A few months ago Bauwerk Group, a Switzerland-based manufacturer of hardwood flooring that also owns the Boen brand, purchased the prefinished side of Somerset Hardwood Flooring, the company founded by Steve Merrick in 1990 as a supplier of unfinished goods. The company got into the prefinished game in 1999, at which time Paul Stringer joined the company as vice president of sales and marketing.

A few months ago Bauwerk Group, a Switzerland-based manufacturer of hardwood flooring that also owns the Boen brand, purchased the prefinished side of Somerset Hardwood Flooring, the company founded by Steve Merrick in 1990 as a supplier of unfinished goods. The company got into the prefinished game in 1999, at which time Paul Stringer joined the company as vice president of sales and marketing.

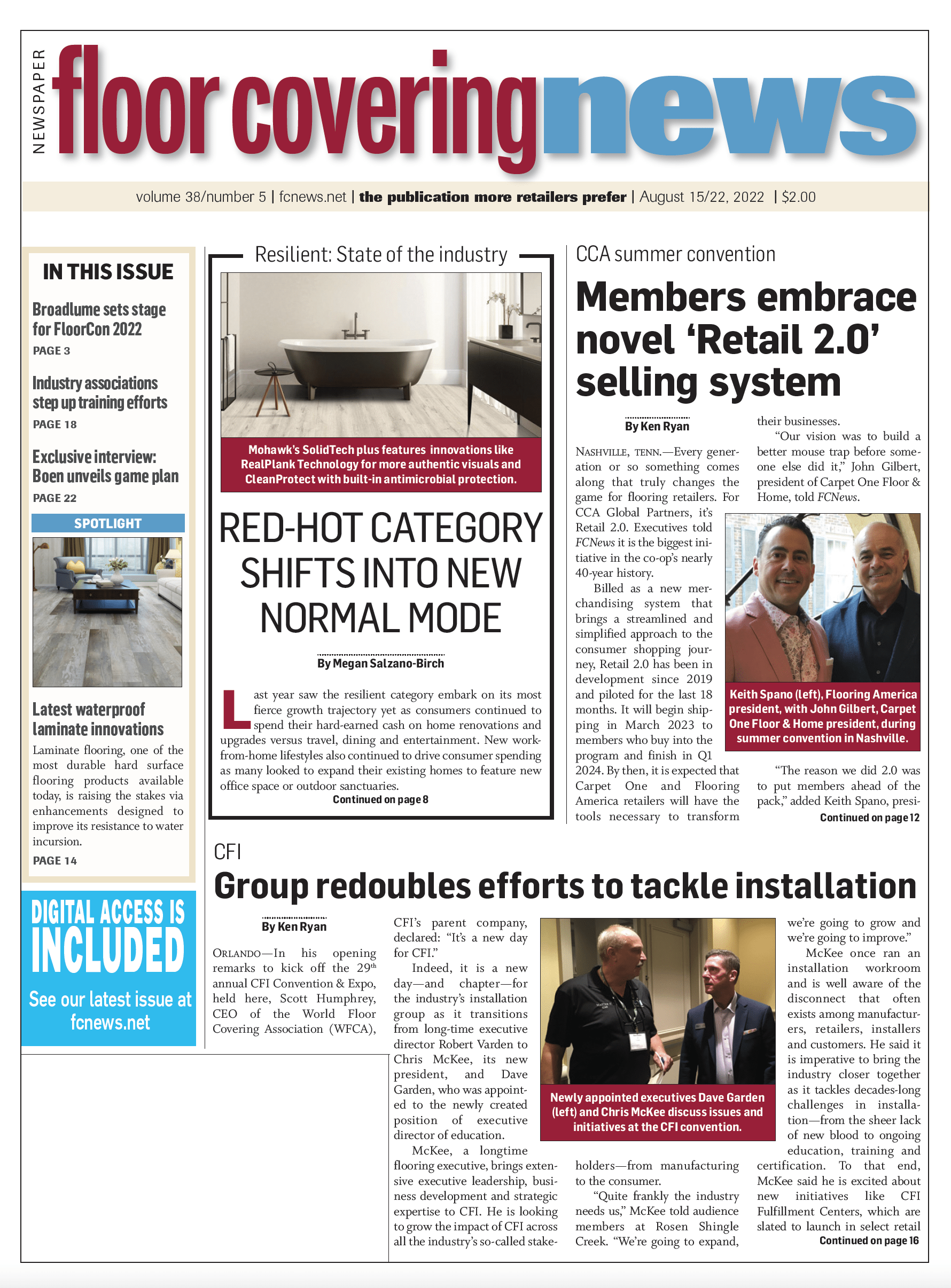

Ask Patrick Hardy, president and CEO of Bauwerk Group, what made Somerset Hardwood Flooring an attractive purchase and he will tell you three things: the brand, the management and the fact Somerset makes a quality product. FCNews recently sat down with Hardy, Merrick, Stringer and Dan Natkin, managing director, Boen, to discuss the combined company and industry at large today.

