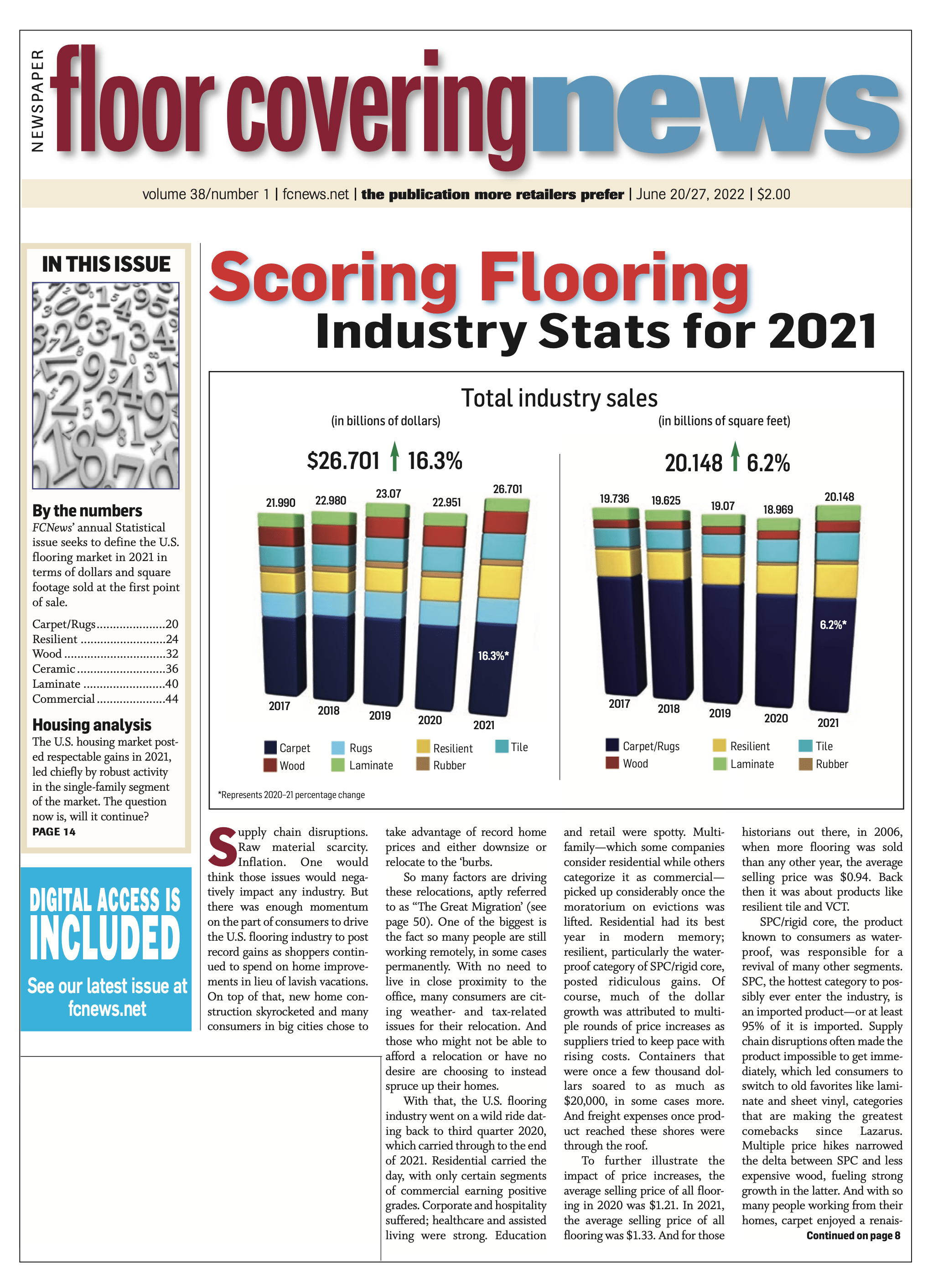

It’s common knowledge among industry observers that commercial tends to lag behind residential activity—at least during normal business cycles anyway. And while business has been anything but normal these past two and a half years, it’s safe to say that the tide is turning as select commercial end-use markets—not all—are beginning to participate in the spoils that the residential market has enjoyed in recent years. Preliminary FCNews research shows the commercial flooring market totaled $6.488 billion in sales in 2021, an uptick of 6% over 2020. While modest, this marks an about-face for the sector, which fell just over 11% in 2020.

“Certain Main Street/ Commercial segments, like education, performed very well in 2021 and into 2022,” noted Quentin Quathamer, director of Main Street commercial, Shaw Industries. “Retail and office segments, commonly referred to as tenant improvement, have both fared well since small businesses have opened back up after COVID-19 shutdowns.”

The coronavirus pandemic impacted all sectors of the economy last year as businesses saw supply chains interrupted, demand for products and services decline, and government-mandated closures. Some major commercial flooring sectors, such as education, retail and healthcare, recovered faster than others, according to published reports. Hospitality is showing signs of coming back as budget and travel restrictions are being lifted while office spaces are gradually filling up as more employees return to work.

