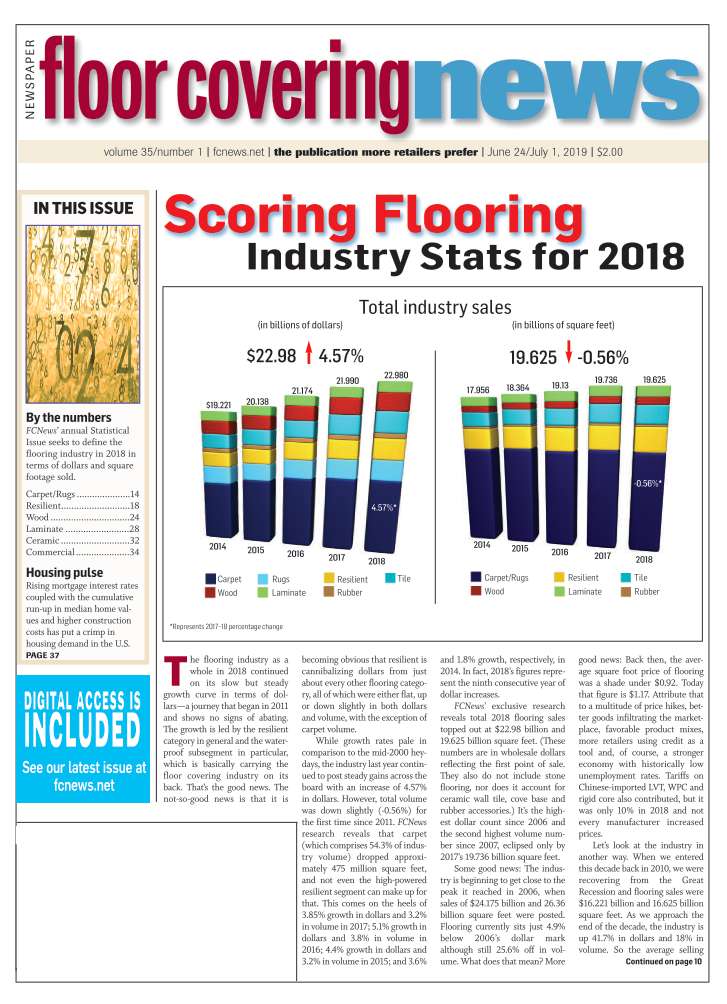

June 24/July 1, 2019: Volume 35, Issue 1

By Lindsay Baillie

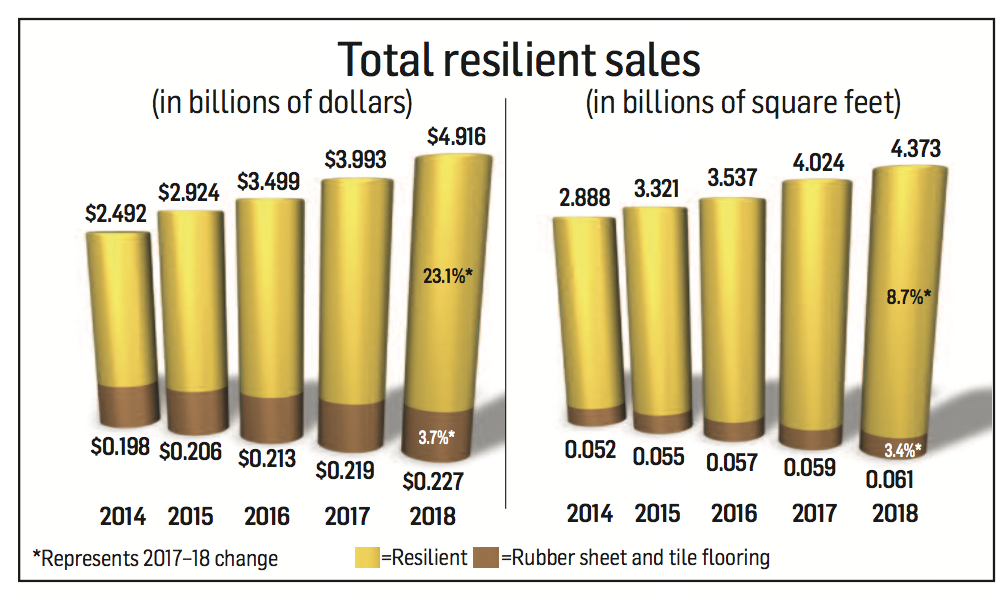

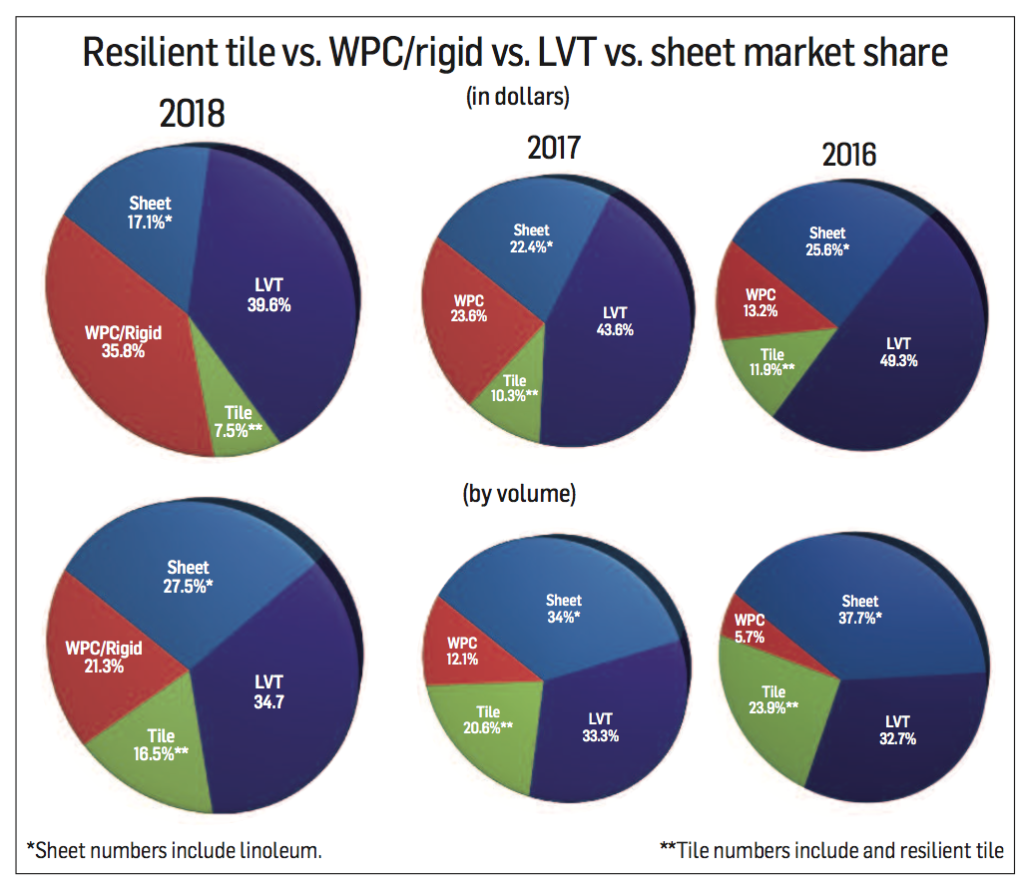

Industry observers will not be surprised to hear that the resilient category had another spectacular year of growth in both sales and volume. FCNews research shows the category generated $4.916 billion in sales (not including rubber) in 2018—an industry-leading 23.1% increase over 2017’s $3.993 billion. In terms of volume, the category accounted for 4.373 billion square feet (not including rubber) at the first point of sales, an 8.67% increase from 2017’s 4.024 billion square feet. This positive momentum, executives say, is directly attributed to the performance of subcategories such as WPC and rigid core.