Patrick, you have a unique perspective coming into this industry with a background in consumer brands. How will that background advance these two brands?

Hardy: When I talk with the people from the industry, it’s about construction. I’m looking on the floor. And that’s a whole different perspective. I’ve always worked for consumer brands but also production brands. It started with Bally, then Swarovski, then Victorinox (Swiss army knives). But at the very end, it’s all about having strong brands and qualitative great products. I’m bringing in the end consumer perspective.

This industry is unique in that the retailer and retail salesperson control so much of the sale as opposed to other consumer brands where a consumer walks in knowing the brand.

Hardy: That’s why we need to have a good balance in pushing and pulling. We need to continue the pushing through our distribution channels—communication-wise and training and all those kind of things—but we need to build up the pull as well.

So, the idea is to talk to both the retailer and retail salesperson as well as the consumer?

Hardy: Yes, we need to start doing that much better. If you have a consumer product that buy is more repetitive, but the floor you buy maybe once or twice in your life. We need to be smarter and find different ways how to connect to them. When I was flying to the U.S., I went into the lounge and then you have these free magazines. There were about 30 magazines, and 20 of them are about living at home. That is where we need to get our footprint and start talking about not only the advantages of wood flooring but also the advantages of our brands.

What are the plans to advance both the Somerset brand and the Boen brand?

Hardy: In Europe it’s very fragmented; there are lot of small players. We don’t have any more production capacity. If you want to grow, you need to have more capacity. But if you have more production capacity, you need to have the right people. And similar to the U.S., people are an issue. If you do have the people, the next hurdle is raw materials. So, if you want to grow, you need to grow through acquisition. And that’s why we did this because you need to be sure that you have production capacity, raw material capacity and people. That’s why this is a great step for the Bauwerk Group.

Stringer: You think about the strength of this relationship now; we need to grow in engineered. That’s where the opportunities are. We’re already well established in the solid market. What better partner than somebody that’s been making engineered for centuries that can come over and give us their expertise and help us grow that business. So, when you talk about helping each other and what this does for us, it’s a wonderful marriage.

Natkin: We’re still the untold story. Boen has been in the States off and on over the last 30 years or so. But our name is still just getting out there. So, as far as a growth perspective, when you look at the advantages that we bring from the European precision and manufacturing, the type of products that we offer and now the ability to continue to expand our markets—our markets have been predominantly really focused in the West up to this point. We’re now expanding into Texas and into the upper Midwest. We have a great relationship with the Belknap Haines group, so from Maine to Florida you’ll now find our products as well. So, it’s only an upward trajectory for us. And now with the partnership with Somerset the sky’s the limit for us.

Paul, how have you seen the wood flooring business evolve since Somerset got into prefinished goods in 1999?

Stringer: We’ve seen changes in distributors and the way they go to market. We’ve seen it switch from large to many smaller distributors and then back to larger distributors through acquisition. But the biggest change I’ve seen occurred roughly around 2015 when WPC and then SPC came out. That changed the wood flooring market, taking market share from low-end engineered. But it also affected solid products.

Natkin: We’re coming up on the first replacement cycle of those rigid LVT products, and they don’t stand up like a wood floor does. So in the short term it certainly impacted wood, but I think there’s a turn of the screw coming with consumers coming back into the category.

How has Somerset evolved? What changes have you made over time?

Stringer: One of the biggest drivers to help us grow and be more important to distributors was when we added the engineered category around 2012. That made us a more versatile manufacturer. And engineered is where we see the bulk of our growth and profitability.

What percentage of the businesses today is prefinished vs. unfinished?

Merrick: It’s probably 60/40 prefinished. And I’m keeping the unfinished product line.

What about solid vs. engineered?

Stringer: We’ve been in the solid business for 23 years, and we’ve had that market already mature for us, so we’re still about 70/30 solid. But the growth rate is faster for engineered and we have more potential. Eventually we will have more capacity on the engineered side.

What are the competitive advantages of Somerset compared to other wood flooring manufacturers?

