By Megan Salzano While 2020 was anything but ordinary, there was one thing the flooring industry could count on: the continued popularity of the resilient category. It will come as no surprise that resilient—led mostly by the rigid core/SPC sub-segments—once again registered gains while many other flooring categories in 2020 did not.

By Megan Salzano While 2020 was anything but ordinary, there was one thing the flooring industry could count on: the continued popularity of the resilient category. It will come as no surprise that resilient—led mostly by the rigid core/SPC sub-segments—once again registered gains while many other flooring categories in 2020 did not.

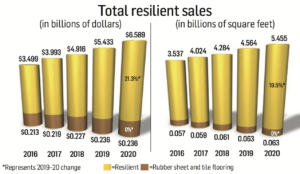

FCNews research shows the category generated $6.589 billion in sales (not including rubber) in 2020—an industry-leading 21.3% increase over 2019’s $5.433 billion. In terms of volume, the category accounted for 5.455 billion square feet (not including rubber) at the first point of sale, a 19.5% increase from 4.564 billion in 2019.

The resilient flooring category’s strong performance in 2020 is even clearer when measured against the hard surface market. When compared to ceramic tile, hardwood, laminate and other hard surface materials, resilient accounted for 50.6% of sales vs. 2019’s 45.1%. When taking total flooring sales into account, resilient comprised 28.7% of dollars and 28.8% of volume, compared to last year’s 24.6% and 24.2%, respectively. Over these last several years, resilient’s share of the market has more than doubled in terms of dollars and increased by nearly half in terms of volume.

This positive momentum, executives say, is directly attributed to the category’s performance, ease of installation and cost of entry—as well as changing consumer habits accelerated by the pandemic.

To justly analyze the resilient flooring category in 2020, it would be difficult without looking at the consequences of the COVID-19 pandemic—a truth for any product category in the building materials or home improvement industries. For the flooring industry itself as a whole, the stay-at-home lifestyle created by the lockdowns during the early stages of the pandemic in the U.S., while initially setting off a whirlwind of doubt, gave an unprecedented boost to sales in the second half of the year.

Suppliers agreed, as consumers spent more time in their homes they began to more quickly point to updates and renovations needed within those homes. In addition, consumer spending and financial reserves traditionally earmarked for travel, leisure and entertainment— which were on hold for most of the year and into 2021—were now readily available to be put toward home renovations. In essence, it created overwhelming demand.

“COVID-19 changed the dynamic, which we’re still seeing post-COVID-19, where there is just an incredible amount of home improvement business taking place,” said David Sheehan, vice president residential resilient, Mannington. “There clearly is an insatiable drive that is directly pandemic related where consumers are looking to remodel. Every category, for the most part, saw pretty significant growth for the second half of 2020, and we’re still seeing that same phenomenon in 2021.”

For the resilient flooring category, the quick turnaround time needed to reshape existing spaces into work-from-home or learn-from-home areas—regardless of purchase process—was an added advantage. “The nature of click together flooring in resilient really lends itself to the end user being able to make a quick transition,” said Ed Sanchez, vice president of product management, resilient, Mohawk. “Whether they are updating the room themselves as a DIYer or using an installer, they are very quickly able to transition a room vs. tile or hardwood where it’s a much longer process.”

In addition to its ease of installation, updated designs and performance within the LVT segment have contributed to the category’s growth. “Rigid core luxury vinyl products offer the consumers a number of opportunities,” explained Richard Quinlan, senior vice president of sales and marketing, Wellmade Performance Flooring. “Visual designs throughout the LVT category continue to improve and rival the look of real hardwood as well as tile and natural stone, all at lower prices than the real thing. Ease of installation and the benefit of durable resilient flooring round out the value opportunity, making the decision to buy LVT a very logical choice.”

A major benefit of resilient flooring—and a subsegment of its performance—is its waterproof claims. “Piet Dossche, [founder of USFloors and the COREtec brand] found something that really resonated with the consumer, which was waterproof,” explained Drew Hash, vice president hard surface product and category management, Shaw Industries. “Obviously, that has been a big part of why resilient flooring has become what it has, because of that waterproof story.”

Hash went on to add that while waterproofing is a driver of growth for resilient flooring, the category’s value proposition—a.k.a. pricing—is equally important. “A lot of the consumers who entered the market over the last 12 months were first-time buyers and first-time remodelers,” he said. “What you get for what you pay for certainly resonates as to why the category continues to grow from a residential perspective.”

