A year ago, Cain & Bultman president Buddy Faircloth was singing the praises of his high-end laminate business, reporting double-digit increases from 2007 to 2008 and a slight increase in 2009. At the time, he said, “We have more displays out in the marketplace, more feet on the street. It’s all tied to higher-end business with the Armstrong and Bruce laminate lines.”

A year ago, Cain & Bultman president Buddy Faircloth was singing the praises of his high-end laminate business, reporting double-digit increases from 2007 to 2008 and a slight increase in 2009. At the time, he said, “We have more displays out in the marketplace, more feet on the street. It’s all tied to higher-end business with the Armstrong and Bruce laminate lines.”

Fast forward to October 2010 and overall business conditions in Cain & Bultman’s market have grown more ominous. “Business in Florida is really tough,” he said. “We were the first in and will be the last state out of this major slowdown. We don’t see any real opportunity coming our way until the first quarter of 2012.”

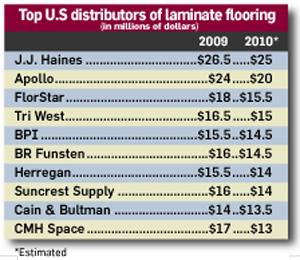

He is not the only one. Several distributors surveyed by Floor Covering News said business conditions are worse today than they have seen in years. A sudden and precipitous drop in business that occurred in the August-September time frame has overspread the industry. Naturally, laminates are getting the short end.

For no matter how realistic the wood and ceramic visuals are on laminate products, if consumers are postponing purchases, as they are, there is not much flooring distributors or dealers can do about it. “This is the first time in my 35 years in the flooring business that all markets are down at the same time,” Faircloth said. “Builder/multi-family, remodel, DIY and commercial are all down with no end in sight. Business seems to be getting worse, not better, in September and October. We just need to keep holding our own until business improves.”

Jeff Striegel, president of Elias Wilf, Owings Mills, Md., put the downturn in perspective. “From 1980 to 2006, the flooring industry went up 300% without a down year. In other words, if retail fell off, builder picked up and so on. This is now the worst downturn in three decades. There has been a horrendous loss of market share. We went from 75% of the industry going through retail flooring stores, and now that number is down to 51%. You can buy laminate on a Walmart website. We are getting bombarded by Lumber Liquidators and Empire Carpet with their home deliveries. Our retailers have their backs against the wall. They are really hurting. Not one thing the government has done has helped. Our retailers don’t need more credit, more financing—they need more customers.”

Hardest hit

No flooring category has been hit harder during this vicious economic/housing situation than laminate. As consumers look for value deals, laminate products are getting squeezed. Many distributors have reduced their dependence on laminate as a percentage of their overall business. “It’s dying right now,” one wholesaler said of the laminate category.

“Laminate is extremely price driven at this point,” said Rick Holden, executive vice president of Derr Flooring in Willow Grove, Pa. “Laminate is very similar to wood in that the better-looking product in the category has suffered tremendously. Everyone is looking to see how cheap you can go on an 8mil or 12mil product.”

David Sheehan, vice president, resilient and laminate business, Mannington, agreed. “Pricing is so bad; it’s not a good market.”

Hoy Lanning, CEO, CMH Space Flooring Products, Wadesboro, N.C., echoed those sentiments. “Everyone is jumping into the pricing whirlpool in a race to the bottom.”

Sheehan said after a strong first two quarters, August ushered in a “step change” in the market. “The most recent drop-off has us baffled. I keep going back to the unemployment rate. Until they are gainfully employed, people are not going to be buying. This is not going to be a quick recovery.”

A combination of factors has hurt the category, wholesalers say. Laminate is primarily a retail-only product; it is not as diversified as the others, has little commercial or builder application, and is not as insulated from the fickle behavior of consumers.

“Laminate continues to struggle,” said Terry Gray, vice president of marketing at NRF Distributors, Augusta, Maine. She noted one problem with laminate is that it can be purchased anywhere — on the web, even at the local megastores.

Roger Farabee, senior vice president of marketing with Unilin and Mohawk Hard Surfaces, said laminate is under pressure from the very same categories from which it took market share in the past. “In general, as LVT has improved its looks and as people have become more value conscious, they have gravitated back toward vinyl, particularly LVT,” he said. “You have also seen people go back to carpet because of the price point. And you have seen some of the inexpensive wood products take share from higher-end laminate.”

Despite the harsh business conditions, suppliers are working harder than ever to develop products that resonate with distributors and retailers. For example, Armstrong, in its biggest tile launch in laminate in five years, has come out with a stone/ceramic visual intended to energize distributors.

Not every distributor is copping a “woe-is-me” attitude with laminate. Innovative products from Mannington and Quick•Step have boosted Elias Wilf’s business, according to Striegel. “I am in the catbird’s seat with two of the top five lines,” he said. “My laminate business is good. Last year wasn’t nearly as pretty but then again I didn’t have the right design products. Laminate is about design. It was like last year I had the jeans but not the Levis. This year hip huggers are hot and, baby, I got them.”

-Ken Ryan