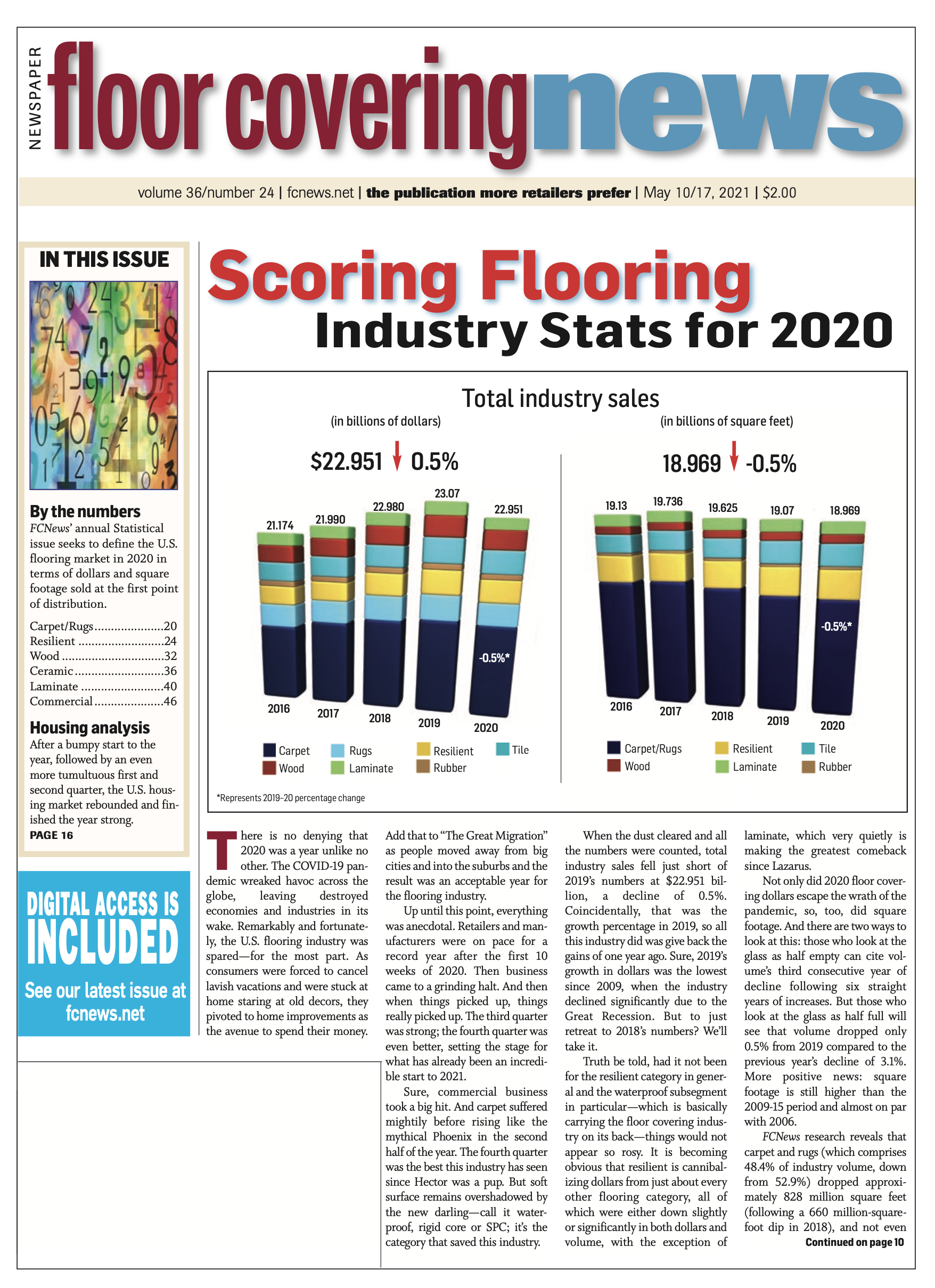

By Reginald Tucker The hardwood flooring category continued to feel the effects of the rising popularity of competing wood look-alike alternatives in 2020, as the hardwood segment took another hit for the second year running. FCNews research shows the U.S. hardwood flooring market generated approximately $2.207 billion in sales, a 4% decrease from 2019 and a shade below the five-year low of $2.23 billion achieved in 2015.