Industry observers will not be surprised to hear that the resilient category had another spectacular year of growth in both sales and volume. FCNews research shows the category generated $4.916 billion in sales (not including rubber) in 2018—an industry-leading 23.1% increase over 2017’s $3.993 billion. In terms of volume, the category accounted for 4.373 billion square feet (not including rubber) at the first point of sales, an 8.67% increase from 2017’s 4.024 billion square feet. This positive momentum, executives say, is directly attributed to the performance of subcategories such as WPC and rigid core.

The resilient category’s strong performance in 2018 is even clearer when measured against other hard surfaces. When compared to the likes of tile, wood and laminate, resilient accounted for 42.4% of sales. When taking total flooring sales into account, resilient comprised 21.4% of revenue and 22.3% of volume.

The category’s skyrocketing growth really comes into perspective when you consider the fact the segment’s percentage increase in revenue is over five times the growth of the entire industry, while volume is almost four times that of the flooring sector as a whole.

Resilient’s continued double- digit growth in sales in 2018 is made that much more significant when looking at its performance over the past few years. FCNews research shows 2018’s sales represent a 40.5% increase over 2016’s $3.499 billion and a 68.13% increase compared to 2015. To put this growth into perspective, total resilient sales increased 123% from 2013’s $2.206 billion and 130.3% from 2008. Meanwhile, total resilient volume increased 68.8% from 2013’s 2.59 billion square feet and 49.76% over 2008.

Industry executives cite a multitude of factors that contributed to the resilient category’s meteoric rise. One of which is the fact that the category possesses a wide range of products to fulfill a range of retailer and consumer needs. As Michael Raskin, CEO, Raskin Industries, explained, resilient products across the board provide the consumer with value. “Today’s customer wants performance and design. The visuals in this category have vastly improved. All of these attributes—waterproof, durability, ease of installation and maintenance—provide an unsurpassed value. Also, it is more difficult to find skilled labor, which impacts products like ceramic and wood. Retailers ultimately push products they can install with confidence in a timely manner.”

Other executives agree, citing the features and benefits the category provides. “Resilient flooring provides tremendous value to consumers through advancements in visuals that are better than natural wood and tile looks, superior performance and ease of installation,” said Ed Sanchez, vice president product management, Mohawk Industries—parent of the Pergo Extreme brand. “Consumers want value but don’t want to compromise on features. With resilient, they don’t have to.”

Other manufacturers see the category’s red-hot LVT segment as a major factor in resilient flooring’s performance. “The resilient flooring market is being fueled by LVT’s continued growth,” said John Szilagyi, manager market intelligence, Tarkett North America. “The category has captured some of the best features of design, performance and price. It has also been a hotbed of innovation. While other product categories have remained somewhat stagnant, LVT has benefitted from digital printing. LVT has also seen advancement in material innovation—especially WPC and SPC— and diverse production.”

Most executives agree LVT’s sister subsegments, WPC and SPC, have brought the category to new heights. “The consumer has embraced the SPC category as a high-value flooring choice,” said Art Layton, director of specialty products, Axiscor. “The performance is proven in high-traffic and high-moisture applications, and it is an extremely easy product to clean and maintain. Retailers love selling the product for several reasons, including ease of transport to and from jobs, faster installations and very few callbacks.”

Most executives agree LVT’s sister subsegments, WPC and SPC, have brought the category to new heights. “The consumer has embraced the SPC category as a high-value flooring choice,” said Art Layton, director of specialty products, Axiscor. “The performance is proven in high-traffic and high-moisture applications, and it is an extremely easy product to clean and maintain. Retailers love selling the product for several reasons, including ease of transport to and from jobs, faster installations and very few callbacks.”

It also helps that LVT, WPC and SPC are all products that provide retailers with a compelling story to sell, executives say. “They can sell the end user on its practicality, the fact that it is waterproof, scratch resistant and so on,” said Chris Dillon, vice president of sales and marketing, Celeste. “Every year it seems the looks get better and more realistic. A few years ago, you could easily see the difference between real wood and resilient; now it’s more difficult.”

