Las Vegas—The resilient flooring category remains the top performer in the industry, overtaking the carpet category in dollars for the first time in 2022—by a whopping $1.3B. In fact, the rigid core subsegment alone outperformed carpet by $10M in 2022.

However, it’s clear that the year ahead will pose many questions—an election year always does—and offer up some challenges (interest and mortgage rates come to mind), which the resilient category will have to weather.

What’s more, it was hard to miss the punches being thrown at rigid core by the comeback kid of TISE 2024—laminate. In fact, several resilient suppliers touted their entrance into the laminate category, albeit alongside new SPC/WPC launches. Many noted the proverbial black eye SPC has received in the last year due to U.S. Customs detentions and shoddy workmanship, which caused issues at the retail level.

“I do think there’s a lot of pressure on traditional resilient formulations,” Seth Arnold, vice president of residential marketing, hard surface, Mohawk, told Floor Covering News. “It’s still the No. 1 category, though. It’s huge, and it’s going to continue to grow. But when you’re the biggest kid on the block, you’ve got a lot of people coming after you. So, it’s more important than ever to have innovation. You can’t just rest on the growth that’s been there for resilient in the past.”

Most resilient flooring suppliers agreed the first half will be somewhat of challenge while the second half will bring along resolutions to some of that stagnation. “I would probably say the market’s going to be, at best, flat, maybe even a little bit down,” said Dick Quinlan, VP of sales and marketing, Wellmade. “All of the people we talk to have been saying, coming into the first quarter, their business is down about 15% in SPC.”

Other resilient flooring suppliers echoed those sentiments, noting interest rates, geopolitical issues and the November election all creating some uncertainty heading into the year. “I think it’s going to be a tough first half of the year,” noted Yon Hinkle, VP of product management, resilient, AHF Products. “We are hopeful for the second half, but with the election looming, there’s still a lot of uncertainty. But what we’re doing is doubling down on investments that we believe will pay off at the end of ’24 or in ’25, and we’re in a good position to be able to do that.”

Mannington, too, noted its intention to invest despite challenges ahead. “I think the LVT category is going to be down again, like it was in ‘23,” David Sheehan, senior VP residential product, told Floor Covering News. “There’s still a lot of pricing mechanization going on, and as a result I think you’re going to see dollar sales will probably be down. Units might be flat. We intend, despite all that, to go on the offensive.”

Buying buoys uncertainty

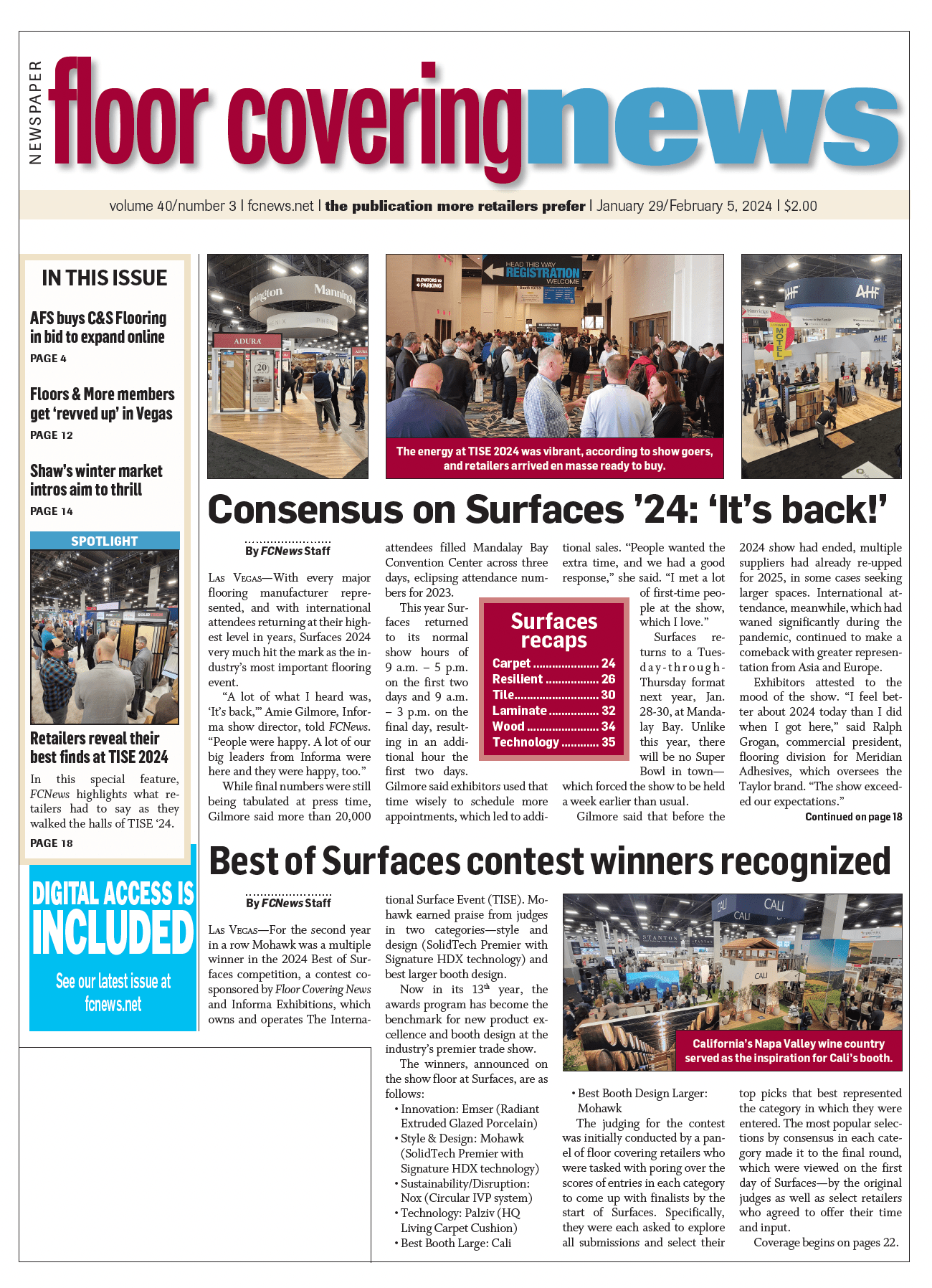

While some resilient flooring suppliers say there are questions walking into 2024, the show itself seemed to quash some of them. For instance, would the distribution and retail communities converge in Las Vegas and open their wallets for new product? The answer: a resounding yes.

“What’s cool about having a selling event is you get instant feedback,” Mannington’s Sheehan said. “We’re getting a good vibe that they’re buying. The retailers feel confident enough that they’re going to go ahead and pre-buy inventory. That’s encouraging.”

The show itself, too, seemed to flourish this year with more vendors exhibiting and more attendees ready to hit the ground running. “There are a lot of new booths that I haven’t seen before, and it’s been active since we started,” AHF’s Hinkle said. “Whatever is going on with the economy—people are saying ‘we’re working through it. We’re going to have a good 2024 and we’re going to make the best of it.’”

PVC-free/recycled product

The name of the game is always style and design when it comes to flooring, but another top driver for today’s consumer that seems to be picking up steam—again—is sustainability. It was at the forefront of several new resilient flooring introductions at the show, which is no easy feat when you’re talking rigid core flooring.

“We see change in demographics and the rise of the ethical purchase driver,” Mohawk’s Arnold said. “A lot of people expect brands to take a stand for something. Our whole industry has not really had a solution for addressing that rising sustainable marketplace. So, one part of our revolution within resilient is offering a planet-friendly alternative to some of the traditional formulations that are on the market. And that’s what PureTech is.”

Indeed, Mohawk’s PureTech, which was prominently displayed at the show, is a PVC-free waterproof construction that features 70% recycled content and an 80% organic, renewable core.

AHF Products launched its Ingenious Plank, what it calls a hybrid resilient flooring, across several of its brands—including Armstrong Flooring, Bruce and Robbins. The line is a PVC-free alternative to traditional SPC. “Most retail showrooms have a sea of SPC and some of those aren’t performing—any retailer knows that,” Hinkle said. “So, we wanted to bring in an alternative that doesn’t take up much space but has a different story to tell and is also just as price competitive as everything else out there. It’s a good story. We’re really excited about that.”

The line’s call outs include its 100% waterproof construction and indent, scratch and stain resistance with a lifetime limited warranty and 10-year light commercial warranty.

Nox is a major sustainability player and touts an entire product portfolio focused on offering bio-based, recyclable products. Its Circular IVP system is said to produce the most sustainable LVT flooring—with over 90% key materials converted into carbon-reducing materials. What’s more, its Bio-Circular Balanced PVC reduces carbon emissions by 114%. The process also minimizes energy usage and waste in manufacturing, and minimizes the use of resources for installation and maintenance with product innovation. Some of its product lines include its LVT click flooring, EcoClick, and loose lay LVT, EcoLay. The company took home the Best of Surfaces award in the Sustainability/Disruption category at this year’s show.

Benchwick also plays heavily in the sustainable field. Take, for instance, its Blue 11, a rigid core line that features a core made with 80% recycled plastic recovered from oceans and waterways. As opposed to SPC floors that primarily utilize materials derived from oil or virgin PVC, Blue 11 offers a more sustainable and feasible alternative to current manufacturing methods that are dependent on petroleum.

Elevated SPC

While hybrid formulations may be all the rage, the resilient flooring category is still bolstered by its focus on style and design—and its powerhouse SPC subsegment. That’s exactly what many suppliers chose to focus on for 2024. Even more chose to tackle the “shoddy SPC” issue head on, boasting thicker boards, elevated quality and on-trend colorways in their latest introductions.

Karndean, for example, focused on being “better” at TISE 2024. The company’s theme this year was “Better by design” and it definitely lived up to it with an elevated product offering for its partners. “We are so excited about 2024,” said Jenne Ross, product director. “It is the most new product that we’ve ever put in the market in a year. We started in 2019, setting a roadmap for ourselves on product development, focusing on rationalizing our overall portfolio and expanding our dual format offerings. The introduction of Art Select this year represents the end of our five-year journey for that part of the business plan. Art Select underwent a revamp many years in the making.”

Karndean, for example, focused on being “better” at TISE 2024. The company’s theme this year was “Better by design” and it definitely lived up to it with an elevated product offering for its partners. “We are so excited about 2024,” said Jenne Ross, product director. “It is the most new product that we’ve ever put in the market in a year. We started in 2019, setting a roadmap for ourselves on product development, focusing on rationalizing our overall portfolio and expanding our dual format offerings. The introduction of Art Select this year represents the end of our five-year journey for that part of the business plan. Art Select underwent a revamp many years in the making.”

With the launch of the new designs in May 2024, Art Select will feature more than 45 wood and stone looks in a broad spectrum of tones. Art Select is made with a top-of-the-line, 30-mil wear layer, and all designs are available in both glue-down and—new with this launch—rigid core. The woods and stones that inspire Karndean designs are sourced from around the world—forests and lumberyards to remote mountain quarries, some even exclusive to Karndean.

MSI is known for keeping its finger on the pulse of design trends across categories. That hasn’t changed, according to Manny Llerena, director, sales and marketing, who noted several design trends for 2024 that influenced the company’s new launches for the year. “The first one is definitely the warm tones,” Llerena said. “The blondes are at their peak of consumer demand. Second is wider, longer and a little bit larger is still very much in demand.”

Indeed, in SPC the company unveiled Laurel and Laurel Reserve with new color intros in both its Cyrus and Andover lines to suit changing demand. For Laurel, the company moved away from a traditional 7 x 48 size and went with a 9-inch width. “Why 9 inches? All of the high-end woods really started at 9 or 10 inches wide,” Llerena explained. What’s more, the new line even comes with a dent warranty—almost unheard of in the SPC category.

Cali not only diversified its product line for its retail partners—now offering SPC, WPC, hardwood and laminate to boot—but expanded its color offerings as well. “The reception to a more diversified Cali has really been wonderful,” Doug Jackson, president, told Floor Covering News. “But SPC is the land of many. So, we are very focused on color. We’re one of the few suppliers of color and design on the West Coast. We have a real coastal flair and a real coastal visual in our SPC looks, which differentiates us in this sea of sameness. And I think it gives our customer a product that they can make good margins on.”

Cali not only diversified its product line for its retail partners—now offering SPC, WPC, hardwood and laminate to boot—but expanded its color offerings as well. “The reception to a more diversified Cali has really been wonderful,” Doug Jackson, president, told Floor Covering News. “But SPC is the land of many. So, we are very focused on color. We’re one of the few suppliers of color and design on the West Coast. We have a real coastal flair and a real coastal visual in our SPC looks, which differentiates us in this sea of sameness. And I think it gives our customer a product that they can make good margins on.”

The company also unveiled its new merchandising display that boasts that California lifestyle and showcases each flooring category in its arsenal to consumers.

In addition to sustainability, Mohawk also threw its hat into the style and design ring with the launch of its SolidTech Premier with Signature HDX, billed as “the next diamond” of the industry. “We know that at the end of the day, the [consumer] is trying to create the most beautiful space she can,” Arnold noted. “Beauty is the primary driver. That’s how they start their journey. That’s how they finish their journey. The resilient revolution had us saying, ‘We’re not going to be satisfied with what can be done in beauty. We’re going to push the envelope and make the most beautiful, most realistic resilient floor possible.’”

With 14 SKUs, SolidTech Premier with Signature HDX showcases sought-after oak styles with a variety of rustic and clean visuals, along with true white visuals not currently on the market. SolidTech Premier took home the Best of Surfaces award in Style & Design this year.

Wellmade is also focused on bringing elevated looks to market. The company is working to bring EIR and new bevel technology to its domestic production. “We’re bringing EIR production capability to the United States for the first time,” Quinlan said. “The visuals are going to be better and better and better, until you put it down next to a real product—a wood or a ceramic—and they look exactly the same. That’s going to continue to drive the consumer to SPC.”

Engineered Floors’ unveiled its PureGrain High-Def direct digital print line of SPC, which includes 35 unique planks. Joe Young, vice president of residential product, said the company expects PureGrain High-Def to be a category changer in much the same way COREtec was to WPC. The product line is made domestically. There will be six collections of PureGrain shipping to retailers in 2024.

WPC makes a comeback

WPC is gaining traction once again within the resilient flooring category as many suppliers say it offers a better performance story—and, thus, didn’t have the same quality issues in the field as its SPC brethren.

Tarkett Home, for example, launched its first WPC: EverGen. “We think WPC will gain some traction,” Surratt said. “There’s been over-saturation of SPC and some products that really raced to the bottom that have given the overall category a bad name.” Plus, he added, “you can get a little bit deeper embossing with WPC compared to SPC—it brings out that truly realistic look of the wood.”

There are 20 wood visuals available, all in wide-and-long formats—9 x 60 and 9 x 72. The line also includes 10 stone visuals that will utilize the company’s new bevel technology.

Stanton entered the WPC space at the show with the launch of its Stanton Decorative Waterproof Flooring Select line. The branding aligns with its DWF line of SPC while giving retailers the option of a WPC construction. Stanton is expanding rapidly into all manner of hard surface flooring—it also launched a full laminate line at the show, now plays in the ceramic market and intends to add hardwood soon. “We want to be equally important in both soft and hard surface,” said Christine Zampaglione, senior marketing director. “And we are aggressively going after WPC.”

Twelve SKUs will be available under the Stanton brand while another 12 will be available under the Floors 2000 heading—Stanton acquired Floors 2000, a Florida-based supplier of LVP and porcelain tile, in 2022.

“WPC makes sense,” added Jamann Stepp, senior vice president of hard surface. “It started this entire craze. And we want to diversify the collections. WPC puts us in a different category.”

Lions Floor is quickly becoming a powerhouse in the flooring industry and is now in every hard surface product category—it even launched its first WPC at the show. Seaside Summit and Canyon Coast are both WPC constructions. Canyon Coast is available in 9 x 72-inch boards with a 30-mil wear layer, EIR embossing and a unique pressed edge while Seaside Summit is 9.5 inches wide and 84 inches long and features a painted bevel. “Customers are more focused on the quality of a product,” said Jerry Guo, president, Lions Floor. “WPC achieves the essential features that SPC brings to the table, but at the same time we can make the board itself to a thicker spec, which delivers on the customer’s demands.”

What’s more, Lions Floor said it is ready to expand nationwide in 2024—which can only mean good things for its retail partners—and is “going to take an aggressive approach” to do just that, according to Guo.

Tile looks that get it right

Tile looks in resilient flooring were all the rage at TISE 2024, but only a select few pulled it off with flying colors. For example, Novalis introduced its Cellini Collection featuring Unilin’s FlinTile Technology at the show, a new groutable rigid core flooring system that features the look of porcelain. “Like wood flooring, tiles are always on trend in some form or fashion,” said Kimberly Hill, director of marketing and creative design. “We see them specifically trending in the luxury style. We launched this collection because we believe our customers can have it all—the look of a natural grouted stone without the time or mess of traditional installation. Our product is also much softer and warmer underfoot than traditional tile.”

Tile looks in resilient flooring were all the rage at TISE 2024, but only a select few pulled it off with flying colors. For example, Novalis introduced its Cellini Collection featuring Unilin’s FlinTile Technology at the show, a new groutable rigid core flooring system that features the look of porcelain. “Like wood flooring, tiles are always on trend in some form or fashion,” said Kimberly Hill, director of marketing and creative design. “We see them specifically trending in the luxury style. We launched this collection because we believe our customers can have it all—the look of a natural grouted stone without the time or mess of traditional installation. Our product is also much softer and warmer underfoot than traditional tile.”

Mannington was hit hard when U.S. Customs began detaining vinyl flooring in 2023. This year it reintroduced some of its major launches that are now available to retailers, including heavy hitters Preservation and Coventry. Another line the company brought back for 2024 is Simple Stairs, which offers a matching stair tread to all plank visuals in the same material as the floor. But perhaps the showstopper was the company’s new products featuring TumbledEdge—the next step in Mannington’s bevel evolution, which gives the look of grouted tile in a vinyl construction. Its NatureForm Glaze surface technology also gives the product the feel of tile, an unprecedented achievement in the category. “We’re all about meaningful innovation,” said Terry Marchetta, vice president, residential styling. “Innovation that matters to the consumer. She wants the product to look and feel like the real thing—and that’s what we’re doing.”

(Look for more resilient Surfaces coverage in an upcoming edition of FCNews.)