It has been called “the great energizer” and “the catalyst.” One thing is for sure: Luxury vinyl tile (LVT) has been a lifesaver for flooring distributors during these unforgiving times. In the resilient category there are some bright spots such as fiberglass-backed sheet vinyl, but LVT is the beacon for industry players.

these unforgiving times. In the resilient category there are some bright spots such as fiberglass-backed sheet vinyl, but LVT is the beacon for industry players.

“It’s the one product that doesn’t seem to recognize there is a recession going on,” said David Sheehan, vice president, resilient and laminate business, Mannington.

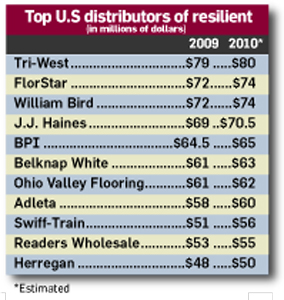

LVT is not the only product that has helped distributors post positive gains in resilient. Fiberglass—and to a lesser extent, felt-backed—sheet goods have fared well in many markets, too. “We have seen a general flattening out in LVT, which began in 2009, and have seen sheet vinyl trend up because it is a value product,” said Fred Reitz, vice president of operations at J.J. Haines, Glen Burnie, Md., which reported a 3% increase in resilient in ’09. “If a homeowner is going to trade down on a kitchen remodel from wood she is more likely putting down sheet.”

For most distributors, unit sales of sheet vinyl were up in 2009 and are looking favorable for 2010. However, Armstrong, Mannington and other suppliers are being hammered by price increases in raw materials, and that has negatively affected low-margin sheet vinyl products.

NRF Distributors in Augusta, Maine, showed flat sales for resilient in 2009 but a small increase so far this year. The category has been fueled by Mannington’s Adura LVT collection, most of which comes in the popular floating format. “We love that product,” said Terry Gray, vice president of marketing at NRF.

Distributors particularly find favor with the new Adura with LockSolid technology, introduced less than two months ago. “It literally is an LVT plank with a tongue and groove click system,” Sheehan said. “It’s getting people all excited. It’s a great energizer for our distributors despite the fact things are tough.”

Jeff Striegel, president of Elias Wilf, Owings Mills, Md., said he continues to have good success with resilient. “Felt sheet vinyl is down, but not much. Fiberglass is up and going well. LVT is through the roof. If you look at vinyl as a category, right now it is my largest and best market.”

For CMH Space Flooring Products, Wadesboro, N.C., Congoleum’s DuraCeramic and its newest entry, Connections, have given vibrancy to the category. Connections features an enhanced glueless installation system called SmartLink that has impressed distributors. LVT products from Azrock have also resonated in the market. “Resilient is our growth point, mainly LVT,” said Hoy Lanning, CEO, who believes the newest offerings will erase the small loss CMH took in resilient last year.

“Resilient is our best and most successful category,” Lanning added. “The vinyl and the rubber products year over year are ahead in that department. We were down just a little last year in commercial but this year we are going to be up a little bit. With other product categories down, we’re finding value in other areas, such as LVT.”

SwiffTrain, Houston, said its LVT line grew more than 10% in 2009. Don Evans, vice president of sales, said LVT’s affordability, forward-looking designs, durability and ease of maintenance have made the difference in a market in which consumers demand value-oriented offerings. Rick Holden, executive vice president of Derr Flooring, Willow Grove, Pa., said that while most flooring categories have been clobbered by the economy and housing debacles, resilient has bucked the trend, led by LVT and then sheet. “We’ve seen a little perkiness with sheet,” he said. “Builders are looking for less expensive alternatives for their projects and going back to sheet, especially now that the floors are floating. When you install the fiberglass floors you save on the installation costs, and everyone is looking for ways to take cost out of the equation.”

Others have seen similar trends. “Our commercial business has seen real growth with sheet,” said Jeff Garber, vice president and general manager, Ohio Valley Flooring, Cincinnati.

The builder business is so depressed that sheet vinyl is now the flavor of the month. “As prices go down vinyl becomes more in vogue,” Striegel said.

Distributors do not see that trend ending anytime soon. “Resilient has been steady for us the last two years in a row, especially a growing LVT category, and we don’t see that changing,” said John Anderson, vice president, BPI, Memphis, Tenn.

-Emily Hooper