Residential

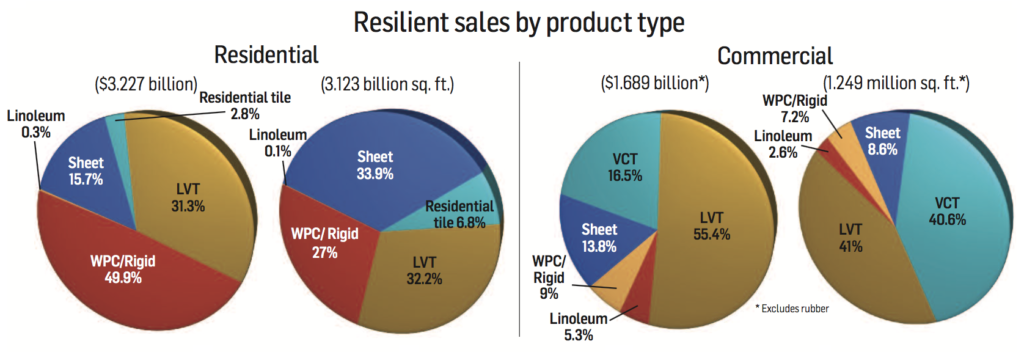

FCNews research shows the residential end-use sector made up almost 65.6% of total resilient revenue or $3.227 billion. With respect to volume, residential resilient accounted for 71.4% of square footage shipped. The bulk of that activity was driven by residential LVT (including WPC and rigid products), which generated an estimated $2.6 billion in revenue or 80.6% of total residential resilient sales. In terms of volume, these trendy products accounted for 1.848 billion square feet, or 59.2% of residential resilient volume.

Resilient manufacturers attribute the category’s success, in part, to the strength of key end-use sectors. Many industry executives see the greatest activity in replacement/redesign markets. However, builder and new home construction—in both single- and multi-family installations—are helping to bring the category to new heights. Executives also say that while WPC and rigid core products remain the darlings of the resilient category, each segment is seeing a different resilient product take market share.

“I have seen this category grow everywhere, but it has been stronger in the residential replacement market,” Celeste’s Dillon explained. “I had a friend recently go into a retailer looking to purchase hardwood, but the retailer kept trying to push her toward a resilient floor. It has become the trend in the retail market, much like laminate used to be.”

The resilient category as a whole is thriving in residential replacement in part because its unique selling points catch the consumer’s attention. That’s according to Jason Hair, vice president of hard surfaces, Phenix Flooring, who sees WPC clearly leading the charge in this sector. “The waterproof story seems to resonate with the consumer since it’s such a practical feature. It’s a feature they can easily understand and apply to their own home.”

While residential replacement has also been a primary driver in the growth of LVT volume, some companies are seeing a strong LVT presence in the multi-family market. There have even been reports that indicate builders are embracing rigid core products. “Residential retail has been a big player in the growth of luxury vinyl flooring, in particular the rigid segment,” said Lindsey Nisbet, director of marketing, EarthWerks. “While there are so many options of flooring to consider, luxury vinyl flooring has all of the looks, performance capabilities and price options for the homeowner.”

Other executives are also seeing builders install more luxury vinyl planks (LVP) and tiles (LVT) in all rooms of the home. “We continue to see the resilient products, planks and tiles along with textile back sheet replacing other hard surface products in new construction, property management and residential replacement,” said Nick Brown, vice president of sales – North America, Beauflor USA.

Industry executives also attribute this continuous growth in the residential arena to the evolution of vinyl plank. “Starting with traditional LVT, followed by WPC and, most recently, HDPC/SPC rigid core products, each incarnation has provided improved structural design and performance with enhanced HD visuals and textures,” said Dick Quinlan, senior vice president of sales and marketing, Wellmade Performance Flooring.

Industry executives also attribute this continuous growth in the residential arena to the evolution of vinyl plank. “Starting with traditional LVT, followed by WPC and, most recently, HDPC/SPC rigid core products, each incarnation has provided improved structural design and performance with enhanced HD visuals and textures,” said Dick Quinlan, senior vice president of sales and marketing, Wellmade Performance Flooring.

