The crippling shipping delays and logjams that plagued the flooring industry in the immediate aftermath of the COVID-19 pandemic in 2020 and into the early part of 2022 have finally begun to subside. Importers and distributors are seeing the resumption of “relatively” normal supply chain activity—so much so that now many are having to contend with excess inventory issues.

The crippling shipping delays and logjams that plagued the flooring industry in the immediate aftermath of the COVID-19 pandemic in 2020 and into the early part of 2022 have finally begun to subside. Importers and distributors are seeing the resumption of “relatively” normal supply chain activity—so much so that now many are having to contend with excess inventory issues.

However, this quasi return to business as usual hasn’t taken the spotlight off the fact that the U.S.—as evidenced by a perennial lopsided trade deficit with China—continues to rely heavily on imports of many popular and essential products. This includes electronics, building materials, apparel, food products and, of course, flooring. The amped-up “Made-in-America” rally cry has spurred both reshoring efforts (the drive to bring more manufacturing jobs back to the U.S.) and foreign direct investment (FDI) in America more intensely over the past decade plus. However, observers say there’s still room for improvement and opportunity to bring more high-paying manufacturing jobs stateside.

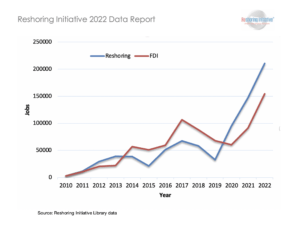

That sentiment is evident in the newly released “2022 Data Report” from the Reshoring Initiative, an organization dedicated to bringing more, higher-quality manufacturing jobs back to the U.S.—positions that heretofore had been outsourced to other nations. The report showed that more than 364,000 manufacturing jobs came back to the U.S. in 2022—that’s a 53% increase from 2021. In fact, nearly 1.6 million manufacturing jobs that were previously outsourced since 2010 have returned to the U.S. It’s certainly impressive, experts say, but it’s clearly not enough.

“The current actions and momentum are a great start,” said Harry Moser, founder and president of the Reshoring Initiative. “But a true industrial policy would accelerate the trend and increase U.S. manufacturing by 40% or 5 million jobs. Moreover, reshoring will reduce the trade and budget deficits and make the U.S. safer, more self-reliant and resilient. With 5 million manufacturing jobs still offshore—as measured by our $1.2 trillion/year goods trade deficit—there is potential for much more growth. We call on the administration and Congress to enact policy changes to make the United States competitive again.”

In his testimony before the U.S.-China Economic and Security Review Commission Hearing on U.S.-China Competition in Global Supply Chains last year, Moser cited encouraging trends. Reshoring by U.S. headquartered companies plus FDI by foreign headquartered companies surged from about 6,000 jobs per year in 2010 to about 238,000 per year in 2021. This is in stark contrast to new “offshoring” initiatives—i.e., closing U.S. factories and replacing with either factories or outsourcing offshore—which have fallen dramatically since around 2010.

The drive to reverse the pace of offshoring, according to Moser, will be contingent upon the manufacturing community resisting the temptation to chase what at first appears to be lower costs in producing outside the United States.

“The primary driver of offshoring is lower prices available offshore, especially in LLC countries but also in most developed countries,” he told the committee. “The lower LLC prices are primarily driven by lower wages. The difference in FOB prices is consistent with the wage differential and labor’s share of manufacturing cost. Initially, very low wages attracted work to China. Today, China’s faster response times and increasing technology and productivity also play a role. U.S. factories in China also sold to a rapidly growing middle class. A strong reshoring effort, coupled with China’s slowing economic growth and shrinking population, will help convince companies to shift more of their investment to the U.S.”

U.S. government policies, or the lack of appropriate policies, Moser noted, have been the major cause of the massive trade deficit. These manufacturing-job-killing policies include: prioritizing degrees over skills training; allowing the U.S. dollar to stay at uncompetitive levels; high corporate tax rates and regulations; high medical insurance expenses paid by the employer; and low duty rates, etc. In contrast to the U.S., many of the top developed countries have trade surpluses. These include Germany, Ireland, Netherlands, Italy, South Korea, Australia, Singapore, Switzerland and Belgium, Moser noted.

“Our resulting uncompetitive price structure drove offshoring, hollowing out U.S. manufacturing, reducing investment in automation and reducing the appeal of manufacturing careers,” he explained. “Until about 1980 the U.S. had at least balanced trade and was self-sufficient in a broad range of products and industries. Now, our trade profile looks more like that of a developing country than the Arsenal of Democracy.”

Truth be told, the U.S. maintains trade surpluses in a few high-tech categories such as aircraft and semiconductor manufacturing machinery, but mainly in commodities like minerals and agricultural products, according to Moser. However, the U.S. has large trade deficits in other manufactured products, including most high-tech products. America, he argued, lacks the industrial infrastructure to respond timely to a catastrophe such as COVID-19 or to provide the increased material for—in a worst-case scenario—an extended war. Defense Department reports show a growing list of needed raw materials and components that cannot be sourced domestically.

The cost of offshoring

The development of effective reshoring policy recommendations, according to Moser, requires a clear understanding of the causes of offshoring. Companies source products and site their factories at least 70% based on FOB price/manufacturing cost comparisons of the offshore and domestic alternatives. U.S. price averages about 40% higher than Chinese price and about 15% higher than most other developed countries. Faced with domestic and offshore competitors accessing those lower prices, U.S. companies aggressively offshored, starting with Japan and Mexico but followed with South Korea, India, S.E Asia and China. “As long as that huge price differential remains, our trade imbalance and weak supply chain will not improve,” Moser stated. “To subsidize enough domestic production to overcome our $1.1 trillion 2021 goods trade deficit would cost about $330 billion/year—probably more—since other countries would likely respond with more aggressive pricing.”

The development of effective reshoring policy recommendations, according to Moser, requires a clear understanding of the causes of offshoring. Companies source products and site their factories at least 70% based on FOB price/manufacturing cost comparisons of the offshore and domestic alternatives. U.S. price averages about 40% higher than Chinese price and about 15% higher than most other developed countries. Faced with domestic and offshore competitors accessing those lower prices, U.S. companies aggressively offshored, starting with Japan and Mexico but followed with South Korea, India, S.E Asia and China. “As long as that huge price differential remains, our trade imbalance and weak supply chain will not improve,” Moser stated. “To subsidize enough domestic production to overcome our $1.1 trillion 2021 goods trade deficit would cost about $330 billion/year—probably more—since other countries would likely respond with more aggressive pricing.”

According to Moser, there are two basic ways to attack the underlying lack of price competitiveness. The simplest should be to change perceptions, to educate companies to use Reshoring Initiative’s Total Cost of Ownership (TCO) formula to quantify all of the costs and risks associated with offshoring (see sidebar). By switching to TCO, companies will see that about 20% of what they now import from many places can be sourced domestically without raising prices or cutting profits.

Option No. 2: A more basic approach, Moser noted, would be to reduce the price differential as a means to level the playing field by instituting an industrial policy. This may include: massive transfer of resources from liberal arts university education to engineering, apprenticeships and credentials; 20% to 30% lower USD; not raising the corporate income tax; and implementing a well-designed border adjustment tax. This policy would make the U.S. more like Germany, which has equally high wage rates but achieved a 2020 trade balance of about +5.7% of GDP vs. U.S. -3.1%.

“Balancing trade would increase U.S. manufacturing by 40% to 50%, requiring 5 million to 6 million more manufacturing employees at current levels of U.S. productivity,” Moser stated.