Stringer: One of the things about Somerset is we’ve always been and continue to be dedicated to wood flooring. You don’t see us merging into LVT or any other things. We have long-term employees who know the wood business. We have sawdust in our veins. I was fortunate to work with Steve for 23 years, and we built this company slowly. We have good relationships with our distributors and a good customer base.

Bauwerk is looking to grow the company, and now we have more resources to put into that. So, if you’re looking toward the future with an American-made brand and the support we’re going to have, I think it’s an exciting time to be a Somerset distributor or retailer.

Merrick: First and foremost, we’re wood people. We’re passionate about wood. We understand wood. And the thought of branching off into other types of products that are non-wood related has never crossed our mind.

Paul, how is your role going to change?

Stringer: I’m still going to be involved in sales and marketing but I’m drinking out of two fire hoses now. We have a great team here. They don’t have to rely on me that much. I just have to make sure they have what they need to get the job done. My job is to not mess anything up.

You’re probably the second-largest domestic hardwood flooring manufacturer in the U.S.?

Stringer: Of course, we lose the unfinished portion as part of our numbers, so we’re going to go down a bit. But as far as pure prefinished production, I would say it’s AHF and then us.

What does the Somerset brand stand for?

Stringer: We sell mid to high end. We’re not much in the low-end category.

What will a consumer pay for Somerset product?

Stringer: Probably $5 to $12 a foot. Our Handcrafted line that comes in random construction in 6- or 7-inch-wide boards will probably be $12. Seven-inch is the widest we do on engineered and 5-inch is the widest on solid.

Natkin: Somerset makes a gorgeous handcrafted series on the engineered side called Winter Wheat that has been sold out from the day it was introduced.

Stringer: We have never had material sitting on the floor for any length of time. It sits there and goes on a truck.

Meat and potatoes products?

Stringer: Well, on the solid side, you could say we’re meat and potatoes. We’re probably one of the most name-worthy, solid, prefinished products. We came out years ago with Hoboken and they helped establish us in the Northeast. So, up and down the East Coast, especially, we have a very strong presence in solid. And then we’ve grown that nationwide. In engineered we’re still finding our niche and we’ve been growing ever since we built that plant. I think it’s just a matter of time until our engineered falls in the same category. But we need expansion, and I think you will see new products, new designs and we’ll get help from our friends at Bauwerk as well. But I think you’ll see some interesting things happen with our engineered first, because we are pretty established in solids. I think you’ll see us start to level that volume mix, where we’re a more complete supplier of our entire product line to these distributors and retailers.

What species do you specialize in?

Stringer: Well, red oak is mostly what we sell. That’s one of the differences between us and Bauwerk Group. They’re almost all white oak. And then we use white oak, hickory and maple as well.

Natkin: Ash is one of the primary species. It’s amazing with the cutting techniques that we use in Europe and our latest finishing technique, the finish that we call Live Pure, we can actually make Ash look like almost a better version of white oak. The prototypes we saw when I was in Switzerland last week were beautiful. I’ve always had a soft spot for that species. Ash is actually more resilient than a lot of other wood species. So, that’s one of the species. White oak will always be there for sure, but from a global sourcing perspective, we have to begin to diversify the wood basket.

Why don’t many manufacturers use ash?

Merrick: They’re not going to be using it anymore. It’s all dying out. Ash trees are probably one more year away from extinction here in the U.S.

Do you think the consumer knows or cares about the species when she walks into that retail store?

Natkin: I think it’s different in Europe than it is in the U.S. In Europe they’ve been so conditioned to oak for years. That’s what sells. The U.S. is completely different. The consumer comes into the store with a look and feel and color in mind. So, whether it’s white oak, red oak, ash or maple, it comes down to the salesperson. Part of it is just salesperson re-education; the other part of is it consumer education and making sure we’re following the visual trends that are emerging. Before I left Mannington, we saw an emergence of a return to the less grainy species, things like maple and birch.

We’ve always heard Somerset was sold out when it came to product. How do you get more capacity into Somerset?

Hardy: That’s exactly why this is such a good fit between Somerset and Bauwerk Group. We can learn a lot from all the good things that Somerset has done with distribution and presence in the U.S. market and what they have done for the name. And I think especially on the engineered side, we can contribute to increase efficiency and output.

Is the answer increasing capacity by adding more equipment? Do you supplement the domestic Somerset line with engineered products from Europe?

Hardy: Shipping goods around the world doesn’t make any sense. It’s a U.S.-made product and we should keep it like that. We have good production people here; we just need to make some improvements to increase output.

Merrick: The Crossville plant was going to get some expansions but COVID-19 stalled that.