Subsegment breakout

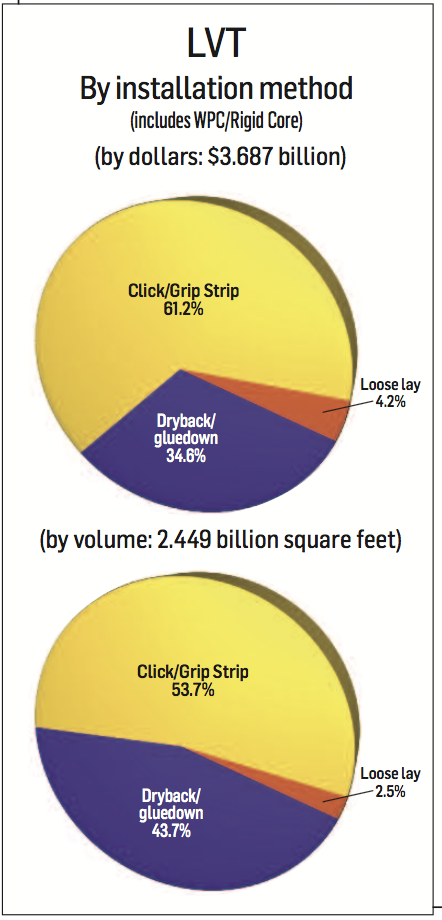

Within residential LVT, dryback and click products experienced decreases in 2018, research shows. Dryback was down roughly 1% from $523.65 million in 2017, while click saw a 6.56% decrease from $460.6 million two years ago. Conversely, loose lay revenue grew 22.2% from $33.8 million in 2017 to $41.3 million in 2018. In terms of volume, dryback represented 34.5%, click was 18.8% and loose lay was roughly 1% of total LVT volume in 2018.

“We are seeing growth within all three categories of LVT—glue- down, loose lay and rigid—residentially because they provide practical benefits in addition to original visuals,” said Bill Anderson, CEO, Karndean Designflooring. It is ultimately the intended use that dictates which LVT format is chosen by the consumer, he added.

WPC and rigid had another stellar year in 2018, on the heels of astronomical growth in 2017. The subsegments together claimed 61.9% of residential LVT dollars and 46.5% of residential LVT volume, respectively. That is an 84.7% uptick in dollars and 92% increase in volume from 2017. Observers believe this trend provides evidence of WPC and rigid core’s cannibalization of LVT click products.

Rigid core’s growing acceptance, experts say, boils down to several factors: ease of installation, waterproof qualities and visuals. “Rigid core has the trifecta of irresistible attributes: unbelievably realistic look and feel, fast and easy installation and upkeep, and 100% worry-proof and waterproof with industry- leading warranty,” said Sam Kim, senior vice president, MSI. “We have seen increased acceptance of rigid core LVT in all areas of construction—new, replacement, low-end, mid-end, high-end, spec homes and custom homes.”

Innovations in subsegments such as WPC and SPC are also driving appeal. As Axiscor’s Layton explained, “Technologies and improvements to SPC products such as embossed in register finishes, beveled edges and superior natural visuals have made a major impact on the popularity of the category.”

While WPC has been outpacing other flooring categories (including traditional LVT) since its inception, the subsegment has felt increasing pressure from rigid core over the past two years in particular. This phenomenon, executives say, is due to rigid core’s differentiating qualities.

“SPC does not require adhesive during production so it is more efficient from a production standpoint,” Raskin explained. “The consumer market can still differentiate as WPC uses a thicker foam board that is less dense. It depends if the consumer sees value in a thicker foam product filled with air used in WPC or a denser board with no air or foam. If the consumer is educated properly, then WPC sales should continue to decline.”

What’s more, rigid is expected to continue taking market share away from almost every sector. “Our results indicate it is primarily taking share from residential, both single- and multi-family,” said Kurt Denman, chief marketing officer and executive vice president of sales, Congoleum. “With the growing preference for hard surface, it is seen as a product that can go anywhere in the home.”