Suppliers also agree that the resilient flooring category has grown in terms of awareness among consumers as well as in acceptance by RSAs. “I think you’ve seen a shift in the last couple of years where consumers are now aware of the category and they’ll say things like ‘waterproof flooring,’” Mannington’s Sheehan said. “In many instances, I’m convinced that consumers will gravitate toward wood or stone and then they will go into the store and they will leave buying rigid/LVT. Because they are in the buying cycle for a floor every five to seven years, they don’t know the business and they trust the RSA; and the RSA is so aggressively selling them on the notion of waterproof and rigid flooring. There is excitement and enthusiasm that RSAs have for the category that is driving some of that growth.”

Residential

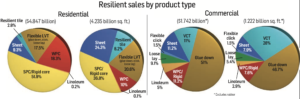

FCNews research shows the residential flooring market made up 73.3% of total resilient revenue or $4.847 billion in 2020. With respect to volume, residential resilient accounted for 77.6% of square footage shipped or 4.235 billion square feet.

FCNews research shows the residential flooring market made up 73.3% of total resilient revenue or $4.847 billion in 2020. With respect to volume, residential resilient accounted for 77.6% of square footage shipped or 4.235 billion square feet.

Residential flooring was supported in large part by the boom in the housing market. Total housing starts for 2020 experienced a 7% gain over the 1.29 million unit total from 2019 to 1.38 million in 2020, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. Single-family starts totaled 991,000, which was up 11.7% from the previous year. Multifamily starts in 2020 totaled 389,000, down 3.3% from the previous year.

Existing home sales grew to 5.64 million units, up 5.6% from 2019 and the highest total since the Great Recession, according to the National Association of Home Builders (NAHB).

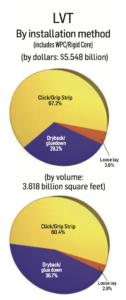

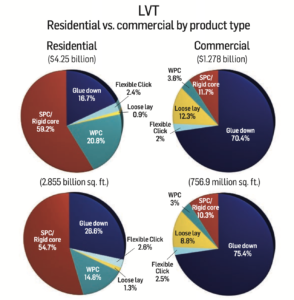

The bulk of the resilient flooring activity was driven by residential LVT (including glue down, flexible click, loose lay, SPC and WPC), which generated an estimated $4.25 billion in revenue in 2020. In terms of volume, residential LVT accounted for 2.855 billion square feet. That’s compared to $3.657 billion and 3.38 billion square feet in 2019, respectively.

Two market segments helped drive that growth exponentially: residential remodel and single-family new construction. Suppliers agreed single-family was the shining star in 2020. “We saw single-family grow, and in some cases that did take share from other categories—hardwood, porcelain and ceramic tile are good examples of that,” Shaw‘s Hash explained. “That residential remodel/single-family new construction had just incredible years, and especially in this particular category.”

Residential breakdown

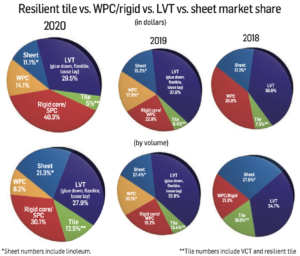

While flexible LVT products and the newer WPC still command decent shares of the market, it was rigid core/SPC that again took the lead. In just one year, FCNews research shows residential SPC grew from 30.8% in total resilient residential dollars to a whopping 51.9%. In terms of its command of the LVT segment in which it resides, 2020 saw an increase from 37% to a staggering 59.2%. In terms of dollars, it generated $2.516 billion of the LVT market’s $4.25 billion in 2020.

While flexible LVT products and the newer WPC still command decent shares of the market, it was rigid core/SPC that again took the lead. In just one year, FCNews research shows residential SPC grew from 30.8% in total resilient residential dollars to a whopping 51.9%. In terms of its command of the LVT segment in which it resides, 2020 saw an increase from 37% to a staggering 59.2%. In terms of dollars, it generated $2.516 billion of the LVT market’s $4.25 billion in 2020.

Suppliers agree the SPC sub-segment of LVT is propped up by its three main features—performance, aesthetics and price of entry. “The hallmark is the waterproof nature of resilient flooring but it’s also about the investment the industry has made in top coating technologies that have scratch and stain resistance—which gives you a realistic wood-look, low-gloss solution that has not been achieved in the past and even out-performs some of the best laminate flooring in the marketplace,” Mohawk’s Sanchez explained. “The planks are also easier to install. You get all that at a great price point. All around, it’s just a superior product.”

