 20,000 associates globally and generates nearly $6 billion in annual sales.

Shaw Industries, interestingly, also started as a small business. Back in 1946 it operated as the Star Dye Co., which dyed tufted scatter rugs. Fast forward to today, the Dalton-based behemoth manufactures and distributes a host of flooring materials, including carpet, resilient, hardwood, laminate, tile and stone, synthetic turf and more to both commercial and residential markets worldwide. The company, led by Vance Bell, chairman and CEO, has around 20,000 associates globally and generates nearly $6 billion in annual sales.

Along the way, Shaw Industries expanded its product portfolio via both investment and acquisition, picking up venerable brands such as Evans & Black, Queen Carpets, Dixie Group, Anderson Hardwood Floors and, more recently, USFloors. Since that time, the company purchased Scotland-based carpet tile manufacturer Sanquhar Tile Services (STS), thereby expanding its global footprint.