Despite rigid core products stealing share from WPC, industry executives still see a market for the latter. “There has been hyper growth in SPC in all of the channels,” said Herb Upton, vice president hard surface flooring, Shaw Industries, parent company of USFloors and Fusion. “If you look at it on a percentage basis, SPC growth is significant but it’s the laws of bigger numbers. There’s more WPC out in the market right now. Both WPC and SPC have a place in the residential home, so they can coexist. WPC is the luxury 60-ounce carpet; it feels great underfoot, looks beautiful and performs. It is what you want in those main rooms within your house. SPC offers a high-performance platform for high traffic.”

Despite rigid core products stealing share from WPC, industry executives still see a market for the latter. “There has been hyper growth in SPC in all of the channels,” said Herb Upton, vice president hard surface flooring, Shaw Industries, parent company of USFloors and Fusion. “If you look at it on a percentage basis, SPC growth is significant but it’s the laws of bigger numbers. There’s more WPC out in the market right now. Both WPC and SPC have a place in the residential home, so they can coexist. WPC is the luxury 60-ounce carpet; it feels great underfoot, looks beautiful and performs. It is what you want in those main rooms within your house. SPC offers a high-performance platform for high traffic.”

Sheet

With the continued success of LVT—more specifically WPC and rigid products—residential sheet vinyl flooring saw another year of decline in 2018. According to FCNews research, the segment was down 12.3% from $579 million in 2017 to $507.9 million in 2018 in sales and 12.6% off in volume. Several manufacturers see this decline in starter homes and multi-family projects in particular.

Some manufacturing executives do not see sheet ever regaining market share. “Sheet vinyl has an uphill battle against rigid core and flex vinyl planks and tiles,” said Jamann Stepp, vice president of hard surface, The Dixie Group. “What market share rigid core does not consume from sheet vinyl, flex vinyl such as dryback, click vinyl and loose lay will. There will be a market for sheet vinyl goods; however, that market will continue to shrink.”

However, not all manufacturers have written off sheet in residential settings. “Beauflor has revived sheet with textile-back products,” Brown explained. “Textile-back sheet allows the customer to install the floor similar to a luxury vinyl plank and tile with limited floor prep and being able to install over single-layer constructions.”

Mohawk’s Sanchez also sees sheet as a viable product moving forward. While sheet has experienced pressure from the commodity plank products in the market, sheet should be able to hold a unique position for some applications in the face of increased pressure from imports. “Improved realism, design and features such as EIR make sheet an ideal solution for some applications, delivering value and fashion to the consumer,” he said.

While sheet vinyl manufacturers foresee a tough road ahead, there are several moves they can make to jump-start the subcategory. Proponents like Bret Perkins, vice president, hard surface, Southwind, sees potential in installation innovation. “About the only thing the industry can do is create a product that can easily be installed by DIY, is free floating and easy to seam together,” he explained.

Another avenue that may help sheet recover market share is creating unique visuals untouchable by other resilient products. As Dan Natkin, vice president–hardwood and laminates, Mannington, explained, “From a product perspective, we have seen success in reviving sheet through patterns that are nearly impossible in any other category. The other area to revive sheet revolves around telling the quality story and training a new generation of installers.”

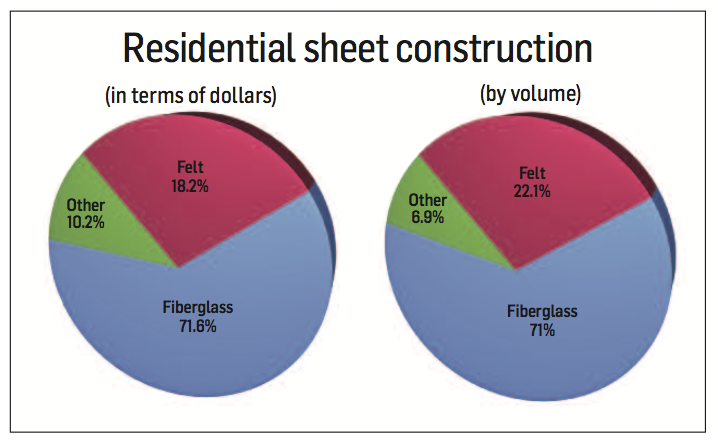

Within this resilient subcategory, FCNews research shows felt goods continuing to lose market share to fiberglass. While felt was approximately 22.5% of dollars and 25.3% of volume in 2017, the product has dropped to 18.2% of dollars and 22.1% volume in 2018. Fiberglass, on the other hand, increased its share to 71.6% of dollars and 71% of volume—a 3.8% and 2% increase, respectively, from 2017.