David Thoresen, senior vice president, product and innovation, Armstrong Flooring, agreed. “The SPC category far exceeded where we thought we could go with double-digit growth. SPC has been endorsed by consumers and installers alike. Installers love the click system that makes the installation go quickly with very few claims, while consumers love the ever-improving designs and durability.”

For Novalis, the claim is the same. “The ability to get essentially any visual in SPC construction at a price that fits every budget makes it so popular,” said Nate Hohenstein, director of strategic accounts. “The printing and finishing capability in the industry has created a product that consumers believe is ‘real wood’ when it is installed; however, without all the challenges real wood faces—scratch, dent, water, etc.”

Suppliers also noted that while other categories like laminate and even SPC’s WPC sister- subsegment tout the importance of thickness, SPC is able to provide superior performance features at a smaller thickness, which helps reduce costs in not only the price of the product but in shipping and transportation as well.

Another boon to SPC is its ongoing core evolution. Manufacturers continue to innovate its core structure, some developing cores with magnesium and other materials to add strength. “MGO has brought an additional level of durability and toughness with a product that is even more difficult to indent,” Hohenstein explained.

WPC, on the other hand, continued its downward trajectory with a 7.1% decline in residential sales with just 18.3% of the total $4.847 billion in 2020 vs. 25.4% the year before.

Suppliers agree it is being cannibalized by its sister subsegment, SPC. “I continue to see WPC declining,” Mohawk’s Sanchez said. “As you look across investment in manufacturing, there really isn’t any in WPC. With the understanding that you have a higher risk of residual indentation, I think the investment globally—and even retrofitting existing plants—is toward SPC.”

Suppliers agree it is being cannibalized by its sister subsegment, SPC. “I continue to see WPC declining,” Mohawk’s Sanchez said. “As you look across investment in manufacturing, there really isn’t any in WPC. With the understanding that you have a higher risk of residual indentation, I think the investment globally—and even retrofitting existing plants—is toward SPC.”

Mannington’s Sheehan agreed, but noted WPC’s continued relevancy in the market despite its loss of share. “I would say, undoubtedly, SPC is growing faster than WPC, but don’t forget that WPC is still extremely large,” he explained. “As I look at it, last year it was probably 50/50 and today it’s 60/40 in favor of SPC. WPC does have a seat at the table; it’s thicker, more comfortable and quieter underfoot. Companies like Mannington and COREtec benefit from having a product like that.”

When it comes to WPC flooring, Shaw’s Hash maintains that it’s COREtec’s bread and butter. “It’s still our flagship product within our rigid categories and it continues to grow,” he said. “It has a great story when compared to other products—from its value, quietness, warmth and design. We continue to see SPCs growth is more in the entry-level price points.”

Flexible LVT (including glue down, click and loose lay vinyl plank flooring) was slightly below WPC in 2020 with 17.5% share in terms of residential dollars. Suppliers agree flexible LVT still has its place as well. “Flexible LVT (glue down and loose lay) offers much more design capabilities than rigid,” said Bill Anderson, CEO, Karndean Designflooring. “All areas of LVT [including glue down and loose lay] were strong for us in 2020.”

Mohawk’s Sanchez added that flexible LVT has a strong foothold in the multifamily market due to its ease and speed of installation, DIY-friendly nature and easy replacement. “Whether it’s glue down or click, it really allows you to turn the multifamily units fast and get new residents in,” he explained. “There’s a value there that [multifamily is] able to leverage. I would also say, from a DIY perspective, that if you’re doing a secondary room, flexible LVT is relatively easy to do on your own, all you really need is a utility knife to cut it. It also makes replacement much easier. But you don’t get some of the performance benefits of a rigid core SPC.”

Suppliers also said supply challenges that occurred in 2020 may have led some consumers to the flexible LVT category—as well as other non-rigid options. “In some instances, when the consumer is looking for a certain visual, which is the No. 1 driver for her, she doesn’t care whether its WPC, SPC or glue down,” Mannington’s Sheehan said. “Lead times have been extended but consumers want to buy now. They will buy any and all [resilient flooring] that is available to make their change. That’s been a very interesting dynamic.”

Looking at the data, residential sheet registered a loss in terms of overall residential resilient dollar sales to make room for rigid’s exponential growth. Sheet claimed 9.3% of the overall $4.847 residential resilient dollar sales in 2020, dropping from $500 million to $450 million.