By Reginald Tucker The hardwood flooring category continued to feel the effects of the rising popularity of competing wood look-alike alternatives in 2020, as the hardwood segment took another hit for the second year running. FCNews research shows the U.S. hardwood flooring market generated approximately $2.207 billion in sales, a 4% decrease from 2019 and a shade below the five-year low of $2.23 billion achieved in 2015.

In terms of volume, the hardwood segment accounted for roughly 888 million square feet—a decrease of 4.2%. That’s the lowest level seen since 2015, when the category accounted for just over 850 million square feet.

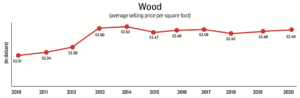

While hardwood still represents the third-largest hard surface category behind resilient and ceramic with respect to sales, the gap continues to widen. In 2020, the hardwood segment accounted for 17% of all hard surfaces sold at the first point of distribution—that’s down from about 20% just two years ago. Volume-wise, hardwood flooring actually came in fourth place behind laminates—which slightly edged out hardwood by less than 1 percentage point.

Taking soft surface into account, the hardwood segment represented 9.6% of the total flooring market in 2020 in terms of dollars. Compared to five years ago, hardwood represented just over 10% of the market. With respect to total volume, the hardwood segment represented 4.7% of total square footage sold in 2020. That’s fairly consistent with wood’s standing in 2015 and 2010 with respect to volume.

One of the factors that has put increasing pressure on the hardwood flooring segment and stolen market share in some end-use sectors is the competition from LVT/P, WPC and SPC products—many of which are designed to mimic not only the visual depth of genuine hardwood but the texture as well. “There is no question that wood flooring has been significantly impacted by the rise of waterproof products in the marketplace,” said Don Finkell, CEO and founder of American OEM, parent company of the Hearthwood brand. “I think wood stopped growing in 2019. This is a direct result of the rise in popularity of LVT and rigid core at the expense of all other categories.”

Other industry observers agree. “Without a doubt, these categories are exerting tremendous pressure on the hardwood category, especially the lower end,” said Dan Natkin, vice president of hardwood and laminate, Mannington. “We have seen significant category cannibalization as vinyl-based products continue to take share. However, the mid to upper ends of the category remain stronger and less prone to impact from the look-alike products.”

Other industry observers agree. “Without a doubt, these categories are exerting tremendous pressure on the hardwood category, especially the lower end,” said Dan Natkin, vice president of hardwood and laminate, Mannington. “We have seen significant category cannibalization as vinyl-based products continue to take share. However, the mid to upper ends of the category remain stronger and less prone to impact from the look-alike products.”

In response to this ongoing threat, some hardwood suppliers have either expanded their portfolio to include branded rigid core luxury vinyl offerings or even developed hybrid wood/rigid core waterproof hardwood products. But some observers say it doesn’t have to be a zero-sum game. Those flooring companies that participate in multiple product categories say the advent of LVT/WPC as well as hybrid offerings has forced hardwood suppliers to emphasize what makes it special and unique to the customers.

“Hardwood at the upper end still remains a viable option because there’s less competition there,” said Adam Ward, senior product director, wood and laminate, Mohawk. “There are a lot of new products in the hardwood category as well as others that are making it a dynamic market. At the end of the day, we welcome the competition; it ultimately forces the stronger players to adapt and innovate, and it gives consumers more choices as well.”

Traditional hardwood flooring enthusiasts, however, see things a little differently. “Surely the LVT category has been taking its toll on the wood market, but it doesn’t seem to be affecting our products as much as it is the lower-end type products,” said Wade Bondrowski, director of U.S. sales, Mercier Wood Flooring. “We are finding the real wood buyer is considering better goods and they understand the added value to their homes.”

Other real wood enthusiasts such as Boa-Franc, maker of the Mirage brand of hardwood flooring, are holding their ground. “For consumers who want to add value to their home, hardwood flooring remains their preferred choice,” said Brad Williams, vice president of sales and marketing. “It’s our responsibility to promote the benefits of hardwood over look-alike products.”