“With the introduction in textile-back sheet and the continued development of fiberglass sheet constructions, felt will continue to lose market share in the residential replacement, property management and builder markets,” Beauflor’s Brown said.

Despite felt losing share to fiberglass and other backings, some executives still see a market for felt-backed sheet. “It is still the most value-oriented construction and performs exceedingly well in many environments,” Natkin stated.

Commercial

FCNews research shows resilient products in the commercial arena generated $1.916 billion in sales in 2018, a 17.8% increase from 2017. Volume, by comparison, was up 7.7%. Industry experts believe key end-use sectors such as healthcare, hospitality, education and Main Street assisted in resilient flooring’s growth in the commercial market. This trend is expected to extend through 2019 and beyond as LVT, WPC and SPC products continue to poach market share from soft goods as well as other hard surfaces.

“Resilient flooring—particularly LVT—is growing across virtually all commercial channels, as hard surface is seen more often in spaces that used to feature carpet,” said Deb Lechner, vice president of marketing, Armstrong Flooring. “Growth occurred in healthcare and also within the office sector, with the ongoing growth in employment. The education market showed growth as well, as state and local tax revenues improve. In addition, hospitality improved last year as economic conditions encouraged business and leisure travel.”

Others are seeing growth in resilient in education as well as retail. “We are in the education buying/specification season with much school construction under way,” said David Thoresen, senior vice president commercial hard surface, Mohawk Group. “We are seeing the growth in retail because of our  strong position in the segment with strategic accounts and relationships.”

strong position in the segment with strategic accounts and relationships.”

Similar to 2017, much of resilient contract sales came from commercial-grade LVT, which accounted for roughly $1.087 billion in 2018—a 35.9% jump over 2017’s $799.8 million. Within this subcategory, WPC and SPC made up a significant portion of dollar growth, rising from $72 million in 2017 to $151.7 million in 2018. Dryback saw a 19.17% growth in volume, while click continues to see a drop-off—likely due to the growth of commercial SPC, which captured 57.7 million square feet in volume in 2018, observers say.

“In a commercial setting—such as those with roller traffic—LVT or a glue-down SPC will perform very well,” said Amy Tucker, senior marketing manager, Philadelphia Commercial. “WPC, however, is engineered for spaces less likely to encounter roller traffic. Resident living spaces and areas looking for more comfort underfoot pair best with WPC.”

The growth of LVT in the commercial market, experts say, is likely due to the subcategory’s low maintenance requirements, ease of installation and performance attributes. “If you look at many restaurant chains where they used to specify wood, they now have vinyl planks,” said Perry Coker, CEO, CFL Flooring North America. “Same for hotels, which used to have wood or ceramic in the lobbies and carpet in the guest rooms. Ditto office space.”

FCNews research shows commercial sheet increased 3.79% in revenue to $232.5 million in 2018 from 2017’s $224 million. This is slightly down from the 4.9% growth the subcategory saw in 2017. This slowdown, executives say, is likely the result of an uptick in commercial-grade LVT sales as well as the growing popularity of SPC in commercial applications.

However, some believe sheet resilient still has a place in the commercial sector. “Because there are no seams with sheet resilient, it is ideal for spaces where spills and messes may happen and has less maintenance requirements than other flooring options,” Tucker said.

VCT

Increases in commercial-grade LVT, WPC and rigid products have finally caught up to traditional resilient categories such as vinyl composition tile (VCT), which is now seeing a decrease in dollars and volume. According to FCNews research, VCT saw a 6.8% decrease in dollars from $299 million in 2017 to $278.6 million last year. In terms of volume, square footage fell 7% in 2018.

