OK. We can finally come up for air. Our annual statistical issue is in the can. The FCNews team has been combing through industry statistics for months, making countless phone calls to manufacturers and industry associations, and in some cases extrapolating data from annual reports.

OK. We can finally come up for air. Our annual statistical issue is in the can. The FCNews team has been combing through industry statistics for months, making countless phone calls to manufacturers and industry associations, and in some cases extrapolating data from annual reports.

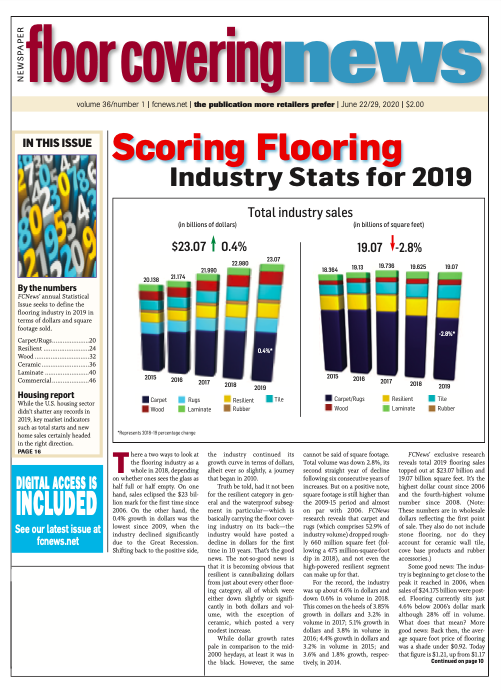

When the dust settled, FCNews pegged U.S. floor covering industry sales for 2019 to be a shade above $23 billion and 19.07 billion square feet, meaning dollars were up a hair and volume was down about 2.8%. That suggests a slightly higher average square foot price for flooring—$.04 to be exact. That can be attributed to a more favorable product mix across the board as less expensive products, particularly Chinese wood and laminate, gave way to pricier domestic alternatives.

Also, on the resilient side, we saw the meteoric rise of SPC/rigid core at the expense of products with traditionally lower price points. Every year, I like to use this space to remind our readers that there are numerous statistical reports out there. While we are quite confident that our assessment of the industry is the most accurate, we understand that other reports can have different results simply by virtue of what they include. For example, some reports contain sales of stone flooring; some estimate stone flooring to be around $1 billion. Stone includes marble, granite, travertine, slate, etc., which have applications beyond flooring. It’s hard to ascertain how much of the stone market is indeed flooring. A lot of the info would be purely anecdotal.

Another product not included in this report is polished concrete. Last year, I talked about how some believe polished concrete is bigger than anyone in our industry cares to admit. Curt Thompson, president of Aggretex, reasons that total flooring volume was not down, and if we report it to be down 2.8%, then what do you think is grabbing that share?

Now, when it comes to ceramic tile, you may see that number somewhat larger in other reports. That’s because they may include wall tile. Today, so much of ceramic can be used interchangeably on the floor or wall. Industry insiders tell us floor tile represents about 75% of the total ceramic number. So that’s what we use.

Likewise, our rubber numbers include only tile and sheet flooring. Three years ago, we made the decision to eliminate cove base, accessories, stair treads, etc. We revised our numbers back five years to reflect this change.

Here’s the fun part: Arguably the most difficult category to nail down is resilient. There is so much that constitutes the segment: residential and commercial sheet, LVT and its WPC and rigid subsegments. You also have VCT and the inexpensive peel-and-stick tile sold primarily at home centers.

FCNews has taken a unique approach these past few years. I personally call every manufacturer that does any appreciable business in the category for their sales figures with the promise of confidentiality. You’d have to kill me for those numbers. Wait—you still wouldn’t get them if I was dead, so don’t bother.

We asked everyone to break down their numbers in terms of residential vs. commercial, LVT vs. sheet, WPC vs. SPC/rigid and so on—in dollars and square footage. Everyone complied because, after all, they want the best benchmark. We only failed to connect with two companies, and I doubt our estimates for their business were too far off.

Are our numbers exact to the penny? No. Are they as close as you’re going to get? Absolutely. And for the record, the saving grace for this industry in 2019 was SPC/rigid core. SPC was around $585 mil- lion in 2018 with an average selling price of $1.58. For 2019? Try $1.13 billion residentially and another $116.5 million commercially. That’s where all the growth is coming from, in case you’ve been sleeping under a rock for a year.

As for determining that “other” LVT/WPC/rigid number, this is the piece we estimate. There are a lot of companies doing between $2 million and $10 million in imported product; it would be impossible to talk to each and every one of them. But we think we have a good handle on what’s coming in.

Enjoy the report.

Steven Feldman