However, suppliers agreed that residential sheet vinyl benefited from the boom in demand that occurred in 2020 directing consumers to any and all waterproof vinyl flooring products that were available. While it didn’t register gains in terms of market share or sales, it did gain resurgence in the minds of consumers. “Categories like sheet vinyl have been on the decline over the last 10 years, but we saw growth in sheet vinyl in 2020,” Sheehan said. “What I attribute both sheet and flexible LVT growth to is the continued overwhelming demand and a shortage of supply.”

Armstrong’s Thoresen agreed, adding, “Lining up the benefits side by side, sheet is still a wonderful product that just keeps getting better looking.”

Commercial

When it comes to the commercial market, the resilient category (not including rubber) generated $1.742 billion in dollars and 1.222 billion in square feet in 2020. That is down from $1.771 billion in dollars and 1.183 billion square feet in 2019, albeit great strides considering it was a pandemic year.

When it comes to the commercial market, the resilient category (not including rubber) generated $1.742 billion in dollars and 1.222 billion in square feet in 2020. That is down from $1.771 billion in dollars and 1.183 billion square feet in 2019, albeit great strides considering it was a pandemic year.

Industry experts said key commercial market segments were hit hard by the coronavirus pandemic and overall did not see the same speedy recovery the residential market did in 2020. Health care and hospitality in particular struggled with limitations and project postponements.

“The commercial market did not bounce back as readily as the residential market in 2020 due to the impact of COVID-19 on many of the market segments,” Rick Morris, vice president of commercial hard surface product and category management, Shaw Industries, told FCNews. “With respect to segments like retail and hospitality that depend upon in-person experiences, the persisting uncertainty and sudden drop in business, understandably, slowed any desire to invest in or upgrade flooring in 2020.”

Al Boulogne, vice president, commercial rubber, sheet distribution, Mannington Commercial, agreed, noting, “Residential saw a V-shaped recovery—it went away and recovered very quickly and then grew beyond our expectations. Commercial is more of a U-shaped recovery. 2020 has been a down year vs. our expectations, but it ended up being a better year than what we had expected.”

Scott Brazinski, vice president of sales, North America, Flooring Division, American Biltrite, said he expects growth to be different in the coming years. “Rethinking the workplace environment will drive renovation projects; school and healthcare business should remain stable. We also expect a shift in construction toward less populated urban areas as the pandemic allows workers the ability to prove they can work remotely—which should lead to a de-densification of major cities to other areas.”

Karndean’s Anderson noted that as 2020 came to an end, momentum slowly returned to the commercial market. “As the country starts to slowly rebound from the pandemic, we are starting to see more projects come back that were put on hold and budgets being approved. Much of this work, being commercial in nature, are glue-down or loose lay opportunities.”

Industry experts said retail along with hospitality took the biggest hit in 2020. Healthcare was an interesting segment to watch as it experienced a severe drop-off in projects in the first half but then a quick return before the year ended. What happened in education was segmented between higher education and K-12.

For Karndean, Anderson said healthcare and education continued to be sales drivers in 2020, but the hospitality and retail segments were sluggish. “[It’s] just basic economics; healthcare and education facilities still had a need for and the funds to support flooring activities; many retail and hospitality businesses were fighting to keep their doors open and were impacted by people not traveling and spending their money in other areas.”

When it comes to education, commercial resilient suppliers agreed it was K-12 that weathered the storm best. “K-12 education is more uniquely structured than the others because of how it’s funded,” explained Denis Darragh, general manager, North America/Asia, Forbo. “The answer to every question is always money. When you look at it, their funding stream was left unaffected. So, the bonds were in place that were financing the public construction. Within higher education there was turmoil. Private did well toward the end of the year—with what the stock market did in the second half of the year, their cup runneth over.”

Shaw’s Morris agreed, noting the segment will likely bounce back this year. “As we’re already beginning to see in 2021, the national push to get schools ready for reopening is positively impacting business in the education segment.”

When it comes to healthcare, Mannington Commercial’s Boulogne added, “We definitely saw a quick slowdown because they didn’t have the time or resources to remodel during the beginning of the pandemic, but slowly and then more rapidly those opportunities became available—through pop-up facilities or elective facilities that were being invested in.”

Other suppliers agreed that healthcare saw a bounce back in the second half of the year. “Beginning in late 2020 and into the beginning of 2021, acute healthcare and life science/biomedical labs were showing the greatest potential for growth,” explained Adrienne Roseman, senior product director, Tarkett North America. “Overall, we are optimistic about the coming year as the world turns a corner in overcoming the economic challenges brought on by the pandemic.”