Despite its decline, manufacturers that are heavily leveraged in the product category still see VCT as a viable commercial product. “Although LVT and rigid core are currently attracting the lion’s share of attention, VCT continues to account for a large share of square footage of resilient commercial flooring installed each year,” Armstrong’s Lechner explained. “It offers a durable and cost-effective flooring solution, particularly for education and mass retail applications.”

Rubber

FCNews research shows rubber generated $227.4 million in sales in 2018, a 3.7% increase over 2017. In terms of volume, the category accounted for 61.5 million square feet, a 3.4% increase from last year. “The rubber market continued to fare well in 2018,” Tarkett North America’s Szilagyi said. “Its growth was better than the overall market but not as robust as the rest of the resilient category.”

The main reason for this growth, according to Mark Tickle, director of marketing for American Biltrite, is more end users are acknowledging the benefits of rubber tile and sheet. “Manufacturers are stepping up to the plate with an increasing number of designs and colors to meet the growing demand from designers,” he explained.

Linoleum

FCNews research shows linoleum grew 4.2% to $100 million in 2018 from 2017’s $96 million. What’s more, the subcategory’s volume increased 2.4% to 33 million square feet. According to Tim Donahue, residential national sales manager, Forbo Flooring Systems, linoleum’s growth was driven primarily by residential replacement. “Forbo is seeing double-digit growth with our Marmoleum brand of linoleum for five years straight—residentially,” he said. “This is due to customers seeking healthier flooring options for their homes in colors and patterns that allow design flexibility. Flooring specialty retailers have also been a key driver for the growth in our residential replacement business.”

Imports vs. domestic

The resilient category is still heavily reliant on imports, which represent 76.7% of sales. However, domestic production continues to increase, taking a small percentage away from imports. In 2018, domestic production accounted for 23.3% of the category.

Domestic manufacturers say bringing production to the U.S. helps eliminate several problems often associated with imports. “Domestic investments shorten the supply chain and reduce variability,” Mohawk’s Sanchez explained. “This gives domestic manufacturers and their customers more options on how to service their consumers.”

While some manufacturers are looking to move away from imports, generally, domestic mass capacity comes online to supplement a growing, sustainable product category. So says CFL’s Coker, adding, “We see this now with SPC. The challenge is almost all of the innovation in the vinyl category over the past years has come from China—where change is fast, new ideas are welcome and unique limited-production types of products find success and become the new mass-production norm.”

The Dixie Group’s Stepp sees the majority of flexible vinyl being produced domestically. He also noted more manufacturers are attempting to produce rigid core in the U.S. “However, I look for that to change in the near future—especially if the tariffs on goods from China remain at a punitive 25%.”

When talking about domestic production and import activity, it is almost impossible to not con- sider the recent tariffs imposed in 2018 by the Trump administration. For some industry executives, the tariffs may help drive domestic production capacity in the next five to 10 years. For others, it will remain business as usual as importers look to other countries beyond China for manufacturing. However, virtually everyone agrees the situation has created uncertainty across the board as to whether or not the tariffs—including the new 25% hikes proposed in 2019—will stick.

Regardless of what happens with the tariffs, executives see the opportunity for even further innovation in the resilient category. “Home buyers, renters and remodeling homeowners have already seen $1 billion added to U.S. housing construction costs thanks to tariffs,” said Tom Hume, vice president of marketing, Cali Brands. “The tariffs are also prompting some manufacturers to diversify product portfolios and develop other categories that can be made outside of China.”

While increased innovation is all well and good, it will ultimately create greater saturation in a flooring category that is already overflowing with me-too products. This, executives say, could cause the prices of certain resilient products to dive even lower than current levels. As Chet Graham, president, Marquis Industries, explained, “SPC has allowed a cheap alternative to enter the resilient flooring [arena]. So-called ‘fly by night’ manufacturers are entering the domestic market and just selling product on cost.”