In the third and final part of its COVID-19 ‘Black Swan’ webinar series—held on May 22—Alan Beaulieu, president of ITR Economics, provided a “data-driven” outlook of economic trends and what they mean for consumers and businesses as states around the country begin to reopen. Known for his uncanny ability to accurately predict economic episodes, Beaulieu offered his take on key components of the U.S. economy as states begin the reopening process.

Following are some key takeaways from the presentation:

What employers need to know about the latest House stimulus package

If the $3 trillion package gets passed by the Senate, it would extend unemployment insurance through January 2021. Good for employees; not so good for employers, according to Beaulieu. “As a human being, you might feel good about it, but as an employer it should cause you some concern,” he said. “Right now, the $600 a week federal unemployment insurance is set to expire at the end of July. When that happens, it would cause a lot of people to think, ‘Alright, it’s time for me to go back to work.’ But from what I’ve heard—and it’s mostly anecdotal—there are people who don’t want to come back because they’re making more on unemployment.”

Despite past relief funding, the Fed promises to do more

Of all the stimulus money doled out thus far, $2.3 trillion has still not been deployed. The hang up, according to Beaulieu, is due to nebulous language in previous bills as to how the funding is to be spent. As states begin to reopen, and with governors facing growing budget deficits, it’s likely that even more funding will be approved by Congress to aid in the recovery. “Chairman Powell is in fact urging Congress to do more,” Beaulieu said. “In fact, he said there is ‘no limit to what the Fed itself can do.’ That’s an amazing statement. It shows this man is serious about it.”

With relief funding flooding the market, is there a danger of inflation?

“Our forecast for 2021 for inflation calls for the first half of the year to be below Fed parameters of 2%,” Beaulieu said. “In the second half of the year, we may see it move above 2%. But it’s questionable whether the Fed will feel like there’s enough to move interest rates on into there. We’ll see as we get closer.”

What impact will oil prices have on the recovery?

“We are still very concerned here at ITR Economics that we’re not going to hold in the $30s, and we could go back down into the $20s. But overall, you can see that there’s been some stability, and we’re hoping that overall that stability continues. At $30 a barrel, there are certainly more companies that can be profitable, or at least break even or at least won’t face bankruptcy like they were when it was $15 a barrel, $20 a barrel, even $25 a barrel. This is not where most companies want it to be. They want it to be higher.”

Outside of oil prices, what are some of the other indicators to watch?

“The ITR consumer activity leading indicator and J.P. Morgan Global PMI are on the rise, but seven others are in decline,” Beaulieu said, citing single-family home starts, total industrial capacity utilization and U.S. exports, to name a few. “We need more of these to flip to ‘green.’ If we get to the end of August, my friends, and we still see there’s only two green and there’s all these reds, there’s going to be some changes that have to be made because it is certainly going to be bad news. So, please keep an eye on this.”

The role consumer spending plays in the recovery

“We have a good amount of energy coming back into this as people are out shopping and as people in more states are spending money,” Beaulieu noted. “This is not really a question of a lack of money; there’s a large part of the population that has more money than they did before. It’s a lot about fear and hesitancy. Why am I going to buy furniture when I’m not sure about tomorrow? Why am I going to buy a new car when I don’t know if I’m going to need the money because the world’s falling apart? All those questions that play us as human beings.”

Reopening at the retail level could provide a much-needed spark

“This is a sign of first rays of sunlight at dawn,” Beaulieu said. “I can’t bank on what kind of day it’s going to be, but I can tell the sun is coming up. And so, we’ll watch this to see what’s going on. I would take it as a positive sign, though, given that we see some improvement with openings, and we did not see a second wave begin—at least not yet.”

Encouraging signs on the housing front

The decline in housing starts from February to March was 8.5%; the previous worst was 8% (1980). But there are signs of hope on the horizon. “Recently, the lack of inventory has prices moving higher,” Beaulieu said. “So, if there’s a lack of inventory, and prices are moving higher, that screams ‘build!’ This is a very important part of the economy, and it’s a bellwether for what will be.”

Credit markets need to play their part in the recovery

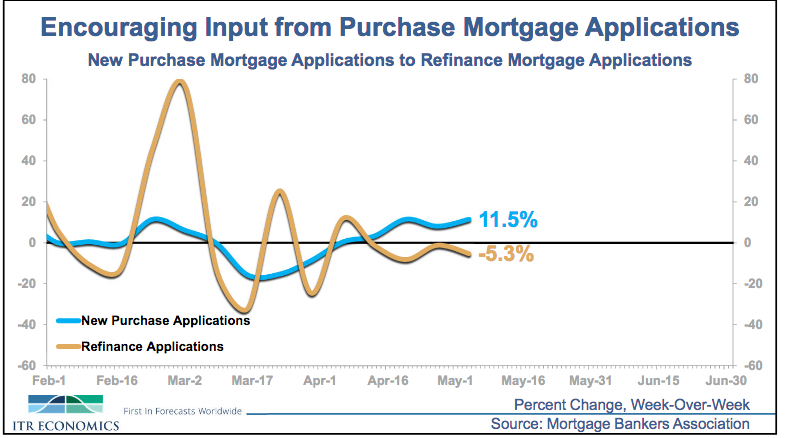

“We need banks to loosen up, but at least mortgage applications for purchase are up,” Beaulieu said. “The refinance applications are down, but the new applications are 11.5% above year-ago levels. That’s a good, strong number. Back in March when we looked at this data, it was negative. ‘No, nobody wants to buy a house,’ people said. Well, yes, they do, as it turns out. However, banks have changed the requirements; they’re not going to make it easy anytime soon. But those that can qualify will find banks who want to lend.”

Some aspects of the resale market are more active than others

“Low-end homes had a very normal February to March monthly rise, which is good,” Beaulieu said. “The mid-range of the market saw a significantly steeper than normal March decline. We also saw the same thing in the higher end with luxury homes. However, I think we’re going to get the more normal activity in the coming months.”

What’s the timetable for a recovery across the board?

“The third quarter is going to be essentially flat with the second quarter,” Beaulieu said. “And then it begins to improve some in the fourth quarter, but still below year-ago levels. We should see a rising trend in ’21, where we will get into positive territory. And it looks very likely that late 2021 will see a return to growth. So, it’s quite a way out from now. This whole shutdown has taken a lot of life out of the economy, but at least we’re going to get back on track before it’s done.”

About the presenter

Alan Beaulieu has been delivering award-winning workshops and economic analysis seminars in countries across the world to thousands of business owners and executives for the last 30 years. He has coauthored several books with his twin brother, Brian Beaulieu, including: “Make Your Move,” “Prosperity in The Age of Decline” and “But I Want It.” He has also penned numerous articles and presented scores of keynote speeches and seminars that have helped thousands of business owners and executives capitalize on emerging trends. Click here for more information on future ITR Economics webinars.