Commercial breakdown

For the commercial resilient market, LVT is still the go-to workhorse. The resilient subcategory (including flexible and rigid) accounted for 72.8%, or $1.268 billion, of the $1.742 billion in overall sales and 61.2% of its total volume. That is roughly 4% growth in terms of dollars from the 68.7% it experienced in overall dollars in 2019 and roughly 4% growth in volume from the year prior.

FCNews research shows flexible LVT (including glue down, loose lay and click) accounted for the bulk of that activity with 61.6% share of the resilient commercial market’s $1.742 billion in sales and 53.6% of its overall volume. That’s up from 59.6% in dollars and 50.2% in volume in the year prior.

Suppliers agreed in 2020 LVT shined in the education segment where projects continued to move forward. “We see more LVT in education and that trend is continuing,” said Whitney LeGate, vice president, commercial LVT, Mannington Commercial. “Some schools just want to try something new. They are trying to streamline their maintenance and performance, and while carpet can stain, LVT can be easily replaced. LVT also lets them do a lot with design. I think all of those things come together to make LVT a nice alternative choice.”

Senior care and hospitality are also experiencing a shift toward resilient products vs. traditional soft surface choices—even if those segments were less active in 2020. “We are seeing the continuing shift in all of senior care from textile products to resilient,” Forbo’s Darragh explained. “It has been a trend for a while, and it’s certainly not slowing and may be increasing. We also do see the continued movement toward more resilient solutions in hospitality, mainly in guest rooms, because—and I think 2020 is only going to make this increase—of the concern for health and hygiene. You already see it in residential.”

He added that while the shift to hard surface is not exclusively in luxury vinyl, “LVT is the 800-pound gorilla in the market.”

Karndean’s Anderson agreed, noting the continued dominance of flexible LVT in the commercial market. “Flexible LVT (glue down and loose lay) offers much more design capabilities than rigid and has added relevance in commercial applications due to its full adherence to the subfloor and the ability to individually replace pieces, if needed.”

Unlike its residential counterpart, rigid core WPC/SPC has not taken hold in the commercial market. However, it did gain ground in 2020 vs. recent years. FCNews research shows rigid core grew from 9.6% in 2019 to 11.2% of total LVT commercial dollars in 2020. “Rigid core LVT is starting to gain traction in North America, where we had seen some slowness to adapt in the commercial space,” Tarkett’s Roseman said. “We’re specifically seeing rigid core grow in the senior living and higher education segments. Rigid core is an excellent solution for both performance and value as a high-quality material at an affordable price. The life cycle costs are also relatively low, without the need for adhesive and minimal maintenance requirements.”

Major rigid core suppliers are bringing forward innovations designed specifically to pique the interest of the commercial market. Shaw, for example, has launched SPC flooring products designed for various market segments. “Our new Made-in-America, SPC tongue-and-groove products are a great solution for many commercial segments, addressing key concerns with service and installation timelines in today’s environment,” Shaw’s Morris said.

Growth in the overall LVT segment continues to cannibalize other resilient flooring segments in the commercial market including vinyl composite tile (VCT), which saw a drop in both dollars and volume in 2020. In one year, VCT went from 13.5% share of overall resilient dollars to 10.8%, or $191.4 million, in 2020 vs. $239.5 million in 2019. In terms of volume, VCT saw a 2.6% decline from 351 million square feet in 2019 to 342 million square feet in 2020.

Despite its loss of share, suppliers note VCT’s continued value to the market. “VCT is slowing in the marketplace and has been for several years, and its sole bright spot is value,” Armstrong’s Thoresen said. “Where else can you have access to over 100 colors at such an attractive price point? Multiple designs and non-PVC options will continue to offer hope to the category.”

FCNews research shows rubber remained relatively flat in both dollars and volume in 2020. Executives like Jeff Robinette, senior product manager, Tarkett, said that most of the challenges faced in the rubber flooring mar- ket were similar to those within other product categories. “The uncertainty of the economy had the market on a bit of a rollercoaster ride for much of the year,” he told FCNews. “Many design projects were placed on hold for a variety of reasons related to the pandemic. Once given the green light, material orders were often placed on a rush, in an effort to keep projects moving as close to their original schedule as possible. Material supplies have all been impacted as manufacturers have made changes to ensure a safe working environment.”

On a positive note, Robinette said rubber tile flooring remains a strong solution in many market segments, “providing a comfortable, easy-to-maintain surface with a strong sustainability story. These are all features our clients are looking for in a post-pandemic world.”