How has the war in Ukraine impacted you, particularly as it relates to plywood?

Merrick: It has certainly impacted us because a lot of our platform was from Eastern Europe. Luckily we had a big stockpile of inventory to get us through this interim period, but we were doing some massive R&D and studies on other products and we’re almost to the point of having an alternative. That’s where Bauwerk will bring expertise.

Stringer: We’re certainly identifying other platforms. We are testing them to make sure they’re going to be high quality and fit into what we do. We’re on schedule to have replacement material. We’ll be letting our customers know how we transition but we’re up to speed on making sure we have an alternate core.

What are you doing to respond to the labor issue?

Stringer: The philosophy at Somerset is to pay the employees as best we can while being fair and equitable. But it’s also about how you treat people and how inclusive you are and making sure we work together. We try to make them feel part of our family. You want to have a good work atmosphere. And that’s where we can make the most progress—making sure we have an atmosphere where people enjoy working, being part of the team.

Tell me about Boen’s competitive advantages in the marketplace.

Natkin: It’s really not dissimilar to Somerset. And that’s part of what drew us to them. We’re a wood company at our roots. That’s all we want to be. Going back to the 17th century, we started with sawmills next to some waterfalls in Norway. We have this trifecta—wood only, with research in wood and bringing meaningful innovation. When I say meaningful innovation, it’s not a new color but its solutions to issues that may plague wood. As an example, our Live Pure finish is extraordinarily stain- and wear-resistant. It’s repairable, which is not true of a lot of the other finishes on the market. And then there’s a very strong environmental commitment within the company.

How does the Somerset purchase help Boen and how does each brand complement each other?

Natkin: Each brand has its own unique identity. Boen is European-look, wide/ long visuals. That’s our core focus. Somerset has a phenomenal domestic line of both solid and engineered that complement each other. Now, where the real complementary relationship comes in is with some of our largest retailers and distributors that we share. So, it’s the power of the two brands coming together. You have the Somerset offering and then bolting on Boen’s portfolio is a phenomenal one-two punch. We can offer everything from two and a quarter strip all the way to a 12-inch-wide engineered product between the two brands.

Is the idea for a retailer to have a Somerset rack and Boen rack next to each other?

Natkin: We’ll see how that plays out over time. I think you’ll see each brand maintaining its own unique identity. And that’s going to stay as such for quite a while. But you’ll certainly start to see us come together more and more.

There’ll be separate sales forces?

Natkin: Yes. The selling story between the two is different. The Somerset sales team is phenomenal. We’re still building out our team in the U.S. I’ve got some great guys, too.

Boen always had that wide, long European oak look. Others received credit for inventing that category, maybe because of the marketing. Boen was always quiet. Will that change?

Hardy: Marketing has not been [a priority] in our group for a long time. We need to do a better job there.

Natkin: Others did a phenomenal job at marketing in the U.S. to both the trade and retail sides and building up that brand. Now you’re going to see increased brand presence from us. We began developing unique marketing elements for the U.S. this year, tailoring the line to the North American market. But we’ve also begun some social media advertising campaigns to begin both the pull- and push-through effects of our marketing.

What’s the opportunity for growth on the Boen side?

Natkin: We’re barely scratching the market today. We have less than 1% market share. So, there’s a tremendous amount of opportunity. When you think about the total engineered market in the U.S. being close to $2 billion at wholesale, if we were to get 5% of that I’d be pretty happy. So, when you think about format and what the consumer desires, it’s been all about wide plank/long length, and our most premium product there isn’t a match for it in the industry today. It’s a product called Chaletino—it’s 11 ¾ inches wide and 9 ½ feet long with a 4.5mm face. Nobody has anything like that. It’s the easiest sell I have in the line. It’s just a matter of continuing to get the brand presence out there.

What does the consumer pay for that product?

Natkin: $16 to $20 a foot.

What’s the retail price range for other products in the line?

Natkin: To the consumer, we’re probably anywhere from $5 to $20. There are four key buckets within the line. Our value-oriented product is something called three strip. It’s the traditional European visual that’s great in smaller spaces like apartments and condos because it breaks up the room and creates some visual interest. Our first step-up is our 5 7/16-inch wide, 7 ½ feet long sawn face with some really nice European character. The next step-up is an 8 ¼-inch wide, and the final step-up is our 12-inch plank. We can extend similar visuals across that entire range. We call it the LP 5, 8 and 12. LP is Live Pure, which is our innovative finish that keeps the raw look of the wood but with extraordinary durability.

Talk a little bit about Live Pure.

Natkin: It’s one of the best finishes on the market. There are two ways to approach finish. The Europeans take a different approach than the North Americans. North American suppliers put a lot of aluminum oxide in the finish, which is great from a scratch-resistance and wear-resistance standpoint. The European approach is to keep the natural look and feel of the wood. The finishes in Europe have evolved from oil finishes into lacquer finishes. And the Europeans were accustomed to maintaining oil finishes. Our R&D team developed a finish called Live Pure because anytime you put a finish on wood it causes it to amber a bit, create more of a yellow look. But they wanted to keep that raw look of white oak but at the same time make it more resistant to staining, masking everyday wear and tear. So we built up this finish. It’s a 10-layer finish that does not have aluminum oxide but has similar scratch-resistant properties to an aluminum-oxide finish. But the difference is it’s repairable. I often equate aluminum-oxide finishes to plastic slip covers on the couch. They will protect the fabric forever until you poke a hole in it. And once you poke a hole in it there’s no repairing it short of a screen and recoat. This finish you could actually put a topical coating on it and it’ll actually seal the finish back out again. And it seals all the way down into the actual brushing of the surface and into the bevels as well. It’s remarkable. So, it’s got a great haptic—when you feel it feels like raw wood, it looks like raw wood. It’s a two gloss, so it’s extraordinarily matte to begin with, and has unbelievable performance properties.

Any thoughts on someday having some domestic production on the Boen brand given you have Somerset now?

Natkin: Part of the vision is that this becomes the North American manufacturing hub for Bauwerk Group. So I can certainly envision a time that we’re making both the Somerset and Boen brands here in the U.S.

Hardy: And this would also put relief on the whole raw material issue we have in Europe.

As a company, what are the greatest challenges you have right now?

Hardy: Raw materials.

Natkin: Transportation.

Hardy: Transportation and people. I think that sums it up. In Europe we have a lack of installers. And we have the raw materials challenge. The second COVID-19 year there was a huge demand for our products. There was a fight for raw materials. Then we thought this would be a normal year. But the war [in Ukraine] put everything in a different position. Logistics is a nightmare in Europe and I heard the same is true here. There are no truck drivers anymore because most of the truck drivers were from the Ukraine. They’re all fighting in the war. What else? Energy prices, of course, are going up to the sky. These are the biggest challenges we have. And demand is still very high, but what will happen in the second half of the year?

How many price increases have you had over the last year?

Hardy: We’ve had 10% in January, 10% in February and 10% in April. And two or three last year.

So you’re average selling price is about 25% more than it was about a year ago?

Stringer: Yeah. Mostly because of the strip, some of the commodity products of the structure of the strip, probably a little better increase in the engineered but it’ll absorb it better than the strip.

Natkin: The biggest variable between the two companies is transportation. So, if I was to go back to January of last year, we were paying about $4,500 for a container landed to the East Coast and we pay about $12,500 for that container today. You’re talking about $0.60 a square foot, roughly, in incremental freight charges.

Five years from now, how much will Boen have grown? Somerset is obviously a much bigger business, so the percentage growth is not going to be as great.

Hardy: Let’s say today, combined revenue of the Bauwerk Group is $400 million. In 2026, if we were close to $600 million that would be very good.

If I put every single retailer and distributor in the floor covering industry in this room and gave you 30 seconds to say something to them, what would you say?

Natkin: We’re the best story still untold in hardwood flooring. From a consumer design perspective to an installer’s perspective to the retailer’s perspective, I think we’re an extraordinarily easy sell. We have a condensed line with visuals the consumer desires that is extraordinarily installer friendly. Our finish will stand up to both the installer trade as well as the everyday life that in the home. So, we’ve got the looks the consumer wants and the performance an installer and consumer wants as well. I think it’s a great combination.

Hardy: I will take the perspective with the dealers and distributors. What is very important for us is if we want to grow, we have to grow together with true partnerships.

Stringer: We have one of the strongest distributor networks in the country. Retailers can get delivery, good service and experienced salespeople and reps to call on them. But when they put our display in their showroom they’re immediately a wood player. They’ve got engineered, solid, different widths and an expansive line that’s simple. We have collections that have the same attributes. You just have to worry about colors. So, if I’m a retailer and starting a business and want to get into wood, the Somerset display is the best thing they can buy. If the retail salesperson is comfortable with your display and understands it, what do you think they’re going to sell? That has been our philosophy. We’ve put a lot of money putting displays across the United States. Our distributors do a good job of servicing them. We do mill tours to educate people about our product line. If you’re a retailer and want to be in the wood business, we’re the best possible company to partner with.