Hard surfaces shine

In commercial, hard surfaces surpassed carpet for the second straight year with hard surface sales reaching $3.5 billion, according to FCNews research. Resilient represents approximately 57.5% of hard surface commercial sales and is the fastest growing category.

Resilient consists of many subcategories, many of which are specified for the commercial market depending on both the application as well as the subcategory of flooring. For example, glue-down accounted for the bulk of resilient commercial sales at 52% (in terms of dollars). This was followed by WPC/rigid core and sheet vinyl, which accounted for While much of resilient flooring’s activity has been focused on SPC/rigid core on the residential side of the business, longtime favorites in commercial continue to generate specifications. These include VCT, linoleum and rubber.

“Linoleum showed very good growth in 2021,” observed Denis Darragh, vice president North America, Forbo Flooring. “Linoleum is primarily a healthcare, education, senior care and specialty retail product.”

Rubber is one flooring which benefitted from the increased emphasis on cleanliness and maintenance, a major reason why applications are reportedly spiking in the education, hospital and healthcare sectors. “We are also seeing a lot more visuals being introduced in rubber flooring, which should also help gain market share within the resilient category,” Catherine Del Vecchio, vice president of marketing – flooring division, American Biltrite, reported.

School and healthcare facilities are also sweet spots for ceramic tile. Like other natural floors, there remains pent-up demand for tile, in part, to accommodate the trend toward sustainable and easily cleaned surfaces. “With smaller spaces and fewer facilities in general, the focus for design is on health, safety and longevity, making ceramic one of the best answers for post-pandemic commercial spaces,” said Rocamador Rubio Gomez, director for Tile of Spain in the U.S.

Ceramic, despite slightly lower commercial sales activity in 2021, still held onto its position as the second-largest commercial hard surface category (26%). Hardwood came in third place, representing 8% of commercial hard surface products sold.

The three biggest segments for hard surface in commercial include corporate offices (38%), healthcare (33%) and education (14%). The hospitality and retail segments were sluggish due to pandemic-related shutdowns, according to published reports.

Soft surface experienced a bounce back year, although growth was modest based on approximately $3 billion in commercial sales, according to FCNews research. An estimated two-thirds of the business is generated from specified contract and volume is running even with Main Street applications. “As a category, commercial carpet growth rebounded in 2021 compared to 2020,” noted Lisa King, vice president and chief innovation officer, Interface. “However, performance has not yet returned to pre-pandemic volume or value levels.”

Carpet tile maintained its position as the dominant product from a sales perspective, although broadloom only lags about 8% behind in volume. “Carpet tile offers ample solutions in Main Street/commercial applications and today’s portfolios are getting even broader to meet various needs and price points,” Shaw’s Quathamer said.

Corporate/office

While the five major commercial sectors each face macro issues influencing flooring choices, much of the conversation about specifications centers on meeting health and safety concerns.

The largest sector—corporate offices—saw its market share dwindle as businesses closed, reduced office space and saw a significant amount of employees work remotely. “Most of the office work was renovation,” said Mari Anne Randall, national A&D sales manager, Dal-Tile. “We are still in a hybrid situation with the combination of working remotely and in the office.”

As coronavirus vaccinations are required in many workplaces, businesses are gradually bringing employees back to the office. This is leading to a reconfiguration of office space to ensure a safe working environment. “Our customers continue to reconfigure their physical office environments to support hybrid work models and the new needs of their employees,” Interface’s King said. “While they are rethinking their spaces, they are also investing in resilient design strategies that support collaboration and face-to-face interaction while prioritizing safety and well-being.”

The workplace is among the most diverse segments for flooring. Carpet tile represents more than half of commercial surfaces found in office spaces, while broadloom remains a favorite in speculative work areas and positioned as a cost-effective initial investment. Resilient, hardwood, porcelain tile and polished concrete are preferred for spaces requiring fashion and functionality.

There are ongoing design trends influencing flooring selections, industry members say. For example, “resimercial” design—featuring a blend of residential and commercial features—continues to take hold. Sustainability remains top of mind with designers for any commercial project as companies remain committed to reducing corporate carbon footprints.

“Sustainability has had a major impact,” Dal-Tile’s Randall noted. “Even if a project is not going for LEED or WELL certification, they want the products to have sustainability or green attributes.”

Healthcare & hospitality

Similar to offices, healthcare is rethinking interior design to accommodate the rising number of people entering their facilities, observers note. A major beneficiary is resilient as the pandemic heightened emphasis on floors which meet health and safety considerations. “We’re seeing owners replace carpet with our luxury vinyl flooring for a hygienic, pet-friendly and easy-to-clean and replace option,” said Bill Anderson, CEO, Karndean Designflooring.

Carpet and LVT are utilized primarily in non-patient areas such as waiting rooms and medical offices, although some experts are bullish about growth prospects for senior living spaces. Natural materials like ceramic tile, panoramic slabs, quartz, hardwood and linoleum are positioned as sustainable options. Tile reportedly gained coverage in areas such as clinics, assisted-living communities and urgent care centers, which are among the fastest growing subsectors.

Hospitality is expected bounce back in a big way, coming off a year of travel restrictions and cancellation of shows and events, plus more people choosing to stay home during their free time and invest in home improvement projects. Some published reports predict the market—which includes food and beverage, travel and tourism, lodging, and recreation—will grow by double its in 2022 as restrictive containment measures are relaxing nationwide.

The pandemic caused facility managers to rethink what a healthcare space looks and feels like. For example, designers are raising the bar for hygiene and cleanliness standards while creating massive changes to ensure the safety and health of guests and staff. And with COVID-19 safety protocols calling for social distancing, using floor layouts to guide people and create spacing have never been more important.

Flooring choices vary widely, often depending on end use. For example, approximately 25% of commercial carpet is sold into hospitality spaces, the majority of which is broadloom, FCNews research found. An even bigger share—roughly 50%—of commercial tile sales come from this sector. LVT is gaining coverage in all spaces, especially guest rooms, while niche products such as rubber stand to benefit from the movement to floors which are considered healthy choices.

Education

Flooring runs the gamut in K-12 and higher education spaces, where the visual and physical experiences for students, faculty and staff are much different than the past. Safety is just as important for interior design as regulatory requirements covering IAQ, sustainability and maintenance, observers say. K-12 accounts for the lion’s share of flooring sales, accounting for approximately 75% share, with the rest coming from higher education, according to industry estimates.

Hard surfaces represent more than half of flooring sold to these spaces as their versatility enables it to be found in virtually all learning environments. An estimated 15% of commercial tile sales are generated from this price-sensitive market, FCNews research found. “As designers, we are drawn to terrazzo and porcelain tile for corridors, cafeteria and large circulation areas,” noted Carla Remenschneider, IIDA, RID, director of interior design for Fanning Howey. “These offer much longer life cycles but are more expensive initially.”

Education is a major segment for VCT while rubber and linoleum are positioned as green flooring choices. LVT checks most boxes for school building needs and nearly every area offers growth opportunities. “LVT is often used in corridors as a durable product with many different visuals and has module sizes that lend themselves well to patterning to help create interest/assist in wayfinding,” Remenschneider said. “It is also commonly used in STEM labs/maker spaces to have a flooring surface that is easily cleanable.”

Retail

No commercial end-use segment was hit harder by COVID-19 than brick-and-mortar retail. This sector saw its ranks shrink considerably as consumers bought more goods online. In fact, the pandemic is believed to have accelerated a shift that was already under way as consumers put greater emphasis on convenience.

The good news is the segment is showing signs of a turnaround. Recent statistics released by the U.S. Census Bureau shows May retail and food sales were up 8.1% from May 2021. “What has helped the retail market is growth in the residential suburbs and multi-family mixed-use activity,” Dal-Tile’s Randall said. “We are seeing growth within certain retail segments.”

Flooring choices for retail vary widely. For instance, ceramic, wood and carpet are often found in high-end spaces such as upscale boutiques and establishments serving an exclusive clientele. As stores welcome back customers in greater numbers, retailers are focused on strategies which distinguish themselves. The challenge is cultivating a shopping environment which incorporates safety and comfort while providing an enjoyable experience for shoppers.

“With online sales continuing to rise, brick and mortar retail is having a rethink on their design strategy,” Tile of Spain’s Rubio Gomez said. “For a customer to travel to a retail location today, there must be an experiential payoff for them.”

Construction outlook

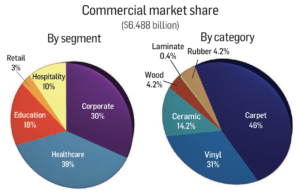

In 2021, the U.S. rebounded from 2020’s short but devastating pandemic recession with the strongest economic growth in nearly 40 years, Commerce Department statistics show. In 2021, the nation’s gross domestic product grew 5.7%, ending the year by with a quarterly expansion of 6.9%, according to the Commerce Department.

In 2021, the U.S. rebounded from 2020’s short but devastating pandemic recession with the strongest economic growth in nearly 40 years, Commerce Department statistics show. In 2021, the nation’s gross domestic product grew 5.7%, ending the year by with a quarterly expansion of 6.9%, according to the Commerce Department.

During 2021, current-dollar GDP increased 10%, or $2.1 trillion, to a level of nearly $23 trillion, compared to a decrease of 2.2%, or about $480 billion, in 2020. A major contributor to the economy is construction, which overall similarly rebounded with 9.3% growth in 2021. The rebound was uneven, however, driven primarily by residential construction spending.

The outlook for the rest of 2022 is even more positive, particularly for nonresidential, with significant and more balanced growth expected across this sector. If current trends continue, this positive outlook looks to accelerate in 2023. According to the AIA Construction Consensus Forecast Panel of leading economic forecasters, nonresidential building construction spending is expected to expand 5.4% in 2022 and strengthen to a 6.1% expansion in 2023.