Who could have imagined that the two best years many flooring distributors will have experienced in their careers—the “ride of a lifetime,” as one distributor called it—occurred during the COVID-19 pandemic.

The momentum that pandemic-related activity produced essentially pulled residential business forward for 18 months, resulting in record sales for flooring distributors and their retail partners.

However, the bill for that gluttony came due—courtesy of a softer retail environment. “We’re in a little bit of a lull right now,” said Scott Rozmus, president/CEO of FlorStar Sales, Romeoville, Ill. “People with money are still spending but they are spending it on experiences—all the things they couldn’t do when the government trapped them in their homes for 18 months. This situation pulled busi

ness forward as [homeowners] did remodeling work that was overdue.”

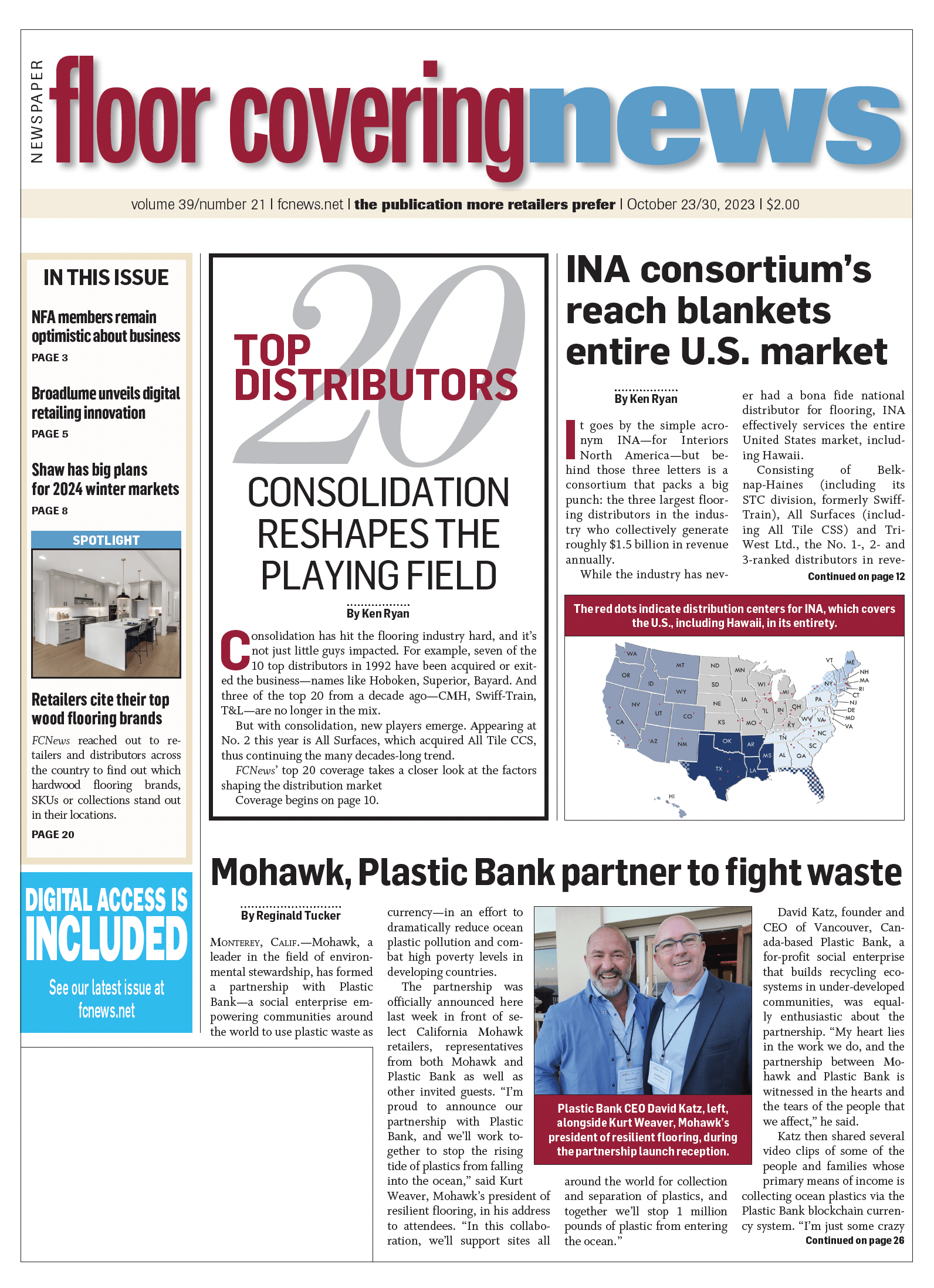

Many of the top 20 distributors revised their 2022 final numbers down several percentage points from their previous forecasts in response to an ebb in the market that occurred last fall. What’s more, they are forecasting a decline in 2023 of anywhere between 3% to 13% vs. 2022 numbers. The fortunate few distributors who say they were flat year-over-year—or who even eked out a small gain—did so by taking market share, acquisitions or by leveraging their commercial businesses.

Jeff Striegel, president of Elias Wilf, Owings Mills, Md., who called the 18-month period in ’21-’22 “the ride of a lifetime,” blamed a shift in consumer spending habits with halting the run of activity. “Since spring 2022 no one wants to do anything around their home,” he said.

Rozmus went so far as to say that residential remodel is in recession, pointing out there have been two consecutive quarters of decline vs. the year-ago period.

What’s behind this malaise in retail is clear—high interest rates, construction softness and inflation. High inflation brought with it the fastest, most aggressive interest rate hikes in more than 40 years. As Striegel explained, “Higher interest rates are keeping people in homes, killing existing home inventory and sales. People can’t afford to sell a home with a 3.5% mortgage and go into a home with a 7% [or higher] mortgage. If interest rates continue much higher, the impact will be felt throughout 2024.”

There is also the psychological effect of higher costs as it relates to everyday expenses, including gas and food, which is impacting larger-ticket discretionary purchases like flooring.

The return to Earth has at least temporarily halted the meteoric rise of some high-flying distributors. A case in point is Galleher, which had been growing at a robust 20%-plus clip for several years in a row. Its 2023 sales are expected to come in at around $320 million, up slightly over 2022’s downwardly revised figure of $310 million. Softness in overall marketplace demand was offset to some degree by continued strength in Galleher’s commercial business and proprietary brand growth in key expansion markets (i.e., Texas, Oregon and Washington).

“Like many companies, we are focusing on growing share through enhanced sales and marketing programs, coupled with a focus on generating operational efficiencies,” said Ted Kozikowski, CEO of Galleher.

All Surfaces, which has acquired several distributors since 2017, culminating with the purchases of Blakely Products and top-5 player All Tile CCS, joined Galleher as one of the few companies seeing an uptick in revenue in 2023. “The economy is the biggest factor to our business,” said John DeYoung, CEO. “Remodeling is still very strong for us, which is positively impacting our supplies business. The softness in new construction and higher interest rates are negatively impacting flooring projects as these tend to be larger ticket purchases. That being said, we’re forecasting positive revenue growth for 2023.”

Housing

The demand for housing remains one of the most pressing issues in the market. The rise in housing prices, combined with stagnant wages, has made it difficult for many individuals and families to secure housing. This predicament worsened with last year’s sharp rise in mortgage rates, which escalated from 3% to over 7% in just a few months. Homeowners with the fixed lower mortgage rates are in no rush to move and incur rates of 7% or higher. It’s also kept prospective homeowners on the sidelines.

The demand for housing remains one of the most pressing issues in the market. The rise in housing prices, combined with stagnant wages, has made it difficult for many individuals and families to secure housing. This predicament worsened with last year’s sharp rise in mortgage rates, which escalated from 3% to over 7% in just a few months. Homeowners with the fixed lower mortgage rates are in no rush to move and incur rates of 7% or higher. It’s also kept prospective homeowners on the sidelines.

“Many projects were completed during COVID-19,” said Dave White, president of Tri-West Ltd. “Buy a home, trade up or fix it up. So many people took advantage of refinancing, and rates were so low. Everybody benefited by existing home turns; those are minimal now.”

The challenges in the single-family housing market had one positive outcome—it helped multi-family, which has been one of the two strongest segments in play, along with commercial. Even as the economy’s momentum slowed in 2022, multi-family construction continued to ramp up, reaching highs not seen since the 1980s, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development. But even here, supply chain disruptions, rising interest rates and a chronic shortage of skilled construction labor have made it more challenging to add supply quickly enough to meet demand.

UFLPA

In February, U.S Customs and Border Protection (CBP) gave notice that it had started detaining PVC (polyvinyl chloride) shipments under the Uyghur Forced Labor Prevention Act (UFLPA), a law enacted in 2022 that bans the importation of goods made in whole, or in part, in China’s Xinjiang region under the presumption they were produced with forced labor. Some manufacturers were forced to store containers in a bonded warehouse to the tune of $300 a day waiting for U.S. Customs and Border Control clearance that might never happen. The cost: $9,000 a month X numbers of containers stuck at the ports. This cost proved prohibitive for some suppliers, and they sent their containers back.

In February, U.S Customs and Border Protection (CBP) gave notice that it had started detaining PVC (polyvinyl chloride) shipments under the Uyghur Forced Labor Prevention Act (UFLPA), a law enacted in 2022 that bans the importation of goods made in whole, or in part, in China’s Xinjiang region under the presumption they were produced with forced labor. Some manufacturers were forced to store containers in a bonded warehouse to the tune of $300 a day waiting for U.S. Customs and Border Control clearance that might never happen. The cost: $9,000 a month X numbers of containers stuck at the ports. This cost proved prohibitive for some suppliers, and they sent their containers back.

The crackdown prompted some distributors to lessen their reliance on Chinese sourcing partners and switch to other Asian countries. “A lot of containers we never received, and at this point we don’t want them,” said Anne Funsten, president/CEO, Tom Duffy Company, Santa Fe Springs, Calif. “We did our best to switch customers to other products. We’re back in a good stocking position now.”

Tri-West, meanwhile, primarily sources its SPC from Vietnam while most of its glue-down LVT comes from Korea. “We have pretty much gotten out of China for most of our goods,” White said. “You trust factories are doing everything right but if they can’t document every little material, [containers] are not getting through. Some freight companies are refusing to ship SPC.”

It is estimated that 80% of LVT (including WPC/SPC/rigid) is imported; in three to five years some say that number will be 40% as onshoring grows. “Everyone is looking for alternatives,” Striegel said. “Vietnam is in play, and there is an evolution out of India and certainly Mexico that is happening. U.S. plants are exploding, and it’s wonderful. While it is painful this year with UFLPA, it is forcing us to do something that will be a positive down the road.”