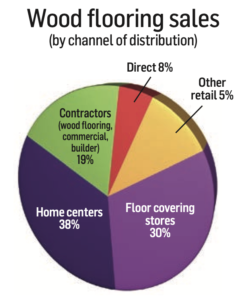

Sales by channel

Along with the gradual loss of market share, the hardwood segment also experienced shifts in channels of distribution in 2020. FCNews research shows home centers increased their share of the pie from 35% to 38%, while specialty retailers saw their share slip slightly from 32% down to 30% of sales. Direct-to-consumer sales rose slightly, mostly on account of aggressive marketing by online outlets and discount stores.

Along with the gradual loss of market share, the hardwood segment also experienced shifts in channels of distribution in 2020. FCNews research shows home centers increased their share of the pie from 35% to 38%, while specialty retailers saw their share slip slightly from 32% down to 30% of sales. Direct-to-consumer sales rose slightly, mostly on account of aggressive marketing by online outlets and discount stores.

The X factor that drove sales across those channels that saw higher wood consumption was clearly the COVID-19 pandemic. Like many other aspirational home improvement categories that benefitted from consumers spending much more time at home, the North American hardwood segment also reaped the rewards. Suppliers across the board attested to the positive impact that the novel coronavirus had on purchases and installations of wood flooring.

“With so many people stuck indoors due to COVID-19 restrictions, many have looked for ways to improve and invest in their homes,” said Drew Hash, vice president of hard surface, Shaw Residential. “Hardwood is a highly coveted and sought-after product that adds value and an elevated look to any space. As consumers continue to remodel their homes, we expect to see positive growth trends, especially while some households still have extra discretionary income from reduced traveling and sheltering in place.”

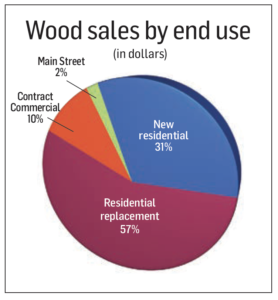

For AHF Products—which markets the Bruce, Robbins, Hartco, HomerWood and LM Flooring brands—the categories that drove the most sales in 2020 were single-family remodel applications and single-family new home construction builds. By its count, about two-thirds of wood sales are residential replacement, with roughly one-third new construction. “Both of them are really strong in terms of demand,” said Brian Carson, president and CEO. “Hardwood does less well in apartment renovations and is a smaller part of commercial. Both of those segments are off.”

That seems to be the consensus among many of the industry’s main players, Mohawk included. “We’re definitely seeing sales come from the renovation and remodel sector,” Ward explained. “The builder channel is strong as well, with housing starts continuing to do well.”

Mannington also said it sees the bulk of activity happening in the residential replacement market. “New construction is always a key driver for hardwood consumption; however, residential replacement has been quite robust post-COVID-19 with consumers frequently upgrading their new flooring into hardwood,” Natkin said.

More telling, though, are the types of wood flooring that are selling as a result of the pent-up demand. “The high end in both new home construction and the remodeling market are very strong for hardwood,” said Neil Wenger, vice president of distribution sales at Mullican Hardwood Flooring. “We see wide width demand in 3⁄4-inch solid hardwood flooring growing with wire-brushed lighter tones garnering the most interest. Buyers who are purchasing larger, more premium homes are choosing hardwood floors for their natural beauty, high-end finishes and products that add value to their home.”

More telling, though, are the types of wood flooring that are selling as a result of the pent-up demand. “The high end in both new home construction and the remodeling market are very strong for hardwood,” said Neil Wenger, vice president of distribution sales at Mullican Hardwood Flooring. “We see wide width demand in 3⁄4-inch solid hardwood flooring growing with wire-brushed lighter tones garnering the most interest. Buyers who are purchasing larger, more premium homes are choosing hardwood floors for their natural beauty, high-end finishes and products that add value to their home.”

Even exotic floors stoked demand in 2020. “Our business tends to be much more focused on residential replacement business, but we’re honestly seeing good demand across all those segments of the building market,” said Jodie Doyle, vice president, sales and marketing, U.S., Indusparquet. “We’re currently in a situation where people are tired of having LVT jammed down their throats when they really wanted wood. And when they get to the hardwood flooring section, seeing lots of European oaks and more of the same. They are telling us they want something different, something that can help them make money.”

That something different includes species such as Brazilian oak (a.k.a. Tauari). Think of it as the “new” Brazilian cherry. “It’s different but a tremendous replacement for oak at a great price,” Doyle explained. “With the current shortage issues with red and white oak, the product is now really relevant, and you are seeing more and more larger companies adopting that. It looks like a rift and quarter-sawn product, so it is inherently cleaner than a normal U.S. oak.”

Another unique hardwood species Indusparquet offers is Sucupira, referred to in the U.S. as Brazilian chestnut. The company also still sells a tremendous amount of Brazilian cherry—a staple dating back decades. “We have to balance the line between unique and on trend with timeless product,” Doyle explained. “The people who say Brazilian cherry doesn’t sell are 100% wrong. It has been selling well up and down the East Coast as well as California and the Midwest. And those sales have ramped up significantly over the past 12 months.”

Impact of imports

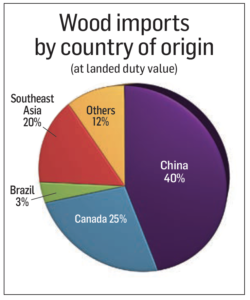

While hardwood flooring imports from South America, Southeast Asia and Europe rose slightly in 2020, hardwood flooring shipments from China to the U.S. fell from 44% to about 40%, mostly due to ongoing strained trade relations. Many of the tariffs put in place during the Trump administration have largely remained in place, while antidumping measures and fines have restricted shipments. At the same time, imports from Asian countries not subject to tariffs and/or antidumping duties (i.e., Cambodia, Taiwan and Indonesia) also surged, as did shipments from large manufacturers based in South America. But it was probably white oak species from Europe that saw the greatest demand, not only in the U.S. but globally.

While hardwood flooring imports from South America, Southeast Asia and Europe rose slightly in 2020, hardwood flooring shipments from China to the U.S. fell from 44% to about 40%, mostly due to ongoing strained trade relations. Many of the tariffs put in place during the Trump administration have largely remained in place, while antidumping measures and fines have restricted shipments. At the same time, imports from Asian countries not subject to tariffs and/or antidumping duties (i.e., Cambodia, Taiwan and Indonesia) also surged, as did shipments from large manufacturers based in South America. But it was probably white oak species from Europe that saw the greatest demand, not only in the U.S. but globally.

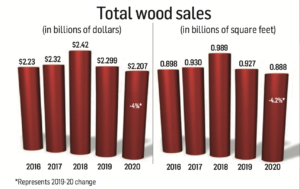

These shifts—as well as higher demand from competing building trades and industries amid strained raw materials and higher costs overall—resulted in higher hardwood prices. With greater consumer pent-up demand comes a dramatic rise in orders, and a direct result of that is a strain on demand. Couple that with extenuating factors such as blockages and tie-ups at major shipping ports around the country, and you have the recipe for escalating prices. In just the past few months alone, some of the major hardwood suppliers have announced multiple price hikes on both sourced and locally produced flooring. While some manufacturers strive to absorb the bulk of the costs in order to help their partners throughout the chain remain more competitive, executives realize it’s an issue that’s having wide-ranging ramifications.

“Price increases are happening as a result of raw material increases and freight, especially things related to lumber and petroleum,” American OEM’s Finkell explained. “The increases are also being propelled by a shortage of labor in most wood flooring plants. This puts upward pressure on wages that must be paid.”

Suppliers view this phenomenon as a perfect storm. “Costs in every area of our business are increasing—freight, supplies and parts have all increased,” Mullican’s Wenger said. “However, the increase in lumber and labor have had the most impact.”

Price increases as a raw material inflation is one of the key drivers behind the hikes. “We haven’t seen inflation like this in nearly a decade, particularly species like white oak and hickory,” Mannington’s Natkin said. “This is driven by higher than forecasted demand, struggles at the sawmills to staff with COVID-19 precautions and weather-related issues. The winter storms across Texas earlier this year also impacted key components used in wood adhesives and finishes, and that has driven pricing dramatically higher as well.”

Freight, from both Asia and Europe, also factor into the higher prices. “Freight rates have been out of control since late last year,” Natkin added. “The ports are clogged with struggles to offload containers and maintain COVID-19 protocols, which is leading to a global shortage of empty containers.”

Some suppliers are really feeling the price pressures when it comes to specific hardwood species—namely white and red oak. Couple that with challenges associated with harvesting logs in inclement conditions, and that just further aggravates the issue. “Everything from the cost of the boxes, to the adhesive, to the finish, to the cost of the raw material and the transportation—all facets have moved and are costing suppliers more money,” Mercier’s Bondrowski explained, citing increases the company enacted at the beginning of the year.

AHF Products, which announced several price increases since last fall, also attested to the effect that a tight lumber supply has on pricing. “Raw materials are tight everywhere,” Carson stated. “Specifically in the lumber in the United States, some prices have tripled coming out of the pandemic. Logging of hardwood in the United States is also down right down. It’s just a shortage and we have to do what we have to do to go out and get the materials to make the product.”

But it’s the freight issue that’s really concerning for executives. “That’s impacting overseas even more significantly than the United States, like our Cambodia operations,” Carson stated.

It’s not just popular domestic species that are being impacted. Indusparquet, which sources predominantly from South America, is also feeling the pinch. “The raw materials situation is real,” Doyle said. “We manufacture everything we sell in Brazil, which is experiencing high demand and low availability. The freight situation that many are feeling on the West Coast isn’t nearly as pronounced for our shipments, which are mainly coming into Miami and some of the eastern seaboard ports. That said, the issues being experienced out there are causing issues here to a lesser extent.”

Amid all the challenges and complexities that continue to vex hardwood suppliers, some companies are working hard both behind the scenes and alongside their channel partners to mitigate the issue. “Wet conditions in the Appalachian/U.S. hardwood belt have led to inflation of raw material prices, but impacts to service have been minimal, or at least manageable, for Shaw Floors,” Hash said. “Our strong relationships with our vendor partners and customer-centric approach to business have enabled us to weather that storm relatively well. We will continue to leverage its strong industry relationships, whenever possible, to work through this challenge alongside our customers.”

AHF Products’ Carson agreed, predicting that freight and material availability will continue to present challenges for the remainder of 2021. “That is the unfortunate situation in which we find ourselves,” he said. “I think it’s going to be with us for a while.”

Outlook for 2021

In spite of the ongoing obstacles facing the hardwood segment in particular, as well as the industry at large, executives say things are looking up for the medium to long term. They cited, among other things, somewhat of a return to normality as vaccines become more widely distributed. They also pointed to rising consumer confidence, which can only bode well for the home improvement sector. “The market rebound is occurring faster and greater than we anticipated, and we are poised to benefit from that,” AHF Products’ Carson said. “Our country is in for a good run in the medium to long term.”

In spite of the ongoing obstacles facing the hardwood segment in particular, as well as the industry at large, executives say things are looking up for the medium to long term. They cited, among other things, somewhat of a return to normality as vaccines become more widely distributed. They also pointed to rising consumer confidence, which can only bode well for the home improvement sector. “The market rebound is occurring faster and greater than we anticipated, and we are poised to benefit from that,” AHF Products’ Carson said. “Our country is in for a good run in the medium to long term.”

Based on how 2020 ended, many executives say they strongly believe the segment is on pace for a strong rebound. “We predict the hardwood category will reach high single to potentially double-digit percentage growth this year,” Boa- Franc’s Williams said. “Our preliminary projections for 2021 is the category will expand 8% to 12%. We see the greatest opportunities within our current customer base. The more we can meet their needs and the needs of their customers, the more we feel we will be able to achieve growth.”

Some suppliers see a silver lining amid the clouds of uncertainty and unprecedented change the industry experienced in 2020. “We feel there has been a bit of a shift in the market that has been created by both lack of supply and consumer demand for value-added products,” Indusparquet’s Doyle explained. “Our products are obviously a smaller segment of the overall hardwood category, but we are also fielding lots of interest from folks wanting to source products from South America—and Brazil in particular. When you add those demands to a nice uptick in our traditional exotics business, we are primed for a terrific second half of 2021 and beyond.”

Same goes for Shaw Floors, which worked both behind the scenes and alongside its customers to address logistical, supply and service challenges. As Hash put it, “We made several strategic adjustments throughout last year that enabled us to see some positive performance in the category for 2020, and we expect that to continue moving into 2021.”

Even in the midst of what is expected to be a robust and continual ascent of wood look-alike resilient products, hardwood flooring manufacturers are confident the hardwood segment will take back share. “We see an opportunity to bring more people back to the hardwood category despite the intense focus on other products out there,” Mohawk’s Ward said. “This is a great time to reintroduce consumers to all the features and benefits